Transformative Technologies: Redefining Finance, Connectivity, and Ethics in the Digital Age

In an era defined by rapid technological advancement, the financial services sector is undergoing a profound transformation driven by emerging innovations. From artificial intelligence (AI) optimizing decision-making processes to blockchain technology reshaping transactional frameworks, the integration of these tools is not only revolutionizing finance but also extending their influence across various industries. Meanwhile, the advent of quantum computing presents unprecedented challenges and opportunities for cybersecurity, compelling organizations to rethink their digital protection strategies. As fintech innovations—such as digital wallets and robo-advisors—gain traction, they are reshaping consumer experiences and investment strategies alike. Furthermore, the rollout of 5G technology promises to enhance global connectivity, enabling smarter solutions for businesses and individuals. However, amidst these advancements, ethical considerations and sustainability challenges must be addressed to ensure that technology serves as a force for good. This article delves into the intersection of these transformative technologies, exploring their implications for financial services and beyond, while highlighting the pressing need for responsible innovation.

- Here are three possible section headlines for your article covering the specified topics:

- 1. **Harnessing AI and Blockchain: A New Era in Financial Services and Beyond**

- 2. **Quantum Computing and Cybersecurity: The Next Frontier of Digital Protection**

Here are three possible section headlines for your article covering the specified topics:

Artificial Intelligence in Financial Services

Artificial intelligence (AI) is profoundly transforming financial services by enhancing efficiency, personalization, and security. AI algorithms analyze vast datasets to identify patterns and trends, enabling financial institutions to provide tailored products and services. For instance, AI-driven chatbots offer 24/7 customer support, handling inquiries and transactions seamlessly. Additionally, AI enhances risk management by predicting market fluctuations and detecting fraudulent activities in real-time. As a result, financial institutions can operate more effectively, reduce costs, and improve customer satisfaction.

Blockchain Beyond Finance

While blockchain technology is most commonly associated with cryptocurrencies, its potential extends far beyond the financial sector. Industries such as supply chain management, healthcare, and real estate are leveraging blockchain for enhanced transparency, security, and efficiency. By enabling secure, immutable records of transactions, blockchain can streamline processes like tracking goods in transit, managing patient records, and verifying property ownership. This decentralized approach fosters trust among stakeholders, reduces fraud, and minimizes the need for intermediaries, leading to significant cost savings and improved operational workflows.

Quantum Computing and Cybersecurity

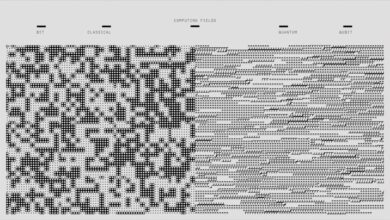

The advent of quantum computing poses both opportunities and challenges for cybersecurity. With its ability to process information at unprecedented speeds, quantum computing could revolutionize data encryption and secure communications. However, it also threatens existing encryption methods, rendering many current security protocols obsolete. As a result, organizations must prepare for a future where quantum-resistant encryption becomes essential. The race is on to develop new cryptographic techniques that can withstand quantum attacks, ensuring that sensitive data remains protected in an increasingly digital world.

1. **Harnessing AI and Blockchain: A New Era in Financial Services and Beyond**

The convergence of artificial intelligence (AI) and blockchain technology is ushering in a transformative era for financial services and various other industries. AI enhances data analysis and decision-making processes, while blockchain provides a secure, transparent, and decentralized framework for transactions. Together, these technologies are not only improving operational efficiency but also enabling innovative solutions that redefine traditional business models.

In financial services, AI algorithms analyze vast amounts of data to identify trends, assess risks, and personalize customer experiences. For example, AI-driven chatbots offer instant support to clients, while machine learning models refine fraud detection processes by learning from transaction patterns. When integrated with blockchain, these AI capabilities gain an extra layer of security and trust. Transactions recorded on a blockchain are immutable and transparent, reducing the likelihood of fraud and enhancing compliance with regulatory requirements.

Beyond finance, the combination of AI and blockchain is making strides in sectors such as supply chain management, healthcare, and real estate. In supply chain management, AI enhances inventory tracking and demand forecasting, while blockchain ensures that every transaction is recorded securely, providing a complete audit trail. In healthcare, patient data can be securely shared across systems using blockchain, with AI analyzing this data to improve patient outcomes and streamline operations.

As organizations leverage the strengths of both technologies, they unlock new opportunities for collaboration and innovation. For instance, financial institutions can use AI to develop blockchain-based solutions for cross-border payments, significantly reducing transaction times and costs. This synergy not only enhances service delivery but also fosters greater financial inclusion by enabling access to services for underserved populations.

In summary, the harnessing of AI and blockchain signals a new era in financial services and beyond, characterized by enhanced security, improved efficiency, and innovative solutions that challenge traditional paradigms. As these technologies continue to evolve, their combined potential will likely reshape industries, driving growth and fostering a more interconnected and transparent global economy.

2. **Quantum Computing and Cybersecurity: The Next Frontier of Digital Protection**

Quantum computing represents a significant leap forward in computational power, with the potential to solve complex problems much faster than traditional computers. This advancement comes with profound implications for cybersecurity, as it poses both threats and opportunities.

On one hand, quantum computers could undermine existing encryption methods. Many of today’s cryptographic algorithms, such as RSA and ECC, rely on the difficulty of certain mathematical problems, like factoring large integers or computing discrete logarithms. Quantum computers, through algorithms like Shor's algorithm, can efficiently perform these calculations, potentially rendering current encryption standards obsolete. This vulnerability raises concerns about the security of sensitive data, from personal information to national secrets, highlighting the urgent need for a transition to quantum-resistant cryptography.

Conversely, quantum computing also brings forth innovative solutions for enhancing cybersecurity. Quantum key distribution (QKD) utilizes the principles of quantum mechanics to create secure communication channels. By leveraging the properties of quantum bits (qubits), QKD ensures that any attempt to intercept the key would be detectable, thus providing a higher level of security than classical methods. As organizations seek to protect their data in an increasingly digital world, the integration of quantum technologies can help create a more robust cybersecurity framework.

As the development of quantum computing accelerates, the cybersecurity landscape will need to adapt rapidly. This includes not only the implementation of quantum-resistant algorithms but also the training of cybersecurity professionals to understand and navigate this new frontier. Collaboration between technologists, policymakers, and industry leaders will be essential in shaping a secure digital future that leverages the benefits of quantum computing while mitigating its risks.

In conclusion, the intersection of advanced technologies such as artificial intelligence, blockchain, quantum computing, and big data is not merely reshaping the financial landscape; it is heralding a transformative era across multiple industries. As AI and blockchain streamline processes and enhance transparency in financial services, they also lay the groundwork for innovation in sectors beyond finance, fostering greater efficiency and reliability. Meanwhile, the advent of quantum computing presents both opportunities and challenges, particularly in the realm of cybersecurity, where safeguarding data becomes paramount in an increasingly digital world.

The rise of fintech innovations, from digital wallets to robo-advisors, exemplifies how technology is democratizing access to financial services, empowering consumers, and driving inclusivity. Coupled with the rapid deployment of 5G technology, which promises unprecedented global connectivity, businesses can leverage real-time data for informed decision-making, leading to enhanced performance and strategic advantages.

However, as we navigate these advancements, we must also confront the ethical challenges they present. The implications of AI and automation demand a thoughtful approach to ensure that technological progress does not come at the expense of societal values. Furthermore, technology plays a critical role in promoting sustainability and green energy solutions, emphasizing the importance of aligning innovation with environmental stewardship.

As we look to the future, the potential for these technologies to foster a more inclusive, secure, and sustainable world is immense. By harnessing their capabilities responsibly, we can pave the way for a future where technology serves the greater good, driving progress while addressing the ethical considerations that accompany such profound change.