Debt Dynamics: Strategies for Personal Management, Economic Impact, and Effective Negotiation

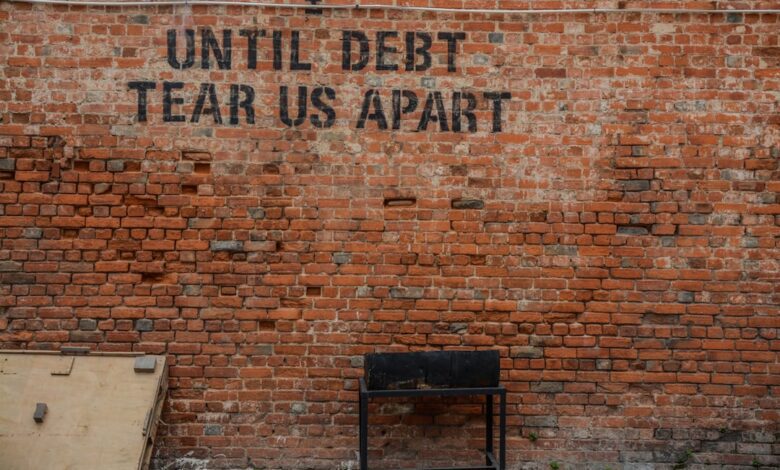

In today's fast-paced financial landscape, managing personal debt has become an essential skill for individuals striving to achieve economic stability and growth. With rising living costs and increasing reliance on credit, many find themselves grappling with high debt levels that can hinder financial freedom and overall well-being. This article delves into effective strategies for managing and reducing personal debt, exploring how personal financial decisions impact not just individuals, but the broader economy.

We will examine the ripple effects of high debt levels on economic growth, the intricacies of negotiating with creditors for more favorable repayment terms, and the vital role of credit counseling services in guiding individuals toward financial resilience. Additionally, we will discuss the complexities of leveraging debt for investment opportunities, the implications of student loan debt on long-term financial planning, and the influence of corporate debt on stock performance. Finally, we will explore how governments navigate national debt and its economic consequences. By understanding these interconnected topics, readers will be better equipped to make informed financial choices and contribute to a more sustainable economic future.

- 1. **Navigating Personal Debt: Effective Strategies for Management and Reduction**

- 2. **The Economic Ripple Effect: Understanding the Impact of High Debt Levels**

- 3. **From Negotiation to Counseling: Tools for Effective Debt Management**

1. **Navigating Personal Debt: Effective Strategies for Management and Reduction**

Managing and reducing personal debt requires a structured approach that empowers individuals to regain control over their financial situation. One effective strategy is to create a comprehensive budget that outlines all sources of income and expenses. By tracking spending habits, individuals can identify areas where they can cut costs and allocate more funds toward debt repayment.

Another crucial tactic is prioritizing debt repayment through the avalanche or snowball methods. The avalanche method focuses on paying off high-interest debts first, which can save money on interest in the long run. In contrast, the snowball method emphasizes paying off smaller debts first, providing psychological motivation through quick wins. Choosing the right method depends on personal preferences and financial circumstances.

Additionally, individuals should consider consolidating their debts through options such as personal loans or balance transfer credit cards. This can simplify payments and potentially lower interest rates, making it easier to manage multiple debts. It is also advisable to communicate with creditors to negotiate better repayment terms. Many creditors are willing to work with borrowers facing financial difficulties, offering lower interest rates or extended payment plans.

Credit counseling services can play a significant role in debt management by providing guidance and resources tailored to individual needs. These services can help create a debt management plan (DMP) and may even negotiate with creditors on behalf of the borrower.

Ultimately, the key to navigating personal debt lies in commitment and consistency. By actively engaging in these strategies, individuals can not only reduce their debt but also build a more stable financial future.

2. **The Economic Ripple Effect: Understanding the Impact of High Debt Levels**

High levels of personal and corporate debt can create significant ripple effects throughout the economy. When individuals and businesses are burdened by excessive debt, their spending power diminishes, which can lead to reduced consumer demand. As consumers cut back on expenditures to manage their debt, businesses experience lower sales, potentially resulting in layoffs or reduced hiring. This, in turn, can lead to a slowdown in economic growth, as less disposable income circulates within the economy.

Moreover, high debt levels can strain financial institutions. When borrowers struggle to meet repayment obligations, it increases the likelihood of defaults, which can destabilize banks and financial markets. This instability can lead to tighter credit conditions, making it more difficult for other borrowers to access loans, thus further constraining economic activity.

On a broader scale, high national debt can place pressure on government budgets, as a larger portion of tax revenues is allocated to interest payments rather than productive investments in infrastructure, education, or healthcare. This can hinder long-term economic growth and exacerbate income inequality, as public services may suffer from underfunding.

Ultimately, the interplay between high debt levels and economic growth illustrates the importance of sound debt management practices at both the personal and corporate levels. By addressing debt sustainably, individuals and organizations can contribute to a healthier economy, fostering an environment conducive to growth and stability.

3. **From Negotiation to Counseling: Tools for Effective Debt Management**

Effective debt management requires a multifaceted approach, combining negotiation tactics with professional support. One of the first steps in managing personal debt is negotiating with creditors to secure better repayment terms. This process can involve requesting lower interest rates, extended payment periods, or even debt settlements for a reduced amount. Preparation is key; borrowers should gather relevant financial information, outline their repayment capabilities, and approach creditors with a clear plan. Engaging in open and honest communication can often lead to more favorable terms, as creditors may prefer to work with borrowers rather than risk default.

In addition to negotiation, credit counseling plays a crucial role in effective debt management. Credit counseling agencies provide guidance and support to individuals struggling with debt. These organizations can help borrowers create a budget, develop a debt repayment plan, and understand their rights and options. Many agencies offer debt management plans (DMPs), where they negotiate directly with creditors on behalf of the borrower, consolidating multiple payments into one manageable monthly payment. This not only simplifies the repayment process but can also lead to reduced interest rates and waived fees.

Ultimately, the combination of negotiation skills and professional credit counseling serves as a powerful toolkit for individuals looking to regain control over their finances. By leveraging these resources, borrowers can navigate the complexities of debt management more effectively, leading to improved financial stability and reduced stress.

In conclusion, effectively managing and reducing personal debt is a multifaceted endeavor that not only influences individual financial health but also has broader economic implications. Understanding the strategies for debt reduction, such as budgeting and prioritizing payments, can empower individuals to regain control over their finances. Moreover, recognizing the economic ripple effects of high debt levels underscores the importance of addressing personal debt as a collective challenge that can hinder overall growth.

Negotiating with creditors and seeking credit counseling are essential tools that can facilitate better repayment terms and provide valuable support in navigating the complexities of debt. While leveraging debt for investment can offer potential rewards, it is crucial to approach this strategy with caution, weighing the risks carefully.

The burden of student loan debt highlights the need for thoughtful financial planning, especially for young adults entering the workforce. Additionally, corporate debt levels can significantly impact stock performance, illustrating the interconnectedness of personal and corporate finance within the larger economy.

Finally, the management of national debt by governments plays a critical role in shaping economic stability and growth. As we navigate our financial landscapes, understanding these dynamics equips us to make informed decisions, ultimately fostering a healthier economy for all. By taking proactive steps towards debt management, individuals can contribute to a more resilient financial future, both personally and collectively.