Balancing the Scales: Strategies for Personal Debt Management and Its Broader Economic Implications

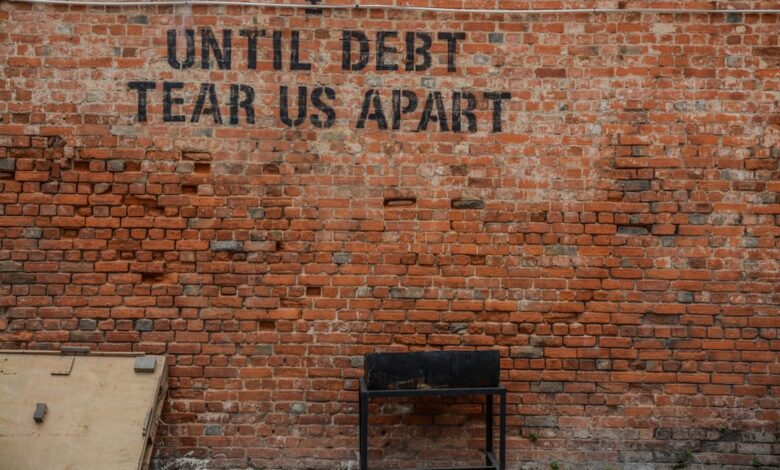

In today's financial landscape, personal debt has become a significant concern for individuals and families alike. With rising living costs, student loan burdens, and the allure of easy credit, many find themselves trapped in a cycle of debt that can hinder financial stability and growth. This article explores a comprehensive range of strategies for managing and reducing personal debt, providing readers with practical tools to regain control over their finances. We will delve into the broader implications of high debt levels on economic growth, examine effective negotiation tactics with creditors, and highlight the essential role of credit counseling in debt management. Additionally, we will discuss the balance between leveraging debt for investment opportunities and the risks involved, the impact of student loan debt on long-term financial planning, and how corporate debt influences stock performance. Lastly, we will consider how governments manage national debt and what this means for the economy as a whole. Whether you are struggling with personal debt or simply looking to enhance your financial literacy, this article aims to equip you with the knowledge needed to navigate the complexities of debt and secure a more prosperous future.

- Here are three possible section headlines for your article on managing and reducing personal debt:

- 1. **Navigating Personal Debt: Strategies for Financial Freedom**

- 2. **The Ripple Effect: High Debt Levels and Economic Growth**

Here are three possible section headlines for your article on managing and reducing personal debt:

Managing and reducing personal debt is a crucial aspect of achieving financial stability and long-term success. Here are three effective strategies that individuals can adopt to regain control over their finances:

1. **Create a Comprehensive Budget:** The foundation of effective debt management is a well-structured budget. By tracking income and expenses, individuals can identify areas where they can cut back on discretionary spending. This extra cash can then be redirected toward debt repayment. A detailed budget not only helps in managing current debt but also prevents future debt accumulation by fostering responsible spending habits.

2. **Prioritize Debt Repayment:** Not all debts are created equal, and prioritizing which debts to tackle first can significantly impact one’s financial situation. The debt snowball method involves paying off the smallest debts first to build momentum, while the avalanche method focuses on paying off debts with the highest interest rates to minimize overall interest costs. Choosing the right strategy depends on individual preferences and financial goals, but both approaches can lead to a faster path to debt freedom.

3. **Explore Debt Consolidation Options:** For those struggling to manage multiple debts, consolidating them into a single loan can simplify repayment. Debt consolidation can take the form of personal loans, balance transfer credit cards, or home equity loans. This strategy can lower monthly payments and potentially reduce interest rates. However, it’s essential to understand the terms and conditions of any consolidation option and to ensure that it aligns with the long-term goal of reducing debt rather than merely shifting it around.

By implementing these strategies, individuals can make significant strides toward managing and reducing their personal debt, ultimately leading to improved financial health and greater economic stability.

1. **Navigating Personal Debt: Strategies for Financial Freedom**

Managing personal debt effectively is crucial for achieving financial freedom and stability. Here are several strategies that individuals can employ to navigate through personal debt:

1. **Create a Budget**: Start by assessing your income and expenses. A detailed budget helps identify necessary expenditures versus discretionary spending, allowing you to allocate more funds towards debt repayment.

2. **Prioritize Debt Repayment**: Use methods like the avalanche or snowball approach. The avalanche method focuses on paying off high-interest debts first to reduce overall interest costs, while the snowball method targets smaller debts first to build momentum and motivation.

3. **Cut Unnecessary Expenses**: Review your spending habits and identify areas where you can cut back. This could include dining out less, canceling subscription services, or finding cheaper alternatives for everyday purchases.

4. **Increase Income**: Explore opportunities to boost your income, such as taking on a part-time job, freelancing, or selling items you no longer need. Additional income can be directed toward debt repayment.

5. **Establish an Emergency Fund**: While paying down debt is essential, having a small emergency fund can prevent new debt from accumulating in case of unexpected expenses. Aim for at least $500 to start.

6. **Communicate with Creditors**: If you’re facing difficulties in making payments, reach out to your creditors. Many are willing to discuss alternative payment plans or reduced interest rates, particularly if you can demonstrate a commitment to repayment.

7. **Seek Professional Help**: If debt becomes overwhelming, consider consulting a credit counselor. These professionals can provide guidance on budgeting, debt management plans, and financial education.

8. **Avoid New Debt**: While paying off existing debt, it’s vital to avoid accumulating new debt. This may involve reassessing the use of credit cards and other borrowing options.

By implementing these strategies, individuals can take proactive steps toward managing their personal debt, ultimately leading to greater financial freedom and improved economic well-being.

2. **The Ripple Effect: High Debt Levels and Economic Growth**

High debt levels, whether at the personal, corporate, or governmental level, can create significant ripple effects that hinder economic growth. When individuals or households are burdened with excessive debt, their disposable income shrinks as more resources are allocated to servicing that debt. This reduction in spending leads to decreased consumer demand, which can slow down business revenues and investment. As businesses face declining sales, they may cut back on hiring or wages, further perpetuating a cycle of reduced economic activity.

At a corporate level, high debt can limit a company's ability to invest in growth opportunities. Companies with substantial debt obligations may prioritize debt repayments over expansion, research, and development, ultimately stifling innovation and productivity. This situation can lead to a stagnation in industry growth, impacting the overall economy.

On a national scale, high levels of government debt can also pose risks to economic health. Governments may need to allocate a larger portion of their budgets to interest payments rather than crucial public investments in infrastructure, education, and health. This can lead to underinvestment in areas that drive economic growth, ultimately reducing the country’s long-term potential.

Moreover, when debt levels rise to unsustainable levels, it can lead to increased uncertainty among investors and consumers alike. Concerns about default or fiscal instability can result in volatility in financial markets, which may deter investment and increase borrowing costs. Thus, the interconnectedness of personal, corporate, and national debt creates a complex web that can significantly impact overall economic growth, emphasizing the importance of managing debt levels effectively across all sectors.

In conclusion, effectively managing and reducing personal debt is crucial not only for individual financial health but also for broader economic stability. By employing strategies such as negotiating with creditors and seeking credit counseling, individuals can regain control over their finances and pave the way toward financial freedom. Understanding the intricate relationship between personal debt and economic growth highlights the importance of sustainable debt levels—both personally and nationally. Moreover, while leveraging debt for investment can yield rewards, it carries inherent risks that must be navigated carefully. As we face mounting student loan debt and its implications for financial planning, it becomes evident that informed decision-making is vital. Ultimately, recognizing how corporate debt influences stock performance and how governments manage national debt can provide valuable insights into the larger economic landscape. By adopting proactive debt management strategies, individuals can contribute to a healthier economy and a more secure financial future.