Navigating the Future: How Emerging Technologies are Reshaping Finance and Beyond

In an era defined by rapid technological advancement, the financial services sector stands at the forefront of transformation, driven by innovations such as artificial intelligence (AI) and blockchain. These technologies are not only reshaping the way financial transactions occur but are also influencing industries far beyond finance, unlocking new efficiencies and opportunities. As we delve into the interconnected realms of quantum computing, 5G technology, and big data, we uncover their potential to revolutionize cybersecurity and enhance global connectivity. However, with innovation comes responsibility; the ethical challenges posed by these emerging technologies demand careful consideration. Furthermore, as the world grapples with climate change, technology plays a pivotal role in promoting sustainability and green energy solutions. This article explores these transformative technologies, their implications, and the urgent need for ethical frameworks to ensure that progress benefits society as a whole. Join us as we navigate this rapidly evolving landscape, highlighting key developments and their potential to redefine the future of finance and beyond.

- Here are three possible section headlines for your article covering the specified topics:

- 1. **Transformative Technologies: AI and Blockchain in the New Financial Landscape**

Here are three possible section headlines for your article covering the specified topics:

Artificial Intelligence in Financial Services

Artificial intelligence (AI) is revolutionizing financial services by enhancing efficiency, improving customer experiences, and enabling more informed decision-making. AI algorithms analyze vast amounts of data to identify patterns and trends, allowing financial institutions to offer personalized services such as tailored investment advice and risk assessments. Machine learning models are employed for fraud detection, enabling quicker responses to suspicious activities and reducing financial losses. Moreover, chatbots and virtual assistants powered by AI are transforming customer service, providing instant support and reducing operational costs. As AI continues to evolve, its integration into financial services promises to streamline processes, enhance compliance, and facilitate better financial planning for individuals and businesses alike.

Blockchain Beyond Finance

While blockchain technology is often associated with cryptocurrencies, its transformative potential extends far beyond the financial sector. Industries such as supply chain management, healthcare, and real estate are exploring blockchain to improve transparency, security, and efficiency. In supply chains, blockchain provides a tamper-proof ledger that tracks products from origin to destination, enhancing accountability and reducing fraud. In healthcare, it enables secure sharing of patient records while maintaining privacy. Real estate transactions benefit from blockchain by simplifying property transfers and reducing the need for intermediaries, thus accelerating processes and lowering costs. As more industries adopt blockchain, its ability to foster trust and streamline operations is poised to disrupt traditional business models.

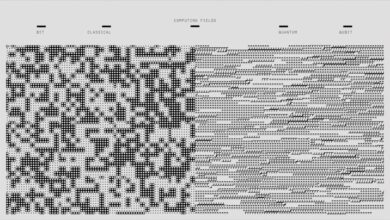

The Promise of Quantum Computing for Cybersecurity

Quantum computing represents a significant leap forward in computational power, with the potential to revolutionize various fields, including cybersecurity. Unlike classical computers, quantum computers can process complex algorithms at unprecedented speeds, which poses both opportunities and challenges for data security. On one hand, they can enhance encryption methods, making data transmission more secure. On the other hand, they also pose a threat to existing encryption standards, potentially rendering current security protocols obsolete. As organizations prepare for the quantum future, they must invest in quantum-resistant encryption methods to safeguard sensitive data. The rise of quantum computing will require a reevaluation of cybersecurity strategies, prompting advancements that protect against emerging threats while harnessing the technology's capabilities for enhanced security.

1. **Transformative Technologies: AI and Blockchain in the New Financial Landscape**

The financial services industry is undergoing a profound transformation, driven primarily by two key technologies: artificial intelligence (AI) and blockchain. These innovations are reshaping how financial institutions operate, enhance customer experiences, and ensure security and compliance.

AI is revolutionizing financial services by enabling more efficient data analysis and decision-making processes. Machine learning algorithms can analyze vast amounts of data in real time, identifying patterns and trends that would be nearly impossible for humans to discern. This capability allows financial institutions to offer personalized services, improve risk assessment, and automate customer interactions through chatbots and virtual assistants. Additionally, AI enhances fraud detection by continuously monitoring transactions for unusual patterns, thereby safeguarding both institutions and their clients.

On the other hand, blockchain technology is redefining trust and transparency in financial transactions. By providing a decentralized and immutable ledger, blockchain eliminates the need for intermediaries, reducing transaction costs and increasing efficiency. This technology is particularly impactful in areas such as cross-border payments, where traditional methods can be slow and expensive. Blockchain also enhances security and reduces fraud, as every transaction is recorded and cannot be altered without consensus from the network.

Together, AI and blockchain are not only streamlining operations but also enabling innovative financial products and services. For instance, smart contracts powered by blockchain can automate and enforce contractual agreements without the need for human intervention, while AI-driven analytics can predict market trends and inform investment strategies.

As these transformative technologies continue to evolve, they promise to create a more efficient, transparent, and secure financial landscape, ultimately benefiting consumers and businesses alike. The integration of AI and blockchain represents a paradigm shift in how financial services are delivered, marking the dawn of a new era in the industry.

Artificial intelligence (AI) is fundamentally reshaping the landscape of financial services, driving efficiency, personalization, and innovation. By harnessing the power of machine learning algorithms, financial institutions can analyze vast amounts of data to identify patterns, predict market trends, and enhance customer experiences. AI-powered chatbots and virtual assistants are revolutionizing customer service, providing real-time support and tailored financial advice, thereby improving customer engagement and satisfaction.

In parallel, blockchain technology is making waves beyond the financial sector, impacting industries such as supply chain management, healthcare, and real estate. By offering a decentralized and secure method for recording transactions, blockchain enhances transparency and trust among stakeholders. For instance, in supply chain management, it enables end-to-end tracking of products, reducing fraud and improving efficiency.

The rise of quantum computing presents both opportunities and challenges, particularly in the realm of cybersecurity. Quantum computers possess the potential to solve complex problems at unprecedented speeds, which could revolutionize data encryption and security measures. However, this advancement also poses risks, as current encryption algorithms may become vulnerable to quantum attacks, necessitating a rethinking of cybersecurity strategies.

In the fintech space, innovations such as digital wallets and robo-advisors are transforming how consumers manage their finances. Digital wallets streamline transactions and enable seamless payments, while robo-advisors leverage AI to offer personalized investment strategies at a fraction of the cost of traditional financial advisors. These innovations democratize access to financial services, especially for underbanked populations.

The advent of 5G technology is set to further enhance global connectivity, enabling faster data transmission and the proliferation of Internet of Things (IoT) devices. This technological advancement will facilitate real-time data sharing and communication, which is crucial for industries reliant on instant information, such as logistics and emergency services.

Big data analytics is playing a pivotal role in shaping decision-making processes within finance and business. By analyzing large datasets, organizations can derive actionable insights that inform strategic initiatives, improve risk management, and enhance operational efficiency. This data-driven approach allows businesses to stay competitive in an increasingly complex market landscape.

However, the rapid adoption of emerging technologies, including AI and automation, raises ethical challenges that must be addressed. Issues such as data privacy, algorithmic bias, and the potential for job displacement necessitate a thoughtful discussion on the responsible use of technology. Stakeholders must work collaboratively to establish frameworks that ensure ethical standards are upheld while fostering innovation.

Finally, technology is becoming a key driver of sustainability and green energy solutions. Innovations in energy management systems, smart grids, and renewable energy technologies are contributing to a more sustainable future. By harnessing technology, businesses can optimize resource use, reduce carbon footprints, and promote environmentally responsible practices. As these technologies continue to evolve, they hold the promise of creating a more sustainable and equitable world.

In conclusion, the rapid evolution of technologies such as artificial intelligence, blockchain, quantum computing, and big data is fundamentally reshaping the financial services landscape and beyond. As we have explored, AI is not only enhancing operational efficiency and customer experience in finance but also paving the way for innovations like robo-advisors and digital wallets. Meanwhile, blockchain is proving to be a game-changer across various industries, fostering transparency and trust in transactions.

The advent of quantum computing presents both opportunities and challenges, particularly in the realm of cybersecurity, where its capabilities could redefine data protection standards. The rollout of 5G technology further promises to enhance global connectivity, unlocking new possibilities for real-time data exchange and communication.

As organizations harness the power of big data, informed decision-making is becoming more precise, driving strategic initiatives in finance and business alike. However, these advancements are accompanied by ethical challenges, particularly concerning AI and automation, which necessitate careful consideration and regulation to ensure responsible use.

Lastly, technology's role in promoting sustainability and green energy solutions highlights its potential to address pressing global challenges. As we move forward, the intersection of these transformative technologies will not only revolutionize industries but also shape a more connected, efficient, and sustainable future. Embracing these changes with a focus on ethical considerations will be essential in navigating the complexities of this new era.