Navigating the Future: The Transformative Power of AI, Blockchain, and Emerging Technologies in Finance and Beyond

In an era marked by rapid technological advancements, the financial services sector stands at the forefront of a transformative wave driven by artificial intelligence, blockchain, and other emerging technologies. As these innovations reshape how we conduct transactions, manage investments, and secure sensitive information, they also promise to redefine the very foundation of global finance. This article delves into the pivotal role of AI in revolutionizing financial services, explores how blockchain is extending its influence beyond finance, and examines the rise of quantum computing and its implications for cybersecurity. Additionally, we will highlight groundbreaking innovations in fintech, the impact of big data on decision-making, and the transformative potential of 5G technology for global connectivity. Finally, we will confront the ethical challenges posed by these technologies and discuss their role in promoting sustainability and green energy solutions. Join us as we navigate this dynamic landscape and uncover the future of finance and technology.

- 1. **Transforming Finance: The Impact of AI and Blockchain on Financial Services**

- 2. **Emerging Technologies: Quantum Computing and Cybersecurity in a New Era**

- 3. **Innovative Solutions: The Role of Fintech, Big Data, and 5G in Shaping the Future**

1. **Transforming Finance: The Impact of AI and Blockchain on Financial Services**

The integration of artificial intelligence (AI) and blockchain technology is fundamentally transforming the landscape of financial services. AI enhances decision-making processes, automates operations, and improves customer experiences through personalized services. Machine learning algorithms analyze vast amounts of data, identifying patterns that enable financial institutions to predict market trends, assess credit risks, and detect fraudulent activities more effectively than traditional methods.

In parallel, blockchain technology introduces a decentralized, immutable ledger system that increases transparency and security in financial transactions. By eliminating the need for intermediaries, blockchain reduces transaction times and costs, making processes like cross-border payments and smart contracts more efficient. Furthermore, the transparency offered by blockchain can enhance regulatory compliance and audit trails, fostering trust among stakeholders.

Together, AI and blockchain provide a robust framework for innovation in areas such as lending, payments, and asset management. For instance, AI-driven analytics can optimize investment strategies, while blockchain can streamline the settlement of trades, reducing the time and resources required. As these technologies continue to evolve, they promise to create more resilient, efficient, and customer-centric financial services, ultimately reshaping how individuals and businesses engage with the financial ecosystem.

2. **Emerging Technologies: Quantum Computing and Cybersecurity in a New Era**

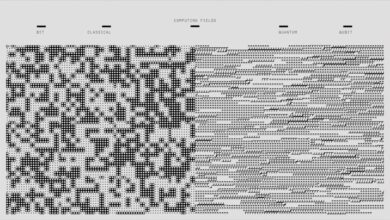

Quantum computing represents a significant shift in computational capabilities, leveraging the principles of quantum mechanics to process information in ways that classical computers cannot. This advancement has profound implications for cybersecurity, an area that is increasingly critical in our digital age.

Traditional encryption methods, such as RSA and ECC, rely on the difficulty of certain mathematical problems, like factoring large numbers. However, quantum computers possess the potential to solve these problems exponentially faster than their classical counterparts. For instance, Shor's algorithm demonstrates how a sufficiently powerful quantum computer could break widely used encryption schemes, posing a substantial risk to data security across various sectors, including finance, healthcare, and government.

In response to this looming threat, researchers are actively developing quantum-resistant algorithms designed to withstand quantum attacks. These post-quantum cryptographic methods aim to secure sensitive information against the capabilities of future quantum systems. The transition to these new algorithms is crucial for safeguarding data integrity and confidentiality as quantum technologies continue to evolve.

Moreover, quantum computing could also enhance cybersecurity measures. Quantum key distribution (QKD) enables the secure exchange of encryption keys, ensuring that any attempt at eavesdropping is detectable. By utilizing the principles of quantum superposition and entanglement, QKD can provide unprecedented security levels, potentially revolutionizing how organizations protect their data.

As businesses and governments prepare for the era of quantum computing, striking a balance between leveraging its capabilities and addressing the cybersecurity challenges it poses will be essential. This dual approach will not only help safeguard sensitive information but also pave the way for innovations that can enhance security frameworks in a rapidly evolving technological landscape. The convergence of quantum computing and cybersecurity thus marks the beginning of a new era, where organizations must adapt and innovate to stay ahead of emerging threats while harnessing the transformative power of quantum technologies.

3. **Innovative Solutions: The Role of Fintech, Big Data, and 5G in Shaping the Future**

The intersection of fintech, big data, and 5G technology is poised to create transformative solutions that will significantly shape the future of financial services and beyond. Fintech innovations, such as digital wallets and robo-advisors, are enhancing user experiences by providing seamless, accessible financial services. These tools enable consumers to manage their finances more effectively, while also offering personalized investment strategies driven by sophisticated algorithms.

Big data plays a critical role in this landscape by enabling organizations to analyze vast amounts of information to derive actionable insights. Financial institutions leverage big data analytics to understand customer behavior, assess credit risk, and tailor products to meet individual needs. This data-driven approach not only enhances decision-making but also improves operational efficiency, driving better outcomes for both businesses and consumers.

The advent of 5G technology further amplifies these innovations by providing faster, more reliable connectivity. With its low latency and high bandwidth, 5G facilitates real-time data processing and communication, enabling fintech applications to operate more effectively. This enhanced connectivity allows for instant transactions, improved customer interactions, and the integration of advanced technologies like artificial intelligence in financial services.

Together, fintech, big data, and 5G are not just reshaping how financial services operate; they are also paving the way for a more inclusive financial ecosystem. By leveraging these advanced technologies, organizations can reach underserved populations, offering them access to essential financial tools and services that were previously out of reach. As these innovations continue to evolve, they promise to create a more efficient, accessible, and responsive financial landscape that meets the needs of a diverse global population.

In conclusion, the intersection of artificial intelligence, blockchain, quantum computing, fintech innovations, 5G technology, big data, and ethical considerations is fundamentally reshaping the landscape of financial services and beyond. As AI and blockchain streamline operations and enhance security, industries are becoming more efficient and transparent. The emergence of quantum computing offers unprecedented capabilities, particularly in bolstering cybersecurity measures, while fintech advancements such as digital wallets and robo-advisors are democratizing access to financial services for individuals and businesses alike.

Moreover, 5G technology promises to enhance global connectivity, paving the way for real-time data exchange and improved user experiences. The influence of big data on decision-making processes is undeniable, enabling organizations to make informed choices that drive growth and innovation. However, these advancements also bring forth ethical challenges that must be addressed to ensure responsible deployment, particularly regarding AI and automation.

Finally, the role of technology extends beyond mere efficiency; it is integral in fostering sustainability and advancing green energy solutions. As we move forward, embracing these innovations while navigating their ethical implications will be crucial in building a future that is not only technologically advanced but also equitable and sustainable. The ongoing evolution of these technologies presents both opportunities and challenges that will define the next era of financial services and global connectivity.