Transforming Tomorrow: The Intersection of AI, Blockchain, Quantum Computing, and Sustainable Innovation in Financial Services

In an era defined by rapid technological advancement, the financial services sector stands at the forefront of a transformative revolution. Artificial intelligence (AI) is reshaping traditional paradigms, enhancing efficiency, and personalizing customer experiences, while blockchain technology is redefining trust and transparency across various industries. As we delve deeper into the implications of these innovations, we also encounter the emergence of quantum computing, which promises to disrupt cybersecurity frameworks and challenge existing norms. Alongside these developments, the rise of fintech solutions—from digital wallets to robo-advisors—illustrates a shift towards more accessible and user-friendly financial services. The advent of 5G technology further amplifies this transformation, paving the way for unprecedented global connectivity and real-time data exchange. Yet, as we embrace these advancements, it is crucial to address the ethical challenges that accompany them and explore their potential role in driving sustainability and green energy solutions. This article will explore the dynamic interplay between these technologies, highlighting their collective impact on finance, cybersecurity, innovation, and the future of our planet.

- 1. "Revolutionizing Finance: The Transformative Power of AI and Blockchain"

- 2. "Quantum Computing and Cybersecurity: Navigating the Next Frontier"

- 3. "Innovating for Tomorrow: Fintech, 5G, and the Sustainability Revolution"

1. "Revolutionizing Finance: The Transformative Power of AI and Blockchain"

The financial services sector is undergoing a profound transformation, driven by the integration of artificial intelligence (AI) and blockchain technology. These innovations are reshaping how financial institutions operate, enhancing efficiency, security, and customer experience.

AI has emerged as a key player in revolutionizing finance by automating processes, improving decision-making, and personalizing services. Machine learning algorithms analyze vast amounts of data to identify trends and make predictions, enabling financial institutions to offer tailored products and services. For instance, AI-powered chatbots provide 24/7 customer support, handling inquiries and transactions with remarkable accuracy. Additionally, AI enhances risk management by detecting fraudulent activities in real-time, significantly reducing losses and improving compliance with regulatory standards.

Blockchain technology, on the other hand, introduces a decentralized and transparent approach to financial transactions. By utilizing a distributed ledger, blockchain ensures that all parties have access to a single version of the truth, thereby enhancing trust and reducing the need for intermediaries. This is particularly transformative in areas like cross-border payments, where blockchain can streamline processes, lower costs, and increase transaction speed. Moreover, smart contracts—self-executing contracts with the terms directly written into code—automate and enforce agreements, minimizing the potential for disputes and enhancing operational efficiency.

The synergy between AI and blockchain creates a robust ecosystem for financial services, where data-driven insights from AI can be seamlessly integrated with the security and transparency of blockchain. This combination not only fosters innovation but also paves the way for new business models, such as decentralized finance (DeFi), which empowers individuals to engage in financial activities without traditional banking intermediaries.

As these technologies continue to evolve, the financial services industry is poised for a future marked by greater efficiency, enhanced security, and improved customer-centric solutions. The transformative power of AI and blockchain is not just revolutionizing finance; it is redefining the very foundations of how financial transactions are conducted and managed.

2. "Quantum Computing and Cybersecurity: Navigating the Next Frontier"

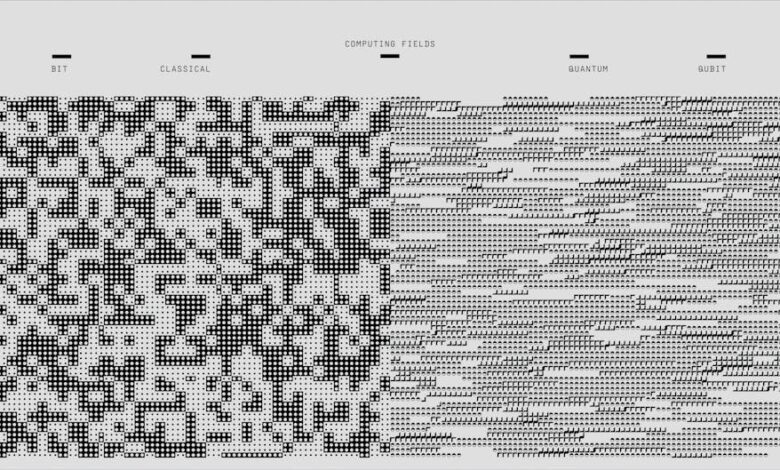

Quantum computing represents a significant leap forward in computational power, offering the potential to solve complex problems that are currently intractable for classical computers. This advancement brings both opportunities and challenges, particularly in the realm of cybersecurity. As quantum computers become more powerful, they could potentially break widely used encryption algorithms, rendering traditional security measures obsolete.

The primary concern lies with public-key cryptography, which underpins much of today’s secure communications, including transactions and data protection. Algorithms such as RSA and ECC (Elliptic Curve Cryptography) could be compromised by quantum algorithms like Shor’s algorithm, which can factor large integers and compute discrete logarithms exponentially faster than classical methods. This vulnerability necessitates a reevaluation of our current cybersecurity frameworks.

In response, the field of post-quantum cryptography is emerging, focusing on developing new algorithms that are resistant to quantum attacks. Researchers are exploring various mathematical problems, such as lattice-based, hash-based, and code-based cryptography, which could secure data against the capabilities of quantum computers. Implementing these new cryptographic standards will be essential as quantum technology matures.

Moreover, quantum computing offers potential advantages for cybersecurity as well. Quantum key distribution (QKD) utilizes the principles of quantum mechanics to create secure communication channels that are theoretically immune to eavesdropping. By ensuring that any attempt to intercept the communication would disturb the quantum states involved, QKD presents a promising avenue for enhancing security.

As we navigate this next frontier, collaboration between technologists, policymakers, and industry leaders will be crucial to establish robust cybersecurity measures that can withstand the evolving threats posed by quantum computing. The timeline for widespread quantum computing adoption remains uncertain, but proactive steps in cybersecurity will help safeguard information and maintain trust in digital systems, ensuring that the benefits of this revolutionary technology can be realized without compromising security.

3. "Innovating for Tomorrow: Fintech, 5G, and the Sustainability Revolution"

The convergence of fintech, 5G technology, and sustainability is fostering a transformative landscape that promises to redefine how financial services operate while addressing pressing environmental challenges. Fintech, characterized by its rapid technological advancements, has already disrupted traditional banking and financial systems through innovations such as digital wallets, mobile payment solutions, and robo-advisors. These tools not only enhance consumer accessibility but also drive financial inclusion by providing services to underserved populations.

The advent of 5G technology amplifies these fintech innovations by enabling faster, more reliable connectivity. With significantly reduced latency and increased bandwidth, 5G allows for real-time data processing and transactions, which can enhance user experiences and improve the efficiency of financial operations. For example, the ability to conduct instant transactions can facilitate micro-financing and peer-to-peer lending platforms, empowering individuals and small businesses to access funds quickly and easily.

Moreover, the integration of fintech solutions with 5G can significantly contribute to sustainability efforts. By harnessing real-time data analytics, financial institutions can better assess the environmental impact of their investments and lending practices. This capability enables them to prioritize funding for green projects and companies that are committed to sustainable practices. Additionally, digital financial services reduce the need for physical infrastructure and resources, leading to lower carbon footprints associated with traditional banking operations.

As both fintech and 5G continue to evolve, they present unique opportunities to address global sustainability challenges. For instance, innovations such as blockchain technology can enhance transparency in supply chains, allowing consumers and businesses to track the environmental impact of products and services. This transparency fosters accountability and encourages companies to adopt greener practices.

In conclusion, the synergy between fintech, 5G technology, and sustainability initiatives not only revolutionizes financial services but also paves the way for a more sustainable future. By leveraging these technologies, the financial sector can play a pivotal role in driving environmental stewardship and fostering economic growth that aligns with the principles of sustainability.

In conclusion, the rapid advancement of technology is fundamentally reshaping the landscape of financial services and beyond. As artificial intelligence and blockchain usher in unparalleled efficiencies and transparency, industries are poised for a transformation that enhances both customer experience and operational effectiveness. The emergence of quantum computing introduces exciting prospects for cybersecurity, challenging existing paradigms and prompting a reevaluation of data protection strategies. Meanwhile, innovations in fintech, coupled with the rollout of 5G technology, are not only improving connectivity but also fostering new business models that prioritize accessibility and sustainability.

As big data continues to inform decision-making processes, organizations are empowered to make more strategic choices that align with their goals and values. However, these advancements also bring ethical challenges that require careful consideration, particularly regarding AI and automation's societal implications. The intersection of technology and sustainability highlights the potential for a greener future, driven by innovative solutions that address pressing global challenges.

Ultimately, embracing these technological shifts is not merely an option but a necessity for businesses aiming to thrive in an increasingly interconnected world. The journey ahead promises both opportunities and obstacles, and it will be crucial for stakeholders across industries to navigate this landscape thoughtfully and responsibly, ensuring that the benefits of emerging technologies are realized for all.