Weathering the Storm: Understanding Recession Signals and Strategies for Economic Resilience

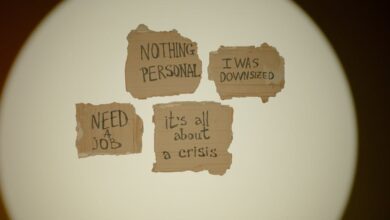

As the global economy continues to fluctuate amid various challenges, understanding the dynamics of economic recessions has never been more vital for individuals, businesses, and policymakers alike. Recessions can manifest unexpectedly, leaving profound impacts across different sectors, from employment rates to consumer spending habits. This article delves into the early warning signs of an impending recession, equipping readers with the knowledge to recognize these indicators before they escalate. We will explore how recessions affect diverse industries, the shifts in consumer behavior during downturns, and the critical role that government stimulus plays in recovery efforts. Additionally, we will discuss effective investment strategies that can help individuals and businesses thrive even in challenging economic climates. By examining lessons from past recessions, we aim to provide actionable insights for preparing for and navigating future economic uncertainties. Join us as we unpack these essential themes and offer guidance on weathering the storms of economic downturns.

- 1. **Recognizing the Signs: Early Indicators of an Economic Recession**

- 2. **Resilience in Crisis: Navigating Investment Strategies During Recessions**

- 3. **Government Intervention: The Role of Stimulus in Economic Recovery**

1. **Recognizing the Signs: Early Indicators of an Economic Recession**

Recognizing the signs of an impending economic recession is crucial for individuals, businesses, and policymakers. Early indicators often emerge from various economic indicators, providing valuable insights into the health of an economy.

One of the most prominent signs is a decline in GDP growth. When a country experiences two consecutive quarters of negative growth, it is often deemed to be in recession. Additionally, a slowdown in consumer spending, which accounts for a significant portion of economic activity, can signal trouble ahead. If consumers begin to cut back on discretionary spending, it may indicate declining confidence in the economy.

Unemployment rates also serve as critical indicators. A rising unemployment rate, particularly when coupled with layoffs and reduced hiring, suggests that businesses are anticipating lower demand for goods and services. Furthermore, a drop in business investment—evident through decreased capital expenditures—can indicate that companies are bracing for tough times ahead.

Other signs include fluctuations in stock market performance and shifts in consumer sentiment. A significant and sustained decline in stock prices can reflect investor concerns about future growth prospects, while consumer confidence surveys can reveal how optimistic or pessimistic individuals feel about their financial situations and the economy at large.

Lastly, changes in leading economic indicators, such as the Conference Board’s Leading Economic Index, can provide advanced warnings of a recession. This index includes metrics like new orders for manufacturing, building permits, and stock prices, which can help to predict future economic activity.

Recognizing these early warning signs allows stakeholders to prepare and adapt to potential downturns, ultimately mitigating the adverse effects of a recession on both individuals and the broader economy.

2. **Resilience in Crisis: Navigating Investment Strategies During Recessions**

Navigating investment strategies during recessions requires a careful assessment of market conditions and the inherent risks associated with economic downturns. Historically, recessions lead to increased market volatility and reduced consumer spending, prompting investors to rethink their portfolios.

One effective strategy is to focus on defensive stocks, which tend to remain stable even when the broader market declines. Sectors such as utilities, healthcare, and consumer staples often provide essential goods and services, making them less susceptible to economic fluctuations. These industries can offer relatively stable dividends, providing a safety net for investors.

Another approach is diversifying investments across asset classes. While equities may suffer during a recession, fixed-income securities, such as bonds, can provide a more stable return. Additionally, commodities like gold often serve as a hedge against inflation and market uncertainty, making them a valuable addition to a recession-proof portfolio.

Investors may also consider adopting a long-term perspective. Recessions are typically followed by recoveries, and maintaining a focus on long-term goals can help mitigate the emotional impact of short-term market declines. Dollar-cost averaging—investing a fixed amount regularly—can also be beneficial, allowing investors to purchase more shares when prices are low.

Furthermore, it’s crucial to stay informed about fiscal and monetary policies. Government interventions, such as stimulus packages and interest rate adjustments, can significantly influence market conditions. Understanding these factors can help investors make informed decisions and adjust their strategies accordingly.

In summary, resilience in crisis involves a blend of strategic asset allocation, a focus on defensive investments, and a long-term outlook. By adapting their investment strategies to the realities of a recession, investors can navigate economic challenges and position themselves for future recovery.

3. **Government Intervention: The Role of Stimulus in Economic Recovery**

Government intervention through stimulus measures plays a crucial role in economic recovery during recessions. When economic activity slows, consumer spending typically declines, leading to reduced business revenue and, subsequently, increased unemployment. In response, governments often implement stimulus packages aimed at injecting liquidity into the economy, supporting businesses, and providing direct assistance to individuals.

Stimulus measures can take various forms, including direct cash transfers, tax relief, increased unemployment benefits, and funding for public projects. These strategies aim to boost consumer confidence and encourage spending, which is vital for stimulating economic growth. For example, during the COVID-19 pandemic, many governments around the world enacted unprecedented fiscal responses, such as the U.S. CARES Act, which provided direct payments to individuals and support for small businesses.

Moreover, government intervention can stabilize markets by ensuring liquidity. Central banks may lower interest rates or engage in quantitative easing to make borrowing cheaper and stimulate investment. This monetary policy approach is designed to encourage lending and spending, counteracting the negative effects of a recession.

However, the effectiveness of government stimulus can vary based on factors such as the size and timing of the intervention, the existing economic conditions, and public response. While stimulus can provide a necessary lifeline during downturns, reliance on such measures can also lead to concerns about inflation and long-term fiscal sustainability.

Ultimately, effective government intervention not only aids in immediate recovery but also lays the groundwork for future economic resilience, reinforcing the importance of strategic planning and preparedness in facing economic challenges.

In conclusion, understanding the multifaceted nature of economic recessions is crucial for individuals, businesses, and policymakers alike. By recognizing the early warning signs, such as declining consumer confidence and increased unemployment rates, stakeholders can take proactive measures to mitigate the impact of an economic downturn. Different sectors respond uniquely to recessions, requiring tailored investment strategies that emphasize resilience and adaptability. Government stimulus plays a vital role in cushioning the blow, providing essential support to those most affected and fostering a quicker recovery.

Consumer behavior shifts dramatically during recessions, with heightened caution and prioritization of necessities, prompting businesses to rethink their strategies and offerings. The global landscape is also affected, as recessions disrupt trade and supply chains, illustrating the interconnectedness of economies worldwide. Lessons learned from past downturns serve as valuable guides, reminding us of the importance of preparedness and flexibility.

Ultimately, businesses that adopt a proactive approach, leveraging the insights gained from previous recessions, can not only survive but potentially thrive in challenging economic climates. By embracing innovation, maintaining financial prudence, and prioritizing customer relationships, organizations can navigate the uncertainties of a recession and emerge stronger in the long run. As we look to the future, it is imperative to remain vigilant and informed, ensuring that we are ready to face economic challenges head-on.