Weathering the Storm: Understanding Recession Indicators, Impacts, and Strategies for Resilience

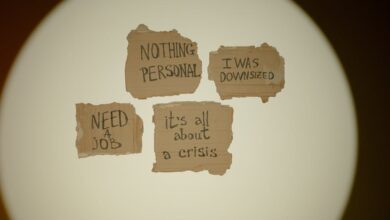

In an ever-evolving economic landscape, understanding the nuances of recessions is crucial for individuals, businesses, and policymakers alike. As economic cycles fluctuate, early warning signs can provide valuable insights into impending downturns, allowing stakeholders to adapt and strategize effectively. This article delves into the early indicators of a recession, the multifaceted impacts on various sectors, and the strategies investors can employ to navigate these turbulent times. We will explore the vital role of government stimulus in mitigating economic challenges, examine shifts in consumer behavior during downturns, and assess the implications for global trade and supply chains. Furthermore, by reflecting on lessons learned from past recessions, we can glean insights that remain relevant today. Finally, we will discuss proactive measures businesses can take to prepare for and weather economic storms, ensuring resilience in the face of adversity.

- 1. **Recognizing the Signs: Early Warning Indicators of an Economic Recession**

- 2. **Navigating Uncertainty: Investment Strategies for Recessions**

- 3. **Government Intervention: The Crucial Role of Stimulus in Economic Recovery**

1. **Recognizing the Signs: Early Warning Indicators of an Economic Recession**

Recognizing the early warning signs of an economic recession is crucial for individuals, businesses, and policymakers alike. Several key indicators can signal an impending downturn, allowing stakeholders to take proactive measures.

One of the most watched indicators is the Gross Domestic Product (GDP). A consistent decline in GDP over two consecutive quarters is a traditional definition of recession. Additionally, a slowdown in economic growth rates can foreshadow a recession, even before GDP figures turn negative.

Another critical sign is the unemployment rate. Rising unemployment rates often precede recessions, as businesses begin to cut costs in response to declining sales. Similarly, a significant increase in initial jobless claims can indicate that companies are anticipating reduced demand for their products or services.

Consumer confidence is another vital indicator. Surveys, such as the Consumer Confidence Index, track how optimistic consumers feel about the economy. A marked decline in consumer confidence can lead to reduced spending, which is crucial for economic growth.

Manufacturing activity also provides insights into economic health. A decrease in manufacturing output or a drop in the Purchasing Managers' Index (PMI) can signal that businesses expect lower demand for goods and services, often a precursor to a broader economic slowdown.

Moreover, financial markets can offer early warnings. A sustained yield curve inversion, where short-term interest rates exceed long-term rates, is historically seen as a predictor of recession. This phenomenon occurs when investors anticipate a slowdown and seek safer, longer-term investments.

Lastly, inflation and interest rates should not be overlooked. Rapid inflation can erode purchasing power and prompt central banks to raise interest rates, which can slow down economic activity. Conversely, deflationary pressures can indicate weak demand and contribute to recessionary conditions.

By monitoring these indicators, stakeholders can better prepare for potential economic downturns, enabling them to make informed decisions to mitigate risks and seize opportunities.

2. **Navigating Uncertainty: Investment Strategies for Recessions**

During economic recessions, investors often face heightened uncertainty and volatility in the markets. However, with careful planning and strategic adjustments, it is possible to navigate these challenging times effectively. Here are several investment strategies that can help mitigate risks and potentially capitalize on opportunities during a recession.

First, diversifying investments is crucial. By spreading assets across various sectors, including defensive stocks such as utilities and consumer staples, investors can minimize losses since these sectors typically perform better during downturns. Additionally, including fixed-income securities, such as government bonds, can provide stability and income, as they often retain value when equity markets decline.

Second, investors may consider adopting a more conservative approach by focusing on high-quality stocks with strong balance sheets and consistent dividend payments. These companies are generally better positioned to weather economic storms and can provide a reliable income stream, even when growth is slow.

Third, exploring alternative investments, such as real estate or commodities like gold, can also be beneficial. Real estate can offer rental income and may appreciate over time, while commodities often serve as a hedge against inflation and market volatility.

Moreover, maintaining a cash reserve is essential during recessions. Having liquidity available allows investors to take advantage of lower asset prices and invest in opportunities that may arise as the market adjusts.

Finally, it is important to continuously monitor economic indicators and market trends. Staying informed about changes in consumer behavior, government policies, and global economic conditions can help investors make timely decisions and adjust their strategies as necessary.

By implementing these strategies, investors can better position themselves to withstand the challenges of a recession and emerge stronger when economic conditions improve.

3. **Government Intervention: The Crucial Role of Stimulus in Economic Recovery**

Government intervention plays a pivotal role in mitigating the effects of economic recessions and fostering recovery. One of the primary tools employed by governments is fiscal stimulus, which involves increased government spending and tax cuts aimed at boosting economic activity. During downturns, consumer confidence typically wanes, leading to reduced spending. By injecting capital into the economy, governments can stimulate demand for goods and services, thereby encouraging businesses to maintain or expand operations.

Historically, stimulus measures have taken various forms, including direct payments to individuals, increased funding for social programs, and incentives for businesses to invest and hire. For instance, during the 2008 financial crisis, the U.S. government enacted the American Recovery and Reinvestment Act, which allocated over $800 billion for infrastructure projects, tax relief, and social services. This infusion of funds was critical in stabilizing the economy and preventing a deeper recession.

Moreover, central banks often complement fiscal measures with monetary policy actions, such as lowering interest rates and implementing quantitative easing. These strategies enhance liquidity in the financial system, making it easier for consumers and businesses to borrow money, which can further stimulate economic activity.

However, the effectiveness of stimulus measures can vary based on several factors, including the speed and scale of implementation, the overall economic context, and the public's perception of government actions. While stimulus can provide a much-needed boost, it is essential for policymakers to balance immediate relief with long-term economic health, as excessive spending or prolonged low-interest rates can lead to inflationary pressures or increased national debt.

In conclusion, government stimulus is a crucial element in responding to economic recessions. By strategically deploying resources to stimulate demand and support vulnerable sectors, governments can facilitate recovery and lay the groundwork for future growth. The lessons learned from past interventions continue to inform current strategies, underscoring the importance of timely and effective government action in navigating economic downturns.

In conclusion, understanding the dynamics of an economic recession is essential for individuals, businesses, and policymakers alike. By recognizing the early warning signs, such as shifts in consumer behavior and declining industrial activity, stakeholders can better prepare for potential downturns. Different sectors of the economy react uniquely to recessions, highlighting the importance of tailored investment strategies that focus on resilience and long-term stability. Government stimulus plays a pivotal role in mitigating the effects of a recession, providing necessary support to both consumers and businesses to foster recovery.

Moreover, the impact of recessions extends beyond national borders, influencing global trade and supply chains, which further complicates the economic landscape. The lessons learned from past recessions serve as valuable guides for navigating current and future challenges, emphasizing the need for proactive measures and strategic planning. By adopting effective preparation techniques, businesses can not only survive but potentially thrive in the face of economic adversity. As we look ahead, maintaining vigilance and adaptability will be key to weathering economic storms and ensuring sustainable growth in the long run.