Transformative Technologies: How AI, Blockchain, and Quantum Computing Are Shaping the Future of Finance and Beyond

In an era defined by rapid technological advancement, the intersection of emerging technologies is reshaping industries at an unprecedented pace. From the financial sector to global connectivity, innovations such as artificial intelligence, blockchain, quantum computing, and big data are not only revolutionizing traditional practices but also presenting new ethical challenges and opportunities for sustainability. This article explores the multifaceted role of these technologies, beginning with how artificial intelligence is transforming financial services, before delving into the revolutionary impact of blockchain beyond finance. We will also examine the rise of quantum computing and its implications for cybersecurity, the innovations driving fintech, the future of 5G technology, and the influence of big data on decision-making processes. Lastly, we will discuss the critical ethical considerations that accompany these advancements and the potential for technology to drive sustainability initiatives. Join us as we navigate this dynamic landscape and uncover the profound changes emerging technologies are ushering in across various sectors.

- 1. **Harnessing AI: Transforming Financial Services and Beyond**

- 2. **Blockchain Breakthroughs: Revolutionizing Industries Outside of Finance**

1. **Harnessing AI: Transforming Financial Services and Beyond**

Artificial intelligence (AI) is fundamentally transforming financial services by enhancing efficiency, improving customer experiences, and enabling more informed decision-making. In areas such as risk assessment, fraud detection, and personalized customer service, AI algorithms analyze vast datasets to identify patterns and trends that would be impossible for humans to discern alone. For instance, credit scoring models powered by machine learning can evaluate a broader range of data points, leading to more accurate assessments of an individual's creditworthiness.

Moreover, AI-driven chatbots and virtual assistants are revolutionizing customer interactions, providing 24/7 support and tailored financial advice. These tools not only streamline operations but also reduce costs, allowing financial institutions to allocate resources more effectively. As AI continues to evolve, it is expected to drive innovations such as predictive analytics, enabling firms to anticipate market movements and consumer behaviors, thereby enhancing strategic planning.

Beyond finance, AI is making significant inroads in other industries. In healthcare, AI systems analyze patient data to improve diagnostic accuracy and optimize treatment plans. In supply chain management, AI enhances inventory tracking and demand forecasting, leading to more efficient operations. The cross-industry applications of AI highlight its potential to drive efficiency and innovation in various sectors, creating a ripple effect that extends far beyond the financial realm.

As organizations harness the power of AI, they must also navigate challenges related to data privacy, ethical considerations, and the need for transparency in AI decision-making processes. Addressing these issues will be crucial for ensuring that the benefits of AI are realized responsibly and sustainably across all industries.

Artificial intelligence (AI) is playing a pivotal role in revolutionizing financial services by enhancing efficiency, improving customer experiences, and enabling sophisticated data analysis. AI algorithms can process vast amounts of data at incredible speeds, allowing financial institutions to identify patterns, detect fraud, and make informed decisions in real-time. For instance, machine learning models are employed to assess credit risk more accurately, leading to better lending practices and reduced defaults.

In addition to risk assessment, AI-driven chatbots and virtual assistants are transforming customer service in finance, providing 24/7 support for inquiries and transactions. This not only enhances customer satisfaction but also reduces operational costs for banks and financial service providers. Furthermore, AI is facilitating personalized financial advice through robo-advisors, which analyze individual user data to recommend tailored investment strategies.

Blockchain technology is also making waves beyond the financial sector, offering innovative solutions across various industries. Its decentralized and immutable ledger system enhances transparency and security, making it ideal for supply chain management, healthcare records, and identity verification. By streamlining processes and reducing the risk of fraud, blockchain is poised to disrupt traditional business models and create new efficiencies.

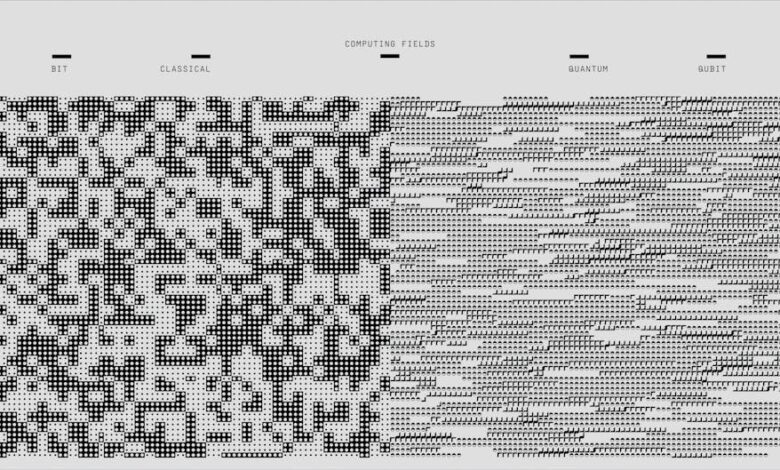

As quantum computing emerges, its potential impact on cybersecurity cannot be understated. While quantum computers promise to solve complex problems exponentially faster than classical computers, they also pose significant risks to current encryption methods. This necessitates the development of quantum-resistant algorithms to safeguard sensitive information against potential breaches.

In fintech, innovations such as digital wallets and robo-advisors have democratized access to financial services, allowing users to manage their finances more conveniently and with greater autonomy. Digital wallets enable seamless transactions and budgeting, while robo-advisors provide low-cost investment options, making financial literacy and investment accessible to a broader audience.

The advent of 5G technology is set to enhance global connectivity, enabling faster internet speeds and more reliable connections. This transformation will support the proliferation of IoT devices, smart cities, and advanced mobile applications, further integrating technology into our daily lives and driving economic growth.

Big data is shaping decision-making in finance and business by offering insights that were previously unattainable. Organizations can leverage data analytics to identify market trends, optimize operations, and enhance customer targeting, ultimately leading to more informed strategic decisions.

However, the rapid advancement of emerging technologies raises ethical challenges that must be addressed. Concerns surrounding data privacy, algorithmic bias, and job displacement due to automation necessitate a careful examination of the societal implications of these innovations. As we embrace the potential of AI, blockchain, and other technologies, it is crucial to establish ethical frameworks that promote accountability and address the risks associated with their use.

Finally, technology plays an essential role in driving sustainability and green energy solutions. Innovative platforms are emerging that facilitate the trading of renewable energy credits, optimize energy consumption, and promote environmentally friendly practices. By harnessing technology to address climate change and drive sustainable practices, industries can contribute to a greener future while also achieving economic benefits.

2. **Blockchain Breakthroughs: Revolutionizing Industries Outside of Finance**

Blockchain technology, initially developed as the backbone for cryptocurrencies, has evolved into a transformative force across various industries beyond finance. Its inherent characteristics—decentralization, transparency, and security—are proving invaluable in sectors such as supply chain management, healthcare, and energy.

In supply chain management, blockchain enhances traceability and accountability. By creating an immutable record of transactions, stakeholders can track products from origin to consumer, mitigating issues like fraud and counterfeit goods. For instance, companies are utilizing blockchain to ensure the authenticity of luxury items and to trace the sourcing of raw materials, which is increasingly important to environmentally conscious consumers.

In healthcare, blockchain is revolutionizing patient data management. By enabling secure sharing of medical records across different healthcare providers, blockchain enhances interoperability while safeguarding patient privacy. This technology allows patients to have greater control over their health data, granting access only to authorized parties and facilitating more efficient care coordination.

The energy sector is also experiencing significant changes due to blockchain. Decentralized energy systems, where consumers can generate and sell their own energy, are becoming more feasible through blockchain applications. This not only empowers consumers but also promotes the use of renewable energy sources. For example, peer-to-peer energy trading platforms leverage blockchain to allow users to buy and sell excess energy directly, optimizing energy distribution and reducing reliance on traditional power grids.

Furthermore, industries such as real estate and insurance are exploring blockchain for enhanced transparency and efficiency. Smart contracts can automate and streamline processes, reducing the need for intermediaries and expediting transactions.

As blockchain technology continues to mature, its potential to disrupt traditional business models and foster innovation across various sectors is becoming increasingly clear. By providing secure, efficient, and transparent solutions, blockchain is not just a financial tool but a catalyst for broader industrial transformation.

In conclusion, the convergence of emerging technologies such as artificial intelligence, blockchain, quantum computing, and 5G is reshaping not only the financial services sector but also industries across the globe. As AI streamlines operations and enhances decision-making processes in finance, blockchain is redefining transparency and security, extending its influence to fields like supply chain management and healthcare. Meanwhile, the rise of quantum computing presents both a challenge and an opportunity for cybersecurity, urging businesses to adapt their strategies in an increasingly digital landscape.

Fintech innovations, from digital wallets to robo-advisors, are democratizing access to financial services, making them more user-friendly and accessible to a broader audience. The implications of 5G technology promise to enhance connectivity, facilitating real-time data exchange and fostering the growth of IoT applications. In tandem, big data analytics is revolutionizing decision-making in finance and business, empowering organizations to make informed choices based on predictive insights.

However, with these advancements come ethical challenges that must be diligently addressed, particularly concerning AI and automation. As we harness technology to drive sustainability and green energy solutions, it is crucial to ensure that ethical considerations remain at the forefront.

The future holds immense potential as we continue to navigate these technologies. By embracing innovation while vigilantly addressing the associated challenges, we can create a more efficient, equitable, and sustainable world. The journey ahead will require collaboration, adaptability, and a commitment to ethical practices, ultimately defining how we leverage technology for the greater good.