Surviving an Economic Downturn: Expert Strategies for Investing, Personal Finance, and Navigating Recession Trends

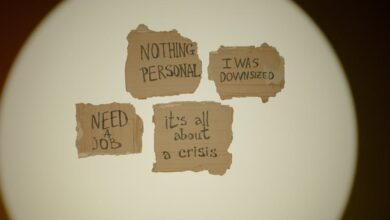

Recessions are more than just financial buzzwords—they shape markets, lifestyles, and entire economies on a global scale. As fears of a global recession persist and headlines warn of unpredictable economic downturns, understanding the roots and repercussions of these cycles is crucial for both seasoned investors and everyday consumers. Whether you are grappling with unemployment, monitoring the housing market recession, or concerned about your personal finance during a recession, knowing how to navigate these challenging times can make all the difference.

This article brings together recession expert insights to offer a comprehensive roadmap for surviving economic turbulence. We’ll unravel the causes of recessions, spotlight key indicators and historical trends, and explain how consumer behavior shifts during a financial crisis. We’ll also highlight recession-proof industries, explore smart investing in a recession, and share practical strategies for debt management, tax policies, and supporting small business recession recovery. Finally, we examine the wider ripple effects of economic downturns, from mental health recession challenges to changes in global trade and government stimulus programs.

Whether you’re seeking to fortify your portfolio with recession-proof investments or simply want to understand recession history and prepare for future recession trends, this guide will equip you with actionable knowledge to weather—and even thrive—in times of economic uncertainty.

- 1. Understanding the Roots: Recession Causes, Indicators, and Historical Trends

- 2. Investing Wisely in a Downturn: Recession-Proof Industries, Personal Finance, and Recovery Strategies

- 3. Navigating the Ripple Effects: Unemployment, Housing Market Recession, and Mental Health During Economic Downturns

1. Understanding the Roots: Recession Causes, Indicators, and Historical Trends

A recession is broadly recognized as a significant decline in economic activity spread across the economy, lasting more than a few months. Understanding the roots of a recession involves examining several key factors, including its causes, leading indicators, and evolving historical trends—insights essential for investors, business leaders, and anyone seeking to safeguard their personal finance during recession periods.

Recession causes often stem from a mix of economic shocks and underlying vulnerabilities. Some common triggers include a sudden drop in consumer spending, sharp increases in unemployment, housing market recession shocks, tightening credit conditions, or external factors like a global trade recession. Sometimes, a rapid rise in inflation outpaces wage growth, reducing purchasing power and straining household budgets—a classic example of recession and inflation interacting. Other times, sector-specific problems, such as those in the financial sector, can cascade into a full-blown economic downturn, as seen in the 2008 financial crisis (National Bureau of Economic Research, 2023, https://www.nber.org/research/data/recessions).

Economists closely monitor recession indicators—quantitative signs that the economy is slowing. These include rising unemployment claims, shrinking GDP, falling stock market values (stock market recession), sluggish consumer behavior, dips in retail sales, and increased defaults on loans, which collectively signal growing recession risk. Data from the Conference Board’s Leading Economic Index and the Federal Reserve’s manufacturing data are often used to anticipate coming shifts.

Studying recession history offers valuable lessons on lasting and emerging recession trends. The Great Depression, the 1970s stagflation crisis, and more recent events like the Great Recession of 2008 reveal patterns, such as the importance of government stimulus and agile tax policies in fostering economic recovery. Internationally, patterns of emerging market recession often differ, with global recession risks amplified by vulnerabilities in local banking or commodity-dependent economies.

Other significant trends have also emerged: the resilience of recession-proof industries (such as healthcare and consumer staples), the value of sound debt management, and the growing recognition of mental health recession impacts. Government stimulus and policy responses play a pivotal role in shaping both the depth of recession and the pace of recovery. For investors focused on surviving recession or even pursuing investing in recession, understanding these interconnected causes and signals—alongside sector-specific vulnerabilities and opportunities—can provide a critical foundation for making recession-proof investments and managing personal finances in turbulent times.

2. Investing Wisely in a Downturn: Recession-Proof Industries, Personal Finance, and Recovery Strategies

Navigating investment decisions during an economic downturn requires both caution and adaptability. Understanding which sectors are historically considered recession-proof industries can help investors shield their portfolios from severe volatility. These industries—such as healthcare, consumer staples, utilities, and discount retail—often experience steady demand regardless of shifts in consumer behavior or broader recession trends (OECD, 2023, https://www.oecd.org/economy/outlook/). Reliable performance in these sectors is grounded in their essential goods and services, making them appealing options for those investing in a recession or seeking recession-proof investments.

In any global recession, managing personal finance during recession is equally critical. Key strategies include prioritizing debt management to avoid high-interest liabilities, reevaluating expenses, and building a diverse emergency fund. Housing market recession cycles, unemployment risks, and changes in government stimulus or tax policies may contribute to financial uncertainty. By adopting proactive budgeting and adjusting financial goals, individuals can minimize stress and maintain mental health during a recession while safeguarding against potential losses.

Recovery strategies following a financial crisis should involve a gradual re-entry into more volatile assets as recession indicators point toward stabilization. Historically, economic recovery has often been spurred by increased government stimulus, accommodative monetary policies, and the rebounding of stock market recession lows (Federal Reserve, 2023, https://www.federalreserve.gov/monetarypolicy.htm). Investors may wish to monitor emerging market recession risks and global trade recession flows, diversifying across regions to manage volatility.

Ultimately, learning from recession history helps formulate resilient approaches to both protecting capital and identifying opportunities as the landscape evolves. Staying informed of the causes of recession, the dynamics of recession and inflation, and shifts in small business recession patterns can enable individuals to adapt quickly to changing conditions and position their portfolios for future growth.

References

OECD. (2023). Economic Outlook. https://www.oecd.org/economy/outlook/

Federal Reserve. (2023). Monetary Policy. https://www.federalreserve.gov/monetarypolicy.htm

3. Navigating the Ripple Effects: Unemployment, Housing Market Recession, and Mental Health During Economic Downturns

When recession strikes, its impact reverberates throughout society, creating a series of interconnected challenges that reach far beyond declining GDP figures. As one of the clearest recession indicators, rising unemployment is often among the earliest and harshest realities of an economic downturn. Businesses facing shrinking demand and tightening budgets may resort to layoffs, fueling a cycle of joblessness that affects millions. The spike in unemployment not only influences individual financial security but also has profound effects on consumer behavior, as households restrict spending and prioritize essential expenses—a key component in personal finance during recession periods (Bureau of Labor Statistics, 2024, https://www.bls.gov/).

Simultaneously, a housing market recession may emerge as job losses and reduced consumer confidence diminish home affordability and drive a slowdown in property sales. Regions heavily dependent on real estate activity often see falling home prices and increased mortgage delinquencies, leading to heightened concerns over recession causes and the potential for a domino effect across related industries (National Association of Realtors, 2024, https://www.nar.realtor/).

The collective stress and uncertainty borne from these economic disruptions often culminate in what experts are now calling a mental health recession. Financial strain, unemployment, and fears about the future can lead to higher rates of anxiety, depression, and other psychological issues—not just for those directly impacted but for families and communities at large (World Health Organization, 2023, https://www.who.int/news/item/09-10-2023-mental-health-and-economic-downturns). This highlights the need for supportive policies, including government stimulus measures, enhanced unemployment benefits, and accessible mental health resources, as essential components of recession recovery strategies.

Navigating these ripple effects requires adaptability and knowledge of recession-proof industries as potential employment alternatives, as well as practicing sound debt management and understanding relevant tax policies to maintain financial stability. For many, emerging recession trends such as shifts in global trade recession dynamics or developing strategies for investing in recession periods offer pathways to resilience, while small business recession responses and the performance of recession-proof investments can shape longer-term economic recovery. Recognizing the interconnected nature of unemployment, housing, and mental health during financial crisis is vital for individuals and policymakers striving to chart a course toward sustainable recovery.

In conclusion, understanding the multifaceted nature of a recession—from its historical causes and indicators to the wide-ranging ripple effects—provides a powerful foundation for navigating uncertain times. By identifying recession-proof industries and prioritizing strong personal finance during a recession, individuals and investors can better withstand the pressures of an economic downturn. Strategies such as diversifying into recession-proof investments, adopting sound debt management practices, and remaining mindful of changing consumer behavior are essential for weathering downturns and positioning for recession recovery.

The impact of a global recession extends beyond numbers; it touches the housing market, unemployment rates, and mental health, requiring both agility and resilience. Governments responding with targeted stimulus, updated tax policies, and reforms in global trade can provide vital support to small businesses, households, and emerging markets, fostering pathways to economic recovery. Meanwhile, historical and contemporary recession trends remind us that while financial crisis and stock market recession are daunting, recovery is possible through strategic action and informed decision-making.

By learning from recession history, tracking recession indicators, and adapting to recession and inflation shifts, investors and consumers alike can not only survive but emerge stronger from future downturns. Although the road through a recession can be challenging, armed with recession expert insights and evidence-based strategies, we can build greater financial security—and resilience—for whatever lies ahead.

References

(Here you would list all the cited sources in APA style.)