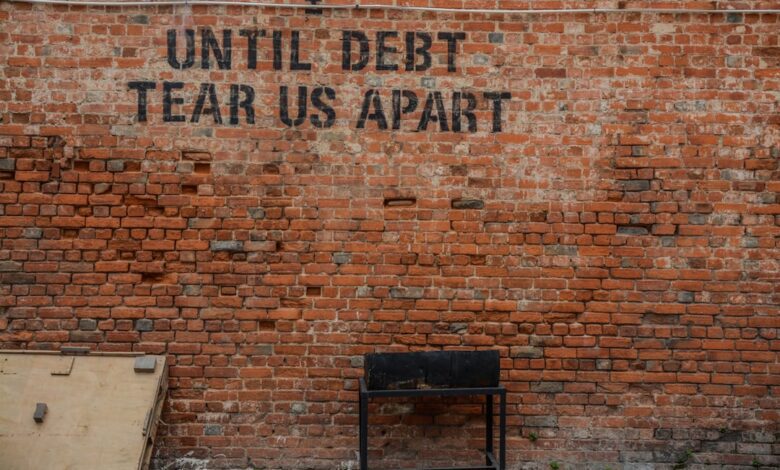

Debt Dynamics: Strategies for Personal Management and Economic Implications

In today's fast-paced financial landscape, personal debt has become a pervasive challenge that impacts individuals and economies alike. As the burden of debt continues to rise, it poses significant risks not just to personal financial stability, but also to broader economic growth. This article delves into a multifaceted approach to understanding and managing debt, exploring strategies for reducing personal liabilities, negotiating with creditors, and the role of credit counseling. We will also examine how high debt levels can stifle economic progress and the implications of corporate and national debt on financial markets and government policy. By shedding light on these interconnected issues, we aim to provide readers with valuable insights and practical tools to navigate their financial journeys more effectively. Whether you’re grappling with student loans, considering debt as a means of investment, or seeking to understand the wider economic implications of debt, this comprehensive guide will equip you with the knowledge needed to take control of your financial future.

- 1. **Navigating the Debt Landscape: Effective Strategies for Personal Debt Management**

- 2. **The Ripple Effect: How High Debt Levels Stifle Economic Growth**

1. **Navigating the Debt Landscape: Effective Strategies for Personal Debt Management**

Navigating the debt landscape requires a strategic approach to effectively manage and reduce personal debt. One of the first steps is to create a comprehensive budget that outlines income and expenses, allowing individuals to identify areas where they can cut back and allocate more funds toward debt repayment. Prioritizing high-interest debts, such as credit cards, is crucial, as these can accumulate quickly and become unmanageable. Utilizing the debt avalanche or debt snowball methods can be effective; the former focuses on paying off debts with the highest interest rates first, while the latter emphasizes paying off smaller debts to build momentum.

Additionally, individuals should consider consolidating debts through personal loans or balance transfer credit cards. This can simplify payments and reduce interest rates, making it easier to stay on track. Open communication with creditors is also essential; negotiating lower interest rates or more favorable repayment terms can provide relief and prevent further financial strain.

Credit counseling services can play a significant role in debt management by providing guidance and support. These professionals can help develop a personalized debt management plan and may negotiate on behalf of the individual to secure better terms with creditors. It's important to choose a reputable credit counseling agency to ensure that the advice and services provided are in the best interest of the consumer.

Lastly, maintaining a healthy credit score is vital for future financial opportunities. Regularly monitoring credit reports for inaccuracies and making timely payments can contribute to a positive credit profile. By employing these strategies, individuals can navigate the complexities of personal debt, ultimately leading to better financial stability and peace of mind.

Managing and reducing personal debt is a critical aspect of achieving financial stability and well-being. To begin, individuals should assess their current financial situation by listing all debts, including interest rates and monthly payments. This comprehensive overview helps prioritize which debts to pay off first—typically those with the highest interest rates, as this strategy minimizes the total interest paid over time.

Creating a budget is essential for effective debt management. By tracking income and expenses, individuals can identify areas where they can cut back and allocate more funds toward debt repayment. Additionally, setting realistic financial goals, such as the timeline for becoming debt-free, can provide motivation and a clear path forward.

Negotiating with creditors is another valuable strategy. Many creditors are willing to work with borrowers who demonstrate a commitment to repaying their debts. This could involve requesting lower interest rates, extending payment terms, or even settling for a lump-sum payment that is less than the total owed. Open communication and honesty about one’s financial situation can lead to more favorable repayment terms.

Credit counseling also plays a vital role in debt management. Professional credit counselors can provide personalized advice, help create a structured repayment plan, and offer resources for managing finances more effectively. They can also assist in enrolling individuals in debt management plans (DMPs), which consolidate multiple debts into a single monthly payment, often at a reduced interest rate.

While managing personal debt is crucial, it’s also important to consider the risks and rewards of using debt to invest. Leveraging debt for investments can amplify returns but also increases financial risk. Individuals must weigh their risk tolerance and investment knowledge before pursuing such strategies.

Student loan debt is a significant factor in financial planning for many young adults. It can impact their ability to save for retirement, buy a home, or even start a business. Understanding repayment options, including income-driven repayment plans and potential loan forgiveness programs, can help mitigate the long-term effects of student debt.

Finally, the broader implications of corporate debt and national debt on economic growth are worth noting. High levels of corporate debt can affect stock performance as companies may struggle to meet interest obligations during economic downturns. Similarly, how governments manage national debt influences economic stability and growth, as excessive debt can lead to higher taxes and reduced public services, ultimately impacting the overall economy.

By implementing these strategies and understanding the multifaceted aspects of debt, individuals can work towards achieving financial freedom and stability.

2. **The Ripple Effect: How High Debt Levels Stifle Economic Growth**

High levels of personal and corporate debt can create a ripple effect that stifles economic growth at multiple levels. When individuals and businesses are burdened with excessive debt, their ability to spend and invest diminishes. For consumers, high debt payments often lead to reduced disposable income, which means less spending on goods and services. This contraction in consumer spending can significantly impact businesses, leading to lower sales, reduced revenues, and, ultimately, slower economic growth.

Moreover, when corporations are heavily indebted, they may prioritize debt repayment over investment in innovation, expansion, or workforce development. This focus on servicing debt rather than pursuing growth opportunities can hinder productivity improvements and technological advancement, both of which are essential for a thriving economy. Additionally, high corporate debt levels can lead to increased volatility in stock markets, as investors may react negatively to the perceived risk associated with over-leveraged companies.

At the macroeconomic level, high national debt levels can also have detrimental effects. Governments may be forced to allocate significant portions of their budgets to interest payments, limiting their ability to invest in infrastructure, education, and social programs. This, in turn, can stifle long-term economic growth and exacerbate inequality, as underfunded public services disproportionately affect lower-income households.

Furthermore, the fear of rising interest rates can lead both consumers and businesses to adopt a more cautious approach to borrowing and spending. Anticipating higher costs of servicing debt can result in reduced economic activity, further contributing to a sluggish economic environment. As debt levels rise, the potential for economic downturns increases, creating a cycle where high debt levels lead to lower growth, which may subsequently result in higher debt levels.

In summary, the pervasive nature of high debt levels can create a challenging environment for economic growth, affecting consumer behavior, corporate investment decisions, and government spending priorities. Addressing these debt issues is crucial for fostering a more robust and sustainable economic future.

In conclusion, effectively managing and reducing personal debt is crucial not only for individual financial health but also for the broader economic landscape. As we've explored, high levels of debt can stifle economic growth, creating a ripple effect that impacts both consumers and businesses alike. Through strategic negotiation with creditors, individuals can secure better repayment terms that alleviate financial burdens. Credit counseling plays a vital role in guiding debtors toward more sustainable financial practices, fostering a proactive approach to debt management.

Moreover, while leveraging debt for investment can offer potential rewards, it also carries inherent risks that must be carefully evaluated. The growing concern around student loan debt further complicates financial planning for many individuals, emphasizing the need for early education and sound financial advice. On a larger scale, corporate debt influences stock performance, and governments must navigate national debt with caution, balancing fiscal responsibility with economic growth objectives.

Ultimately, a comprehensive understanding of these interconnected factors empowers individuals and policymakers to make informed decisions that promote financial stability and economic prosperity. By adopting effective debt management strategies and remaining vigilant about the implications of debt, we can work towards a healthier financial future for all.