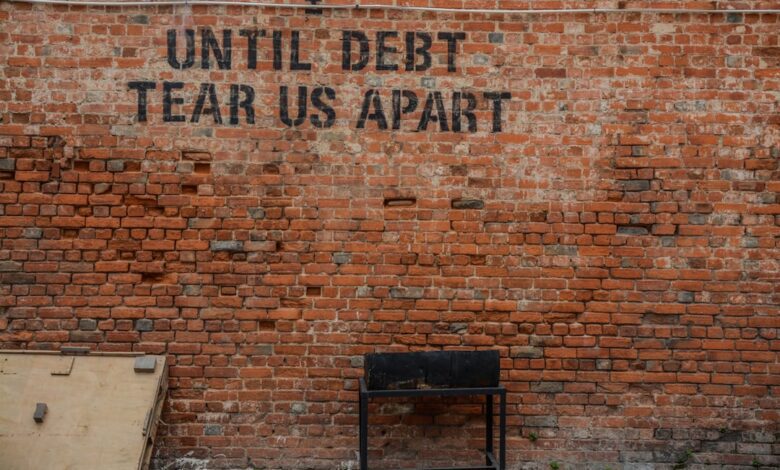

Mastering Debt: Strategies for Personal Management and Economic Impact

In today’s fast-paced financial landscape, personal debt has emerged as a pressing concern for individuals and families alike. With the burden of high debt levels not only affecting personal finances but also posing significant risks to economic stability, it is crucial to explore effective strategies for managing and reducing debt. This article delves into a comprehensive analysis of personal debt, examining its broader implications on economic growth and providing actionable insights for individuals seeking to regain control of their financial futures.

We will discuss practical strategies for navigating personal debt, explore the impact of high debt levels on economic growth, and outline essential tools for negotiating with creditors and accessing credit counseling services. Additionally, we will consider the complexities of using debt as a means of investment, the challenges posed by student loan debt on financial planning, and the effects of corporate debt on stock performance. Lastly, we will touch upon how governments manage national debt and the economic implications of such strategies. Join us as we unpack these critical topics and empower you with the knowledge to achieve financial stability in a world where debt is an unavoidable reality.

- 1. **Navigating Personal Debt: Effective Strategies for Management and Reduction**

- 2. **The Ripple Effect: Understanding High Debt Levels and Economic Growth**

- 3. **From Negotiation to Counseling: Tools for Debt Relief and Financial Stability**

1. **Navigating Personal Debt: Effective Strategies for Management and Reduction**

Managing and reducing personal debt requires a strategic approach that combines discipline, planning, and informed decision-making. One effective strategy is to create a comprehensive budget that outlines income and expenses, allowing individuals to identify areas where they can cut back and allocate more funds toward debt repayment. This budget should also prioritize high-interest debts, such as credit cards, to minimize the overall interest paid over time.

Another useful method is the "debt snowball" approach, where individuals focus on paying off smaller debts first while making minimum payments on larger debts. This creates a psychological boost as debts are eliminated, motivating individuals to continue their repayment efforts. Conversely, the "debt avalanche" method emphasizes paying off debts with the highest interest rates first, which can save money in the long run.

Additionally, individuals should consider exploring options for consolidating their debts. This could involve securing a personal loan with a lower interest rate or transferring high-interest credit card balances to a card with a lower rate. Consolidation simplifies payments and may reduce the total interest paid.

Effective communication with creditors can also play a crucial role in managing debt. Many creditors are willing to negotiate repayment terms, such as lower interest rates or extended payment plans, particularly if the borrower demonstrates a commitment to repay the debt. Seeking assistance from credit counseling services can provide valuable guidance in these negotiations and help develop a personalized debt management plan.

Lastly, it is essential to cultivate healthy financial habits moving forward. This includes building an emergency fund to avoid future debt accumulation and educating oneself about credit scores and responsible borrowing. By implementing these strategies, individuals can effectively navigate their personal debt, leading to improved financial stability and peace of mind.

2. **The Ripple Effect: Understanding High Debt Levels and Economic Growth**

High debt levels can significantly impact economic growth at both individual and national levels. When households carry substantial debt, they often reduce their consumption to prioritize repayment, leading to lower demand for goods and services. This decrease in consumer spending can stifle economic growth, as businesses may experience reduced sales and subsequently cut back on production, investment, and hiring.

At the national level, high public debt can lead to increased borrowing costs and diminished fiscal flexibility. Governments may allocate a larger portion of their budgets to interest payments, limiting their ability to invest in infrastructure, education, and social services that drive long-term growth. Moreover, high levels of national debt can lead to concerns about a country's creditworthiness, potentially raising interest rates and creating a cycle that further constrains economic expansion.

Additionally, the relationship between high debt and economic growth can create a ripple effect across various sectors. For example, if consumers are burdened by debt, industries such as retail and real estate may suffer, which in turn affects employment rates and overall economic confidence.

Conversely, when debt is managed effectively, it can serve as a tool for growth. Strategic borrowing for investment in productive assets can lead to increased economic output. The challenge lies in balancing the benefits of leveraging debt against the risks of excessive borrowing, which can ultimately hinder growth and financial stability. Understanding this complex interplay is crucial for policymakers and individuals alike as they navigate the implications of debt on economic health.

3. **From Negotiation to Counseling: Tools for Debt Relief and Financial Stability**

Negotiating with creditors and seeking credit counseling are two crucial strategies for individuals aiming to achieve debt relief and financial stability.

When it comes to negotiation, open communication with creditors can lead to more manageable repayment terms. Many creditors are willing to work with borrowers who proactively reach out to discuss their financial difficulties. This can involve requesting lower interest rates, extending payment deadlines, or even settling for a reduced total amount owed. The key to successful negotiation lies in preparation: borrowers should gather all relevant financial information, including income, expenses, and outstanding debts, to present a clear picture of their situation. Approaching creditors with honesty and a willingness to find a mutually beneficial solution can foster goodwill and potentially lead to favorable adjustments.

In addition to direct negotiation, credit counseling offers a structured approach to managing debt. Certified credit counselors can assess an individual's financial situation and provide tailored advice. They often help clients develop budgets, create debt repayment plans, and educate them on financial literacy. Many credit counseling agencies also offer debt management plans (DMPs), where the counselor negotiates with creditors on behalf of the client to secure lower interest rates and consolidated payments. This can simplify the repayment process and make it easier for individuals to stay on track.

Both negotiation and credit counseling serve as vital tools for individuals seeking to regain control over their finances. By utilizing these resources, borrowers can work towards reducing their debt burden while also building a foundation for long-term financial stability. Ultimately, a proactive approach to debt management not only alleviates immediate financial stress but also promotes healthier financial habits and a better understanding of personal finance.

In conclusion, effectively managing and reducing personal debt is a multifaceted endeavor that not only enhances individual financial stability but also contributes to broader economic health. By employing strategies such as budgeting, negotiating with creditors, and seeking credit counseling, individuals can take proactive steps toward alleviating their debt burdens. Understanding the ripple effect of high debt levels on economic growth underscores the importance of addressing personal debt, as it impacts not just individual lives but the overall economic landscape.

Moreover, while leveraging debt for investments can offer potential rewards, it carries inherent risks that must be carefully weighed, particularly in the context of student loans, which significantly influence financial planning for young adults. The interplay between corporate debt and stock performance also illustrates how debt management extends beyond personal finance, affecting market dynamics and investor confidence.

Finally, the way governments manage national debt reflects the complexities of economic stewardship, emphasizing the need for sustainable fiscal policies. As we navigate these interconnected issues, it becomes clear that informed debt management is crucial for fostering financial security and promoting economic resilience. By adopting sound practices and seeking support when needed, individuals can not only free themselves from the shackles of debt but also contribute to a healthier economy for all.