Debt Dynamics: Strategies for Personal Management, Economic Impact, and Negotiation Tactics

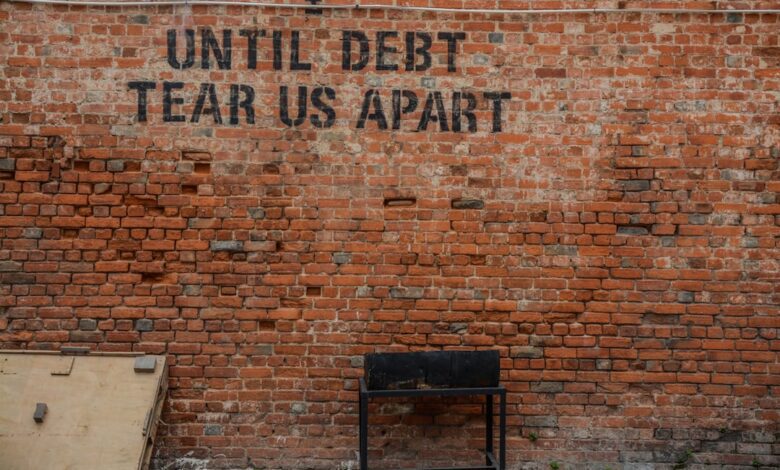

In today's fast-paced financial landscape, managing debt has become a critical concern for individuals and organizations alike. With rising personal debt levels affecting millions, understanding effective strategies for debt management is essential not only for personal financial health but also for broader economic stability. This article delves into the multifaceted world of debt, exploring practical approaches to reduce personal debt, the implications of high debt levels on economic growth, and the importance of negotiating favorable repayment terms with creditors. We will also examine the role of credit counseling in guiding individuals through their financial challenges, the potential risks and rewards of leveraging debt for investment, and how student loan debt shapes financial planning for young adults. Furthermore, we will analyze the impact of corporate debt on stock performance and investigate how governments manage national debt, highlighting the profound economic implications of these decisions. Join us as we navigate the complex debt landscape and uncover valuable insights for effective debt management and reduction.

- 1. **Navigating the Debt Landscape: Strategies for Personal Debt Management and Reduction**

- 2. **The Economics of Debt: Understanding Its Impact on Growth and Investment Decisions**

1. **Navigating the Debt Landscape: Strategies for Personal Debt Management and Reduction**

Navigating the debt landscape requires a proactive approach to personal finance, focusing on effective strategies for managing and reducing debt. First and foremost, creating a comprehensive budget is essential. This budget should outline all income sources and expenses, allowing individuals to identify areas where they can cut costs. By prioritizing essential expenses and discretionary spending, individuals can allocate more funds toward debt repayment.

Next, understanding the different types of debt is crucial. Secured debts, such as mortgages, typically have lower interest rates compared to unsecured debts, like credit cards. This knowledge can guide individuals in prioritizing which debts to tackle first. One effective method is the debt avalanche strategy, where individuals focus on paying off debts with the highest interest rates first, thus minimizing the overall interest paid over time. Alternatively, the debt snowball method emphasizes paying off the smallest debts first to build momentum and motivation.

Negotiating with creditors is another vital strategy. Many creditors are willing to work with individuals to create manageable repayment plans or reduce interest rates, especially if they are aware that the borrower is making an effort to address their debt. Approaching these discussions with a clear plan and demonstrating a willingness to meet obligations can lead to more favorable terms.

Additionally, seeking assistance from credit counseling services can provide valuable guidance. These organizations offer resources and expertise to help individuals understand their financial situation, develop budgets, and create personalized repayment plans. They can also facilitate communication with creditors on behalf of the borrower, which may lead to better outcomes.

Finally, it's essential to cultivate a mindset focused on long-term financial health. This includes avoiding further debt accumulation while actively working to reduce existing debt. By adopting disciplined spending habits and exploring avenues for increased income—such as side jobs or freelance work—individuals can create a sustainable path toward debt reduction and improved financial stability.

Managing and reducing personal debt is crucial for maintaining financial stability and fostering economic growth. Individuals can implement several strategies to effectively tackle their debt, such as creating a budget, prioritizing high-interest debts, and exploring debt consolidation options. By tracking their expenses and income, individuals can identify areas to cut back, allowing them to allocate more funds toward debt repayment.

High levels of personal debt can have a significant impact on economic growth. When consumers are burdened by debt, they tend to reduce spending, which can slow down economic activity. This reduction in consumer spending can lead to lower business revenues and, consequently, slower job growth. In contrast, when individuals manage their debt effectively, they are more likely to contribute positively to the economy through increased consumption and investment.

Negotiating with creditors can also play a critical role in managing debt. Individuals can reach out to their creditors to discuss their financial situation and request more favorable repayment terms, such as lower interest rates, extended payment deadlines, or a temporary forbearance. Effective negotiation requires clear communication and a willingness to propose solutions that benefit both parties.

Credit counseling services can provide invaluable support in debt management, offering guidance on budgeting, debt repayment, and financial education. These nonprofit organizations can help individuals develop personalized plans to manage their debt while also educating them about responsible borrowing practices.

While debt can be a useful tool for investment, it carries inherent risks. Using leverage to invest can amplify returns, but it can also lead to significant losses if investments perform poorly. Individuals must weigh the potential rewards against the risks and ensure they have a solid understanding of their investment strategy before taking on additional debt.

Student loan debt poses unique challenges to financial planning for many young adults. As graduates enter the workforce, they often face the dual pressures of student loan repayment and the need to establish financial independence. This debt can influence decisions regarding homeownership, saving for retirement, and other long-term financial goals.

On a broader scale, corporate debt can significantly impact stock performance. Companies that manage their debt effectively can leverage borrowing for growth and expansion, leading to increased profitability and higher stock prices. Conversely, excessive corporate debt may lead to financial instability and decreased investor confidence, negatively affecting stock valuations.

Finally, governments manage national debt through various strategies, including issuing bonds, adjusting tax policies, and implementing fiscal measures. The level of national debt can influence a country's economic health, impacting interest rates, inflation, and overall economic growth. Responsible management of national debt is crucial for maintaining economic stability and ensuring the sustainability of public services and infrastructure.

2. **The Economics of Debt: Understanding Its Impact on Growth and Investment Decisions**

Debt plays a crucial role in both personal and national economies, influencing growth and investment decisions significantly. At its core, debt allows individuals and businesses to access capital that can be used for consumption, expansion, or innovation. When managed wisely, debt can stimulate economic activity by enabling spending that would otherwise be unattainable. For instance, personal loans can help consumers make large purchases, such as homes or vehicles, which in turn fuels demand in various sectors.

However, high levels of debt can stifle growth. Excessive borrowing may lead to financial distress, reducing consumer spending and investment as individuals prioritize debt repayment over new expenditures. This phenomenon can create a cycle of stagnation, where high debt levels limit economic mobility and growth potential. For businesses, significant corporate debt can result in higher interest expenses, diverting resources away from productive investments and innovation.

On a broader scale, national debt similarly impacts economic growth. Governments may borrow to finance public investment projects, which can lead to economic expansion. However, if national debt becomes unsustainable, it can lead to higher taxes and reduced public spending, ultimately hindering growth. Additionally, if investors lose confidence in a government's ability to manage its debt, it can lead to higher borrowing costs and reduced investment inflows.

In the context of investment decisions, the interplay between debt and growth is critical. When interest rates are low, leveraging debt for investment becomes more attractive, as the cost of borrowing is reduced. This can encourage businesses to expand and invest in new technologies. Conversely, high-interest rates can deter borrowing, leading to reduced capital expenditures and slower economic growth.

Ultimately, understanding the economics of debt is essential for making informed decisions. Individuals and businesses must weigh the potential benefits of leveraging debt against the risks of overextension. Similarly, policymakers need to balance the benefits of borrowing for public investment against the long-term implications of rising national debt. By navigating these complexities, stakeholders can foster a more stable and robust economic environment.

In conclusion, effectively managing and reducing personal debt is crucial not only for individual financial well-being but also for broader economic stability. By employing strategic approaches—such as negotiating with creditors and seeking credit counseling—individuals can alleviate their debt burdens while contributing to healthier economic growth. Understanding the implications of high debt levels, both personal and corporate, underscores the interconnectedness of financial decisions and economic performance. Moreover, as student loan debt continues to shape financial planning for many, it is imperative that individuals remain informed about their options for repayment and investment. Ultimately, while debt can serve as a tool for growth, it also carries inherent risks that require careful consideration. By striking a balance between managing personal finances and understanding the larger economic context, individuals can navigate the complexities of debt with confidence, paving the way for a more secure financial future.