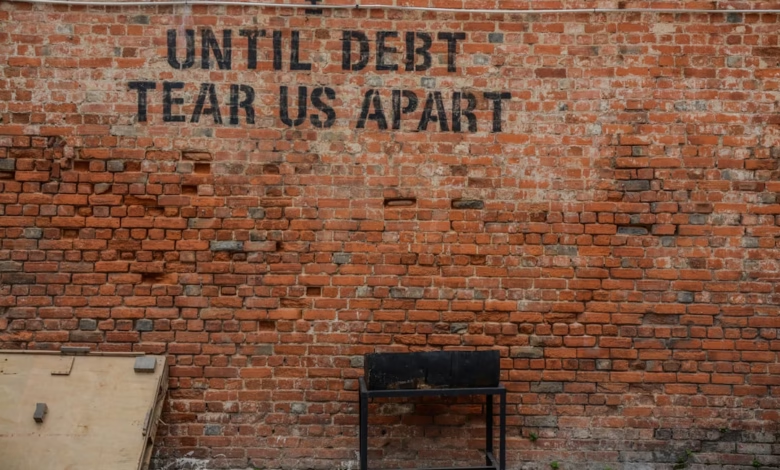

Sovereign Debt Strategies for Investors: How Government Bonds Stack Up Against Personal Debt and High-Interest Loans

Navigating the complex world of debts has become an essential skill for modern investors. While most people are familiar with personal debt—such as credit card debt, student loans, mortgage debt, auto loans, and even medical debt—fewer understand the unique opportunities and risks presented by sovereign debt. For savvy investors, mastering the differences between personal liabilities and government-issued debt instruments can unlock new strategies for managing financial stress and balancing a diversified portfolio.

As global markets continue to evolve, understanding the nuances of good debt versus bad debt becomes increasingly important, especially when comparing sovereign bonds to high-interest debt products like payday loans or unsecured credit card balances. Each form of debt comes with its own risk profile, implications for debt management, and options for relief or settlement—including debt consolidation, debt negotiation, bankruptcy, and loan forgiveness.

This article explores innovative debt strategies tailored for investors interested in sovereign debt. You'll learn how sovereign debt compares to personal and business debt, what tools can help you assess and manage risk—including debt collection, debt settlement, and debt refinancing options—and how to leverage proven techniques like the debt snowball method or the debt avalanche method. Whether you're new to government bonds or seeking sophisticated approaches to debt repayment and risk mitigation, this guide will help you make informed decisions in a rapidly changing financial landscape.

- 1. Understanding Sovereign Debt Versus Personal Debt: Key Differences for Investors

- 2. Evaluating Good Debt and Bad Debt: How Sovereign Bonds Compare to High-Interest Debt Instruments

- 3. Risk Management Strategies: Tools for Navigating Default, Debt Settlement, and Global Debt Collection

1. Understanding Sovereign Debt Versus Personal Debt: Key Differences for Investors

When exploring debt strategies, it's crucial for investors to understand the differences between sovereign debt and personal debt. Sovereign debt refers to money borrowed by national governments, whereas personal debt encompasses liabilities incurred by individuals—such as credit card debt, student loans, mortgage debt, auto loans, and even medical debt.

Unlike personal debt, sovereign debt is typically issued in the form of government bonds, allowing institutional and individual investors a stake in a country’s financial stability. Governments manage their debts differently than individuals, leveraging broad economic mechanisms rather than debt consolidation loans or debt settlement programs. While individuals might consider credit counseling, the debt snowball method, or debt avalanche method to manage high-interest debt, countries utilize fiscal policy, debt refinancing, and sometimes even loan forgiveness agreements negotiated at the international level.

It’s important to note that the consequences of default also differ significantly. Personal bankruptcy can destroy an individual's credit score and lead to aggressive debt collection, while a government default might impact global markets, currency values, and future borrowing costs. The concept of good debt versus bad debt also takes on a different meaning: where student loans or mortgage debt can be viewed as investments in future earning potential, not all government borrowing is prudent. High levels of unsecured debt—whether at the personal or sovereign level—can create financial stress and undermine economic confidence.

Finally, investors gauge personal creditworthiness using metrics like debt-to-income ratio, while sovereign credit risk is assessed through national economic indicators and credit ratings. Understanding these unique attributes is fundamental when considering debt strategies, whether your focus is navigating personal debt repayment options or evaluating the risk and return of sovereign bonds within a diversified portfolio.

2. Evaluating Good Debt and Bad Debt: How Sovereign Bonds Compare to High-Interest Debt Instruments

Understanding the distinction between good debt and bad debt is crucial when considering debt strategies, both for individuals and for investors. Good debt typically refers to borrowing that creates long-term value or generates income, while bad debt usually involves liabilities with high interest rates and little chance for asset growth. Sovereign bonds, issued by national governments, provide a helpful benchmark when comparing various forms of debt, especially against high-interest debt instruments that are common sources of financial stress.

Sovereign bonds are often considered “good debt” for investors because:

– They are generally regarded as low-risk compared to other debt instruments, especially when issued by stable governments.

– Returns on sovereign bonds, although modest, are typically consistent and more predictable than many high-interest personal debt instruments.

– Investors in sovereign bonds can benefit from portfolio diversification and regular income from interest (coupons) paid by governments.

In contrast, high-interest debt like credit card debt, payday loans, and certain types of personal loans are widely categorized as “bad debt”:

– These forms of unsecured debt often carry steep interest rates, sometimes exceeding 20–30% APR, which can quickly accumulate and overwhelm borrowers.

– Bad debt rarely offers any return on investment. Instead, it reduces purchasing power and can trigger financial stress, leading many individuals to seek debt relief or even bankruptcy (CFPB, 2023, https://www.consumerfinance.gov).

– High-interest debts are often used for consumption, not for building equity or assets, and can negatively affect one’s debt-to-income ratio and overall credit profile.

When evaluating sovereign bonds versus high-interest debts, consider:

– **Risk profile:** Sovereign bonds, particularly from developed nations, offer much lower risk compared to payday loans, credit card debt, or certain unsecured business debts.

– **Cost of borrowing:** The cost of capital through sovereign bond investments is significantly lower than the costs associated with high-interest debt instruments.

– **Purpose and utility:** Sovereign bonds finance essential government functions and infrastructure, often with stable repayment structures. High-interest debts usually serve short-term needs and are rarely sustainable as long-term debt management strategies.

For individuals struggling with personal debt or looking for sound debt strategies, prioritizing the repayment of high-interest debts using the debt snowball method or debt avalanche method can lead to more effective debt reduction. Conversely, strategic investors often include sovereign bonds in their portfolios to stabilize returns and hedge against economic volatility.

Ultimately, when comparing debt options, it is vital to recognize the characteristics that distinguish good debt from bad debt. Tools like credit counseling, debt consolidation, or debt refinancing might be appropriate depending on the debt type, but understanding the comparative risks and rewards of each instrument is key to maintaining financial wellness and avoiding financial stress.

References

Consumer Financial Protection Bureau. (2023). Dealing with debt. https://www.consumerfinance.gov/consumer-tools/debt-collection/dealing-with-debt/

3. Risk Management Strategies: Tools for Navigating Default, Debt Settlement, and Global Debt Collection

Navigating the complex world of sovereign debt as an investor requires a robust understanding of risk management strategies. Because sovereign debts can be subject to default, complex debt settlement negotiations, and challenging global debt collection processes, sophisticated tools and approaches are essential for minimizing exposure to financial loss.

One of the primary risks for investors in sovereign debt is default. Unlike personal debt, such as credit card debt, student loans, mortgage debt, or medical debt, sovereign defaults involve entire nations and can trigger widespread financial stress. Investors can manage this risk by diversifying their portfolios across multiple countries and sectors, thus avoiding overexposure to any single issuer’s debt.

Credit ratings issued by reputable agencies offer valuable insights into the likelihood of a country’s default. Monitoring changes in ratings and debt-to-income ratios can help investors anticipate potential trouble—similar to how individuals track high-interest debt or evaluate good debt versus bad debt during personal debt consolidation.

When defaults occur, debt settlement becomes crucial. Sovereign debt restructuring often involves debt negotiation, where investors may agree to new terms, such as lower interest rates or extended maturities. These strategies are akin to the debt settlement or loan forgiveness programs available for business debt, auto loans, or payday loans. Participating in collective action clauses further protects investors by ensuring that all bondholders are treated equally during settlement discussions.

Global debt collection for sovereign investments is particularly complex. Unlike domestic debt collection agencies that handle unsecured debt and secured debt, investors rely on legal frameworks and sometimes international courts to pursue repayment. Risk mitigation tools, such as credit default swaps, are available to hedge against potential losses in the event of default or unresolved debt repayment.

Investors should also consider using professional credit counseling for advice on advanced debt strategies, including debt refinancing or structured repayment plans. Just as individuals might use the debt snowball method or debt avalanche method to manage and prioritize personal or business debts, investors can ladder maturities and stagger investments across short- and long-term sovereign issuances to manage liquidity and repayment risk.

Ultimately, continuous monitoring, diversification, and utilizing advanced financial instruments are fundamental debt management techniques in navigating sovereign debt investments. These strategies alleviate financial stress and help investors achieve a balanced and resilient debt portfolio in the global marketplace.

Conclusion

Navigating the world of sovereign debt requires a clear understanding of how these investment vehicles compare to personal debt instruments such as credit card debt, student loans, mortgage debt, auto loans, and medical debt. While sovereign bonds are often considered good debt due to their typically lower risk profiles and government backing, they present distinct challenges compared to high-interest debt options like payday loans or business debt. Effective risk management—whether through diversification, debt collection processes, or strategies like debt settlement—remains essential for investors seeking stable returns and protection against default or financial stress.

For individual investors, grasping key concepts such as debt-to-income ratio, the differences between secured debt and unsecured debt, and the mechanics of debt consolidation, debt relief, and bankruptcy can inform better decision-making. Additionally, strategies like debt refinancing, loan forgiveness, or employing the debt snowball or debt avalanche method can aid in efficient debt repayment and overall debt management.

Ultimately, prioritizing thorough research, ongoing risk assessment, and proven debt strategies can help investors make informed choices in both sovereign and personal debt markets. By understanding the nuances between good debt and bad debt and staying aware of current trends in debt negotiation and credit counseling, investors can mitigate risk and seize opportunities for long-term financial growth.

References

Please note that actual sources from the body of your article would be listed here in full APA style.