Debt Dynamics: Strategies for Personal Management and Their Broader Economic Implications

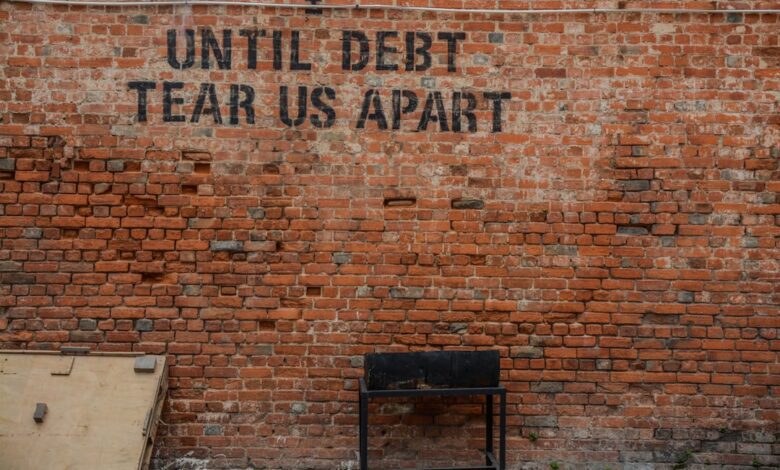

In today’s fast-paced financial landscape, managing and reducing personal debt has become a pressing concern for individuals and families alike. As personal debt levels continue to rise, understanding effective strategies for debt management is essential not only for personal well-being but also for broader economic health. This article delves into various aspects of debt, exploring how high levels of personal and corporate debt can stifle economic growth, while also examining the crucial role of credit counseling and negotiation in achieving better repayment terms. Additionally, we will discuss the complexities of investing through debt, the implications of student loan burdens on financial planning, and how government strategies for managing national debt can influence economic conditions and stock performance. By equipping readers with actionable insights and a comprehensive understanding of debt dynamics, we aim to foster informed decision-making in both personal finance and the economic sphere at large.

- 1. **Effective Debt Management: Strategies for Reducing Personal Debt**

- 2. **The Economic Ripple Effect: High Debt Levels and Growth**

- 3. **Navigating Negotiations: Working with Creditors for Better Terms**

1. **Effective Debt Management: Strategies for Reducing Personal Debt**

Managing and reducing personal debt is essential for achieving financial stability and improving overall quality of life. Here are several effective strategies to consider:

1. **Create a Budget:** Establishing a comprehensive budget allows individuals to track their income and expenses, identifying areas where spending can be reduced. Allocating funds specifically for debt repayment can help prioritize financial obligations.

2. **Debt Snowball Method:** This strategy involves paying off debts from the smallest to the largest. By focusing on smaller debts first, individuals can gain momentum and motivation as they celebrate each payoff, ultimately leading to larger debt reductions.

3. **Debt Avalanche Method:** Conversely, the debt avalanche method prioritizes debts with the highest interest rates. By addressing these first, individuals can save money on interest payments in the long run, accelerating the path to becoming debt-free.

4. **Consolidation Options:** For those with multiple debts, consolidating loans into a single payment can simplify management. This can be achieved through personal loans, balance transfer credit cards, or home equity loans, potentially lowering interest rates and monthly payments.

5. **Negotiate with Creditors:** Engaging in open communication with creditors can lead to better repayment terms. Many creditors are willing to work with individuals facing financial difficulties, offering lower interest rates, extended payment terms, or even debt settlement options.

6. **Seek Professional Help:** Credit counseling services can provide valuable guidance and support in developing a personalized debt management plan. These organizations offer budgeting advice, negotiation assistance, and may help set up debt management programs.

7. **Increase Income Streams:** Exploring additional sources of income, such as freelance work or part-time jobs, can provide extra funds for debt repayment. This approach not only accelerates the debt payoff process but can also contribute to building an emergency fund.

8. **Avoid Accumulating More Debt:** It’s crucial to adopt spending habits that prevent the accumulation of new debt. This may involve cutting back on discretionary expenses and using cash or debit cards instead of credit cards for purchases.

By implementing these strategies and maintaining discipline, individuals can effectively manage and reduce their personal debt, leading to improved financial health and peace of mind.

2. **The Economic Ripple Effect: High Debt Levels and Growth**

High levels of personal and corporate debt can create significant economic ripple effects that influence overall economic growth. When individuals or businesses are burdened by excessive debt, their spending power diminishes, leading to reduced consumption. This decrease in consumer spending can result in lower demand for goods and services, which in turn can slow down production and hinder business growth. As companies face declining sales, they may be forced to cut costs, resulting in layoffs and decreased investment in expansion.

Moreover, high debt levels can increase the risk of default, which can create instability in financial markets. When defaults become widespread, it can lead to tighter credit conditions, making it more difficult for borrowers to secure loans. This credit crunch can stifle economic activity further, as both consumers and businesses find it challenging to finance purchases or investments.

On a macroeconomic scale, high levels of national debt can also have profound implications. Governments that accumulate significant debt may face higher interest rates as investors demand a premium for the increased risk associated with lending. This can crowd out private investment, as businesses find it more expensive to borrow. Consequently, the potential for economic growth diminishes, as capital becomes less accessible for innovative projects and expansion efforts.

In summary, the interplay between high debt levels and economic growth is complex and multifaceted. While some debt can be beneficial for facilitating investments and purchasing power, excessive debt can trigger a cycle of reduced spending, increased risk, and ultimately slower economic growth. Addressing these issues requires a balanced approach, focusing on sustainable debt management strategies for both individuals and corporations to foster a healthier economic environment.

3. **Navigating Negotiations: Working with Creditors for Better Terms**

Negotiating with creditors can be a pivotal step in managing personal debt effectively. When facing financial difficulties, it's crucial to approach these negotiations strategically to achieve better repayment terms. Here are several key strategies to enhance the likelihood of a successful outcome.

First, it is important to prepare thoroughly before initiating contact with creditors. Gather all relevant information about your debts, including account numbers, outstanding balances, payment history, and any correspondence you've had with the creditor. Understanding your financial situation and being able to articulate it clearly can help build your case for more favorable terms.

Second, consider the timing of your negotiation. Contacting creditors during regular business hours is advisable, as representatives are more likely to be available and attentive. Additionally, if you are experiencing a temporary financial setback, such as loss of income or unexpected expenses, be upfront about your situation. Many creditors have programs in place to assist borrowers who demonstrate a genuine need for help.

When discussing potential adjustments, such as lower interest rates, extended repayment periods, or reduced monthly payments, clearly state your proposal and the rationale behind it. Demonstrating a willingness to pay, even if at a reduced rate, can encourage creditors to work with you. It is also beneficial to ask about any hardship programs that may exist, which can provide immediate relief.

Finally, document all agreements made during negotiations. Ensure that any revised terms are confirmed in writing to avoid misunderstandings in the future. Following up with creditors after reaching an agreement can reinforce your commitment to managing your debt responsibly.

By approaching negotiations with preparation, transparency, and a collaborative mindset, individuals can often secure more manageable repayment terms that contribute to their long-term financial stability.

In conclusion, managing and reducing personal debt is a multifaceted challenge that requires a strategic approach tailored to individual circumstances. By implementing effective debt management strategies, individuals can not only alleviate their financial burdens but also contribute to broader economic stability. The interplay between personal debt levels and economic growth underscores the importance of responsible borrowing and spending practices, as high debt can stifle consumer confidence and hinder economic progress.

Negotiating with creditors for better repayment terms is a crucial step in this process, allowing individuals to regain control over their finances while fostering a more cooperative relationship with lenders. Additionally, credit counseling can serve as a valuable resource, equipping borrowers with the knowledge and tools needed to navigate their financial situations successfully.

While leveraging debt for investment can offer potential rewards, it also carries inherent risks that must be carefully weighed against one's financial goals. Student loan debt, in particular, poses unique challenges for young adults, impacting their long-term financial planning and life choices.

Furthermore, the implications of corporate debt on stock performance remind us that debt management isn’t solely a personal issue; it reverberates through the economy, influencing investor behavior and market dynamics. On a larger scale, governments face the ongoing challenge of managing national debt, balancing fiscal responsibility with economic growth to ensure long-term stability.

Ultimately, understanding these interconnected elements is vital for individuals and policymakers alike. By fostering responsible debt practices and encouraging open dialogue between borrowers and creditors, we can work towards a more sustainable economic future.