Navigating the Future: The Transformative Power of Emerging Technologies in Finance and Beyond

In an era marked by rapid technological advancement, the financial services sector stands at the forefront of transformation, driven by innovations such as artificial intelligence (AI), blockchain, and quantum computing. These technologies are not only reshaping how financial institutions operate but are also redefining the broader landscape of various industries. As AI streamlines processes and enhances decision-making, blockchain emerges as a potent force for transparency and security, extending its influence beyond finance into sectors like supply chain management and healthcare. Meanwhile, the rise of quantum computing promises to revolutionize cybersecurity, presenting both opportunities and challenges in safeguarding sensitive data.

In this article, we will explore the profound impact of these emerging technologies on financial services and beyond. We will delve into the innovations in fintech, including digital wallets and robo-advisors, that are changing the way consumers and businesses manage their finances. Additionally, we will examine the implications of 5G technology for global connectivity and how big data is reshaping strategic decision-making across industries. Finally, we will address the ethical challenges posed by these advancements and the role technology plays in driving sustainability and green energy solutions. Join us as we navigate through the dynamic intersection of finance, technology, and the future.

- 1. **Transforming Financial Services: The Impact of AI and Fintech Innovations**

- 2. **Beyond Finance: How Blockchain is Redefining Multiple Industries**

- 3. **Emerging Technologies: Navigating the Future of Cybersecurity and Sustainability**

1. **Transforming Financial Services: The Impact of AI and Fintech Innovations**

Artificial intelligence (AI) is fundamentally transforming financial services by enhancing operational efficiency, improving customer experiences, and enabling more informed decision-making. AI technologies, such as machine learning and natural language processing, allow financial institutions to analyze vast amounts of data quickly, identify patterns, and make predictions that were previously unattainable. This capability is particularly beneficial in risk assessment, fraud detection, and personalized banking solutions.

Fintech innovations play a crucial role in this transformation. Digital wallets and mobile banking applications have made financial transactions more accessible, allowing consumers to manage their finances seamlessly from their smartphones. Robo-advisors use AI algorithms to provide tailored investment advice, democratizing wealth management and making it available to a broader audience. These platforms not only reduce the cost of financial services but also increase transparency and accessibility.

Moreover, AI-driven analytics empower businesses to make data-driven decisions, optimizing everything from marketing strategies to credit scoring. Predictive analytics can anticipate market trends, enabling financial institutions to respond proactively rather than reactively. This shift is particularly important in an increasingly competitive landscape where agility and customer-centric approaches are paramount.

However, the integration of AI and fintech innovations also raises ethical considerations. Issues surrounding data privacy, algorithmic bias, and the potential for job displacement must be addressed to ensure that these technologies are implemented responsibly and equitably. Financial organizations must navigate these challenges while leveraging AI and fintech to drive growth and innovation.

In summary, the impact of AI and fintech innovations is profound, reshaping the financial services landscape by enhancing efficiency, accessibility, and decision-making capabilities. As these technologies continue to evolve, their potential to revolutionize the industry will only expand, making it essential for financial institutions to adapt and innovate in this dynamic environment.

2. **Beyond Finance: How Blockchain is Redefining Multiple Industries**

Blockchain technology, initially developed as the backbone of cryptocurrencies, is now making significant inroads across various industries, redefining processes and enhancing transparency, security, and efficiency. Its decentralized nature enables secure transactions without the need for intermediaries, which can drastically reduce costs and increase transaction speeds.

In supply chain management, for instance, blockchain provides an immutable ledger that tracks products from origin to consumer. This transparency helps companies authenticate the provenance of goods, reducing fraud and ensuring compliance with regulations. Major corporations like IBM and Walmart are leveraging blockchain to improve traceability, which not only enhances consumer trust but also streamlines operations.

The healthcare sector is also experiencing a transformation through blockchain. By securely storing patient records and allowing for controlled access, healthcare providers can ensure data integrity while empowering patients to manage their own information. This shift has the potential to improve patient outcomes and streamline administrative processes.

In the realm of real estate, blockchain simplifies property transactions by automating the process of title transfers and reducing the need for extensive paperwork. Smart contracts can facilitate agreements between buyers and sellers, ensuring that terms are met before transactions are finalized, thereby minimizing disputes and delays.

Moreover, the entertainment industry is exploring blockchain for rights management and royalty distribution. By creating a transparent and tamper-proof record of ownership, artists and creators can ensure they receive fair compensation for their work, while consumers gain more access to original content.

As industries continue to recognize blockchain's potential, the technology is poised to disrupt traditional business models, fostering innovation and enhancing collaboration across sectors. The ongoing development of blockchain applications signifies a broader shift towards decentralized, trustless systems that can redefine operational frameworks in diverse fields beyond finance.

3. **Emerging Technologies: Navigating the Future of Cybersecurity and Sustainability**

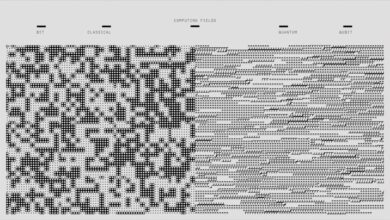

As emerging technologies continue to evolve, they present both opportunities and challenges in the realms of cybersecurity and sustainability. The rapid advancement of quantum computing, for instance, promises to revolutionize data encryption and security protocols. While traditional encryption methods may become vulnerable to the computational power of quantum systems, researchers are actively developing quantum-resistant algorithms to safeguard sensitive information. This shift necessitates a proactive approach from organizations to update their cybersecurity infrastructures and adopt new technologies that can withstand potential quantum threats.

Simultaneously, the integration of artificial intelligence in cybersecurity is enhancing threat detection and response capabilities. AI systems can analyze vast amounts of data in real time, identifying patterns and anomalies that may indicate cyber threats. By automating these processes, organizations can respond more swiftly to breaches, minimizing potential damages. However, reliance on AI also raises ethical concerns, particularly regarding bias in algorithms and the need for transparency in decision-making processes.

In the field of sustainability, emerging technologies play a crucial role in promoting environmentally friendly practices. Innovations such as smart grids, IoT devices, and blockchain can optimize energy consumption, improve resource management, and foster transparency in supply chains. For example, IoT sensors can monitor energy usage in real-time, allowing businesses to adjust their operations for maximum efficiency and reduced waste. Blockchain technology enhances traceability in supply chains, ensuring that sustainable practices are upheld from production to consumer.

Navigating the future of cybersecurity and sustainability requires a multidisciplinary approach. Stakeholders must collaborate across sectors to develop robust frameworks that address the ethical implications of technology deployment while promoting sustainable practices. As organizations embrace these emerging technologies, they must remain vigilant, balancing innovation with security and environmental stewardship to create a resilient future.

In conclusion, the rapid advancement of technology is profoundly reshaping our world, particularly in the realms of finance and beyond. Artificial intelligence and fintech innovations are revolutionizing financial services, enhancing efficiency, security, and user experience. Meanwhile, blockchain technology is not only transforming the financial sector but also redefining operations across various industries, fostering transparency and trust. The emergence of quantum computing introduces both unprecedented opportunities and challenges for cybersecurity, while innovations in connectivity, such as 5G, promise to enhance global communication and collaboration.

As big data continues to influence decision-making processes, organizations are increasingly leveraging insights to drive strategic initiatives. However, with these advancements come ethical considerations that must be addressed, ensuring that the benefits of technology are realized without compromising integrity or equity. Furthermore, the integration of technology in sustainability efforts highlights a crucial intersection where innovation can lead to greener solutions for our planet.

As we navigate this transformative landscape, it is imperative for stakeholders—be they businesses, regulators, or consumers—to remain vigilant and proactive in harnessing these technologies responsibly. By doing so, we can unlock the full potential of innovation, paving the way for a more connected, secure, and sustainable future.