Transforming Tomorrow: The Impact of Emerging Technologies on Finance, Security, and Sustainability

In an era defined by rapid technological advancement, the financial services sector stands at the forefront of innovation, driven by transformative technologies that are reshaping the landscape of commerce and connectivity. The integration of artificial intelligence (AI) and blockchain is revolutionizing how financial institutions operate, enhancing efficiency, security, and customer experience. Beyond finance, blockchain's potential is being recognized across various industries, signaling a shift in how businesses transact and collaborate. Meanwhile, the rise of quantum computing promises to redefine cybersecurity, introducing unprecedented capabilities and challenges in protecting sensitive data.

As we venture further into the digital age, the emergence of 5G technology is set to enhance global connectivity, enabling real-time data exchange and fostering the growth of fintech innovations such as digital wallets and robo-advisors. The advent of big data analytics is likewise transforming decision-making processes in finance and business, allowing for more informed strategies and personalized services. However, with these advancements come significant ethical challenges surrounding AI and automation, prompting critical discussions about accountability and fairness. Moreover, the role of technology in promoting sustainability and green energy solutions is increasingly recognized as vital for addressing global challenges.

This article explores these interconnected themes, delving into how these emerging technologies are not only transforming financial services but also influencing broader societal dynamics. Join us as we examine the profound implications of these innovations on our future.

- 1. **Transformative Technologies: AI and Blockchain Redefining Financial Services**

- 2. **Quantum Leap: The Intersection of Quantum Computing and Cybersecurity**

1. **Transformative Technologies: AI and Blockchain Redefining Financial Services**

The financial services sector is undergoing a profound transformation driven by the advent of transformative technologies such as artificial intelligence (AI) and blockchain. These innovations are not only enhancing operational efficiency but also reshaping the way businesses interact with customers, manage risks, and comply with regulatory requirements.

AI is revolutionizing financial services by enabling organizations to analyze vast amounts of data in real-time, leading to improved decision-making and personalized customer experiences. For instance, AI-powered algorithms can assess creditworthiness more accurately by analyzing alternative data sources, thereby broadening access to credit for underserved populations. Additionally, AI enhances fraud detection capabilities by identifying unusual patterns and behaviors, allowing institutions to respond swiftly to potential threats.

On the other hand, blockchain technology is redefining the landscape of financial transactions by introducing transparency, security, and efficiency. By creating a decentralized ledger that records all transactions securely, blockchain minimizes the risk of fraud and reduces the need for intermediaries. This is particularly transformative in cross-border payments, where blockchain can streamline processes and lower costs significantly. Moreover, smart contracts—self-executing contracts with the terms of the agreement directly written into code—enable automatic execution of transactions when predefined conditions are met, further enhancing efficiency.

Together, AI and blockchain are fostering a new era of innovation in financial services. They empower organizations to offer more tailored services, streamline operations, and enhance customer trust through greater transparency and security. As these technologies continue to evolve, their integration is expected to drive even more significant changes, enabling financial institutions to adapt swiftly to market demands and regulatory challenges while delivering superior value to their clients.

Artificial intelligence (AI) is fundamentally reshaping financial services by enhancing efficiency, improving customer experiences, and enabling smarter decision-making. AI-driven algorithms analyze vast amounts of data to identify patterns, predict market trends, and automate processes, significantly reducing the time and resources required for tasks such as risk assessment and compliance checks. For instance, AI-powered chatbots provide instant customer support, while machine learning models help in fraud detection by recognizing unusual transaction behaviors in real-time.

Simultaneously, blockchain technology is making waves across various sectors beyond finance, including supply chain management, healthcare, and real estate. By offering a decentralized, transparent ledger, blockchain enhances trust and traceability in transactions. Businesses can leverage smart contracts for automated processes, reducing the need for intermediaries and lowering operational costs. This technology is particularly beneficial in industries where verification and authenticity are crucial, such as pharmaceuticals, where it can track the provenance of drugs.

On the horizon, quantum computing presents both opportunities and challenges, particularly in the realm of cybersecurity. Quantum computers can process information at unprecedented speeds, which could revolutionize data encryption and cryptography. However, they also pose a threat to current security protocols, requiring a new generation of cryptographic techniques to safeguard sensitive information against potential breaches.

In the realm of fintech, innovations such as digital wallets and robo-advisors are democratizing access to financial services. Digital wallets streamline transactions and enhance user convenience, while robo-advisors offer personalized investment advice at a fraction of the cost of traditional financial advisors. These tools empower individuals to manage their finances more effectively, fostering financial literacy and inclusion.

The advent of 5G technology is set to enhance global connectivity, enabling faster and more reliable internet access. This advancement will facilitate the proliferation of IoT devices, enhancing data collection and analysis across industries. Consequently, businesses can leverage real-time data to make informed decisions, optimize operations, and create value for customers.

Big data analytics is a game-changer in finance and business, driving data-informed decision-making. Organizations harness vast datasets to gain insights into consumer behavior, market trends, and operational efficiencies. This analytical capability allows businesses to tailor their offerings, mitigate risks, and enhance overall performance.

However, the rapid development of emerging technologies like AI and automation raises ethical challenges. Issues such as bias in AI algorithms, job displacement due to automation, and data privacy concerns necessitate a careful examination of the societal implications. Stakeholders must work collaboratively to establish ethical guidelines and regulations that ensure technology serves the greater good.

Finally, technology plays a crucial role in advancing sustainability and green energy solutions. Innovations such as smart grids, energy-efficient systems, and carbon tracking software help organizations minimize their environmental impact. By leveraging data analytics and AI, companies can optimize resource use, reduce waste, and contribute to a more sustainable future. As these technologies continue to evolve, their integration into various sectors will be vital in addressing the pressing challenges of climate change and resource depletion.

2. **Quantum Leap: The Intersection of Quantum Computing and Cybersecurity**

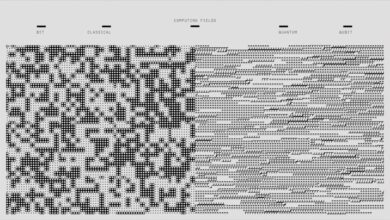

Quantum computing represents a significant leap forward in computational power, with the potential to transform various sectors, including cybersecurity. Unlike classical computers, which process information in bits (0s and 1s), quantum computers leverage quantum bits, or qubits, allowing them to perform complex calculations at unprecedented speeds. This capability poses both opportunities and challenges for the field of cybersecurity.

On one hand, quantum computing could enhance cybersecurity measures through the development of quantum encryption methods, such as quantum key distribution (QKD). QKD utilizes the principles of quantum mechanics to create a secure communication channel that is theoretically immune to eavesdropping. Any attempt to intercept the quantum keys would disturb the quantum states, alerting the communicating parties to the presence of an intruder. This innovation could lead to more secure data transmission and protect sensitive information from cyber threats.

Conversely, the rise of quantum computing also introduces significant risks to existing cryptographic systems. Many current encryption protocols, which underpin online security and data protection, rely on the difficulty of certain mathematical problems (like factoring large numbers) to safeguard information. Quantum computers possess the potential to solve these problems exponentially faster than classical computers, rendering traditional encryption methods vulnerable. For instance, algorithms like Shor's algorithm can break widely used encryption standards, such as RSA and ECC, which would have profound implications for data security across various industries.

As organizations begin to recognize these dual implications, there is an urgent need to develop and adopt quantum-resistant cryptographic algorithms. Researchers and cybersecurity experts are actively working on post-quantum cryptography solutions that can withstand quantum attacks, ensuring data integrity and confidentiality in a future where quantum computing is prevalent.

In summary, the intersection of quantum computing and cybersecurity represents a critical area of focus as we move towards a technologically advanced future. While it offers transformative potential for enhancing security measures, it also necessitates proactive strategies to mitigate the risks associated with quantum threats. The ongoing dialogue between quantum technology and cybersecurity will shape the landscape of digital security in the years to come.

In conclusion, the intersection of transformative technologies such as artificial intelligence, blockchain, quantum computing, and big data is reshaping the landscape of financial services and beyond. As AI and blockchain collaborate to enhance efficiency and security within the financial sector, industries are also witnessing the far-reaching implications of these innovations. Quantum computing, while still in its infancy, holds the potential to redefine cybersecurity, offering solutions that can outpace existing threats.

The rise of fintech innovations, from digital wallets to robo-advisors, is democratizing access to financial services and empowering consumers with unprecedented tools for managing their finances. Meanwhile, the rollout of 5G technology promises to enhance global connectivity, paving the way for more integrated and responsive financial ecosystems.

However, as we embrace these advancements, it is crucial to address the ethical challenges they present, ensuring that the benefits of AI and automation do not come at the cost of equity or privacy. Moreover, leveraging technology for sustainability and green energy solutions underscores the responsibility of the financial sector to contribute positively to global challenges.

As we look to the future, the ongoing dialogue about the role of technology in our lives will be essential in navigating this rapidly evolving landscape, ensuring that innovation serves as a force for good, fostering both economic growth and social responsibility.