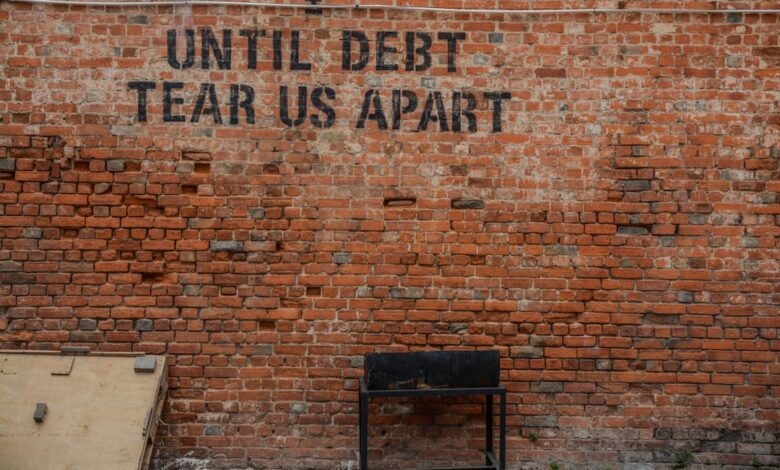

Mastering Debt: Strategies for Personal Management and Economic Impact

In today’s complex financial landscape, managing and reducing personal debt has become a pressing concern for individuals, families, and even governments. With rising living costs and economic uncertainty, many find themselves grappling with high debt levels that not only affect their personal finances but also have broader implications for economic growth. This article explores effective strategies for personal debt management, highlighting the importance of negotiation with creditors, the role of credit counseling, and the delicate balance between leveraging debt for investments and the risks involved. Additionally, we will examine how student loan debt shapes financial planning and the impact of corporate debt on stock performance. Finally, we’ll delve into how governments manage national debt and its economic implications, offering insights into the interconnectedness of personal, corporate, and public finance. Join us as we navigate the intricacies of debt and discover practical solutions to achieve financial stability and growth.

- 1. **Navigating the Debt Landscape: Effective Strategies for Personal Debt Management**

- 2. **The Economic Ripple Effect: How Personal and Corporate Debt Influence Growth and Market Performance**

1. **Navigating the Debt Landscape: Effective Strategies for Personal Debt Management**

Managing personal debt requires a proactive approach and a clear understanding of one’s financial landscape. Here are several effective strategies to help individuals navigate their debt more effectively:

1. **Create a Comprehensive Budget**: Start by assessing your income and expenses to create a detailed budget. This will help you identify areas where you can cut back and allocate more funds toward debt repayment.

2. **Prioritize Debt Payments**: Use the debt avalanche or debt snowball method to prioritize repayments. The avalanche method focuses on paying off debts with the highest interest rates first, while the snowball method emphasizes paying off the smallest debts first to build momentum.

3. **Establish an Emergency Fund**: Before aggressively tackling debt, build a small emergency fund to cover unexpected expenses. This prevents the need to rely on credit cards or loans during emergencies, which can exacerbate debt levels.

4. **Negotiate with Creditors**: Reach out to creditors to discuss your situation. Many are willing to negotiate lower interest rates, payment plans, or even settlements for less than the total owed. Open communication can lead to more manageable repayment terms.

5. **Consider Credit Counseling**: Seeking help from a credit counselor can provide guidance and support. Credit counseling services can assist in creating a debt management plan, negotiating with creditors, and offering financial education.

6. **Increase Income Streams**: Look for opportunities to increase your income, whether through part-time jobs, freelancing, or selling unused items. Additional income can be directed toward debt repayment, accelerating the process.

7. **Limit New Debt**: Avoid accumulating new debt while trying to pay off existing obligations. This may involve refraining from using credit cards and seeking alternatives to borrowing.

8. **Stay Informed**: Educate yourself about personal finance and debt management strategies. Understanding the terms of your debts, the implications of interest rates, and effective repayment options can empower you to make informed decisions.

By implementing these strategies, individuals can take control of their personal debt, improve their financial health, and build a foundation for future financial stability.

Managing and reducing personal debt is a critical concern for many individuals, as high debt levels can have far-reaching consequences not only for personal finances but also for the broader economy. Strategies such as budgeting, prioritizing high-interest debts, and exploring debt consolidation options can help individuals regain control over their finances. Additionally, negotiating with creditors can yield improved repayment terms, allowing for lower interest rates or extended payment plans, which can alleviate financial pressure.

Credit counseling plays a significant role in debt management by providing individuals with expert advice and support. Counselors can help create tailored repayment plans and educate clients on financial literacy, empowering them to make informed decisions about their finances. This can be particularly beneficial for those struggling to manage their debts effectively.

While debt can be a useful tool for investment, it carries inherent risks. Leveraging debt to invest can amplify returns, but it can also lead to significant losses if investments do not perform as expected. Proper financial planning is essential for assessing one’s risk tolerance and ensuring that any investment strategy aligns with long-term financial goals.

Student loan debt poses unique challenges for young adults, often impacting their ability to save for the future or make significant purchases, such as homes. This can lead to delayed financial milestones and a greater reliance on credit for other expenses. As such, understanding the implications of student loans on overall financial planning is crucial for those navigating these waters.

On a larger scale, corporate debt can influence stock performance, as companies with high levels of debt may be viewed as riskier investments. Investors often scrutinize a company's debt levels when making decisions, as excessive debt can limit growth potential and lead to financial instability.

Governments also face challenges in managing national debt, which can impact economic growth and stability. High national debt levels can lead to increased interest rates and reduced public investment, potentially stifling economic expansion. Conversely, strategic management of national debt can support economic growth by funding essential services and infrastructure projects, demonstrating the delicate balance between leveraging debt and ensuring sustainable economic health.

2. **The Economic Ripple Effect: How Personal and Corporate Debt Influence Growth and Market Performance**

Debt, both personal and corporate, creates a significant ripple effect that influences economic growth and market performance. High levels of personal debt can constrain consumer spending, as individuals allocate a larger portion of their income to debt repayment rather than consumption. This reduction in disposable income can lead to decreased demand for goods and services, ultimately slowing economic growth. When consumers are burdened by debt, they may delay major purchases, such as homes or cars, which can further stifle economic activity.

On the corporate side, excessive debt can impact a company’s ability to invest in growth opportunities. Companies with high debt levels may prioritize servicing their debt over reinvesting in their business, leading to stagnation. Additionally, high corporate debt can increase vulnerability to economic downturns; if revenues decline, heavily indebted companies might struggle to meet their obligations, potentially leading to layoffs or bankruptcy. This, in turn, can increase unemployment and further depress consumer spending, creating a cycle that can hinder overall economic performance.

Moreover, both personal and corporate debt levels can influence market performance. Investors often assess debt ratios when evaluating a company’s financial health. High levels of corporate debt can lead to lower stock prices, as investors may perceive greater risk. Similarly, widespread personal debt can affect consumer confidence, influencing stock market trends. When consumers feel financially insecure due to high debt levels, their reluctance to spend can lead to lower revenues for businesses, which is reflected in stock performance.

Overall, the interplay between personal and corporate debt can have profound implications for economic growth and stability. Managing these debt levels effectively is crucial for fostering a resilient economy that supports both consumer spending and corporate investment.

In conclusion, effectively managing and reducing personal debt is crucial not only for individual financial health but also for broader economic stability. As we have explored, the strategies for personal debt management—ranging from negotiation with creditors to seeking credit counseling—empower individuals to take control of their financial futures. Furthermore, understanding the ramifications of high debt levels on economic growth illuminates the interconnectedness of personal, corporate, and national debt.

While leveraging debt can offer investment opportunities, it carries inherent risks that must be carefully weighed, especially in light of significant burdens like student loans that can hinder long-term financial planning. Corporate debt also plays a pivotal role in stock performance and market dynamics, demonstrating that debt is a double-edged sword that requires prudent management. Governments, too, face the challenge of navigating national debt, balancing economic growth with fiscal responsibility.

Ultimately, fostering a comprehensive understanding of these debt dynamics equips individuals and policymakers alike to make informed decisions, promoting a healthier financial landscape that benefits everyone. By actively engaging with these strategies and considerations, we can pave the way for a more sustainable approach to debt that supports both personal aspirations and economic prosperity.