Debt Dynamics: Strategies for Personal Management and Economic Implications

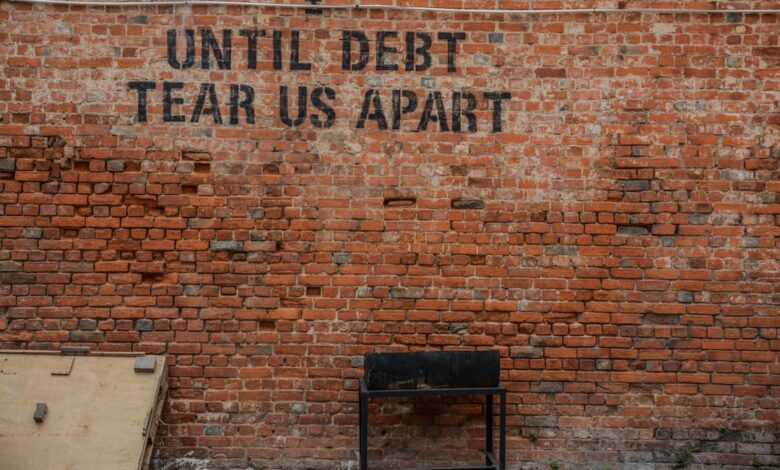

In today's fast-paced financial landscape, personal and corporate debt levels have reached unprecedented heights, prompting a critical examination of their implications on both individual well-being and broader economic growth. As individuals grapple with the burden of debt, the strategies for managing and reducing personal liabilities become crucial not only for personal financial health but also for fostering a stable economy. This article delves into effective approaches for navigating personal debt, highlighting the importance of negotiation with creditors and the role of credit counseling in developing sustainable repayment plans. Additionally, we will explore how high debt levels can ripple through the economy, influencing growth rates and corporate performance. From the nuances of student loan debt to the complexities of national debt management, we aim to provide a comprehensive understanding of how debt affects financial planning and investment strategies. Join us as we uncover the risks and rewards associated with leveraging debt, empowering readers to make informed decisions in an increasingly indebted world.

- 1. **Navigating Personal Debt: Effective Strategies for Management and Reduction**

- 2. **The Economic Ripple Effect: Understanding High Debt Levels and Their Impact on Growth**

1. **Navigating Personal Debt: Effective Strategies for Management and Reduction**

Managing and reducing personal debt requires a strategic approach that combines effective budgeting, prioritization, and proactive communication with creditors. One of the first steps is to create a detailed budget that outlines monthly income and expenses. This helps individuals identify areas where they can cut back and allocate more funds toward debt repayment.

Establishing a debt repayment plan is crucial. The snowball method, which involves paying off smaller debts first to build momentum, can be motivating for many. Alternatively, the avalanche method prioritizes debts with the highest interest rates, potentially saving more money over time. Choosing the right strategy depends on personal preferences and financial situations.

Another effective strategy is to consolidate debts, which may involve taking out a personal loan to pay off multiple debts or using a balance transfer credit card with a lower interest rate. This can simplify payments and potentially reduce interest costs. However, individuals should be cautious about accumulating new debt during this process.

Communication with creditors is also essential. Many creditors are open to negotiating terms, such as reducing interest rates or setting up a more manageable payment plan. Being transparent about one’s financial situation can lead to more favorable terms and avoid potential defaults.

Additionally, seeking professional help through credit counseling can provide valuable guidance and resources. Credit counselors can assist in creating a tailored debt management plan and may negotiate with creditors on behalf of the individual.

Ultimately, reducing personal debt requires discipline, commitment, and a proactive approach to financial management. By employing these strategies, individuals can work toward regaining control of their finances and achieving long-term financial stability.

Personal debt management is a critical aspect of financial health that can have far-reaching implications for both individuals and the broader economy. High levels of personal debt can stifle economic growth by limiting consumer spending, as individuals allocate a significant portion of their income to debt repayment. This reduction in disposable income can lead to decreased demand for goods and services, ultimately affecting businesses and the job market.

Negotiating with creditors can be an effective strategy for individuals seeking to manage their debt. Open communication with creditors may lead to more favorable repayment terms, such as lower interest rates, extended payment periods, or even debt settlements. It is essential for debtors to approach these negotiations prepared, presenting their financial situation clearly and demonstrating a willingness to meet obligations in a manageable way.

Credit counseling plays a pivotal role in helping individuals navigate the complexities of debt management. Certified credit counselors can provide personalized financial advice, assist in budgeting, and facilitate debt management plans. These services can empower individuals to regain control over their finances and develop sustainable repayment strategies.

While debt can be a powerful tool for investment and growth, it carries inherent risks. Using debt to invest can amplify returns, but it also increases the potential for significant losses. Investors must carefully assess their risk tolerance and the stability of the investment before leveraging debt to enhance their portfolios.

Student loan debt poses unique challenges to financial planning, particularly for young graduates entering the workforce. The burden of student loans can delay major life decisions, such as purchasing a home or saving for retirement. As such, understanding the long-term implications of student debt is crucial for effective financial planning.

On a macroeconomic level, corporate debt can significantly influence stock performance. High levels of corporate borrowing may indicate a company's aggressive growth strategy, but it can also raise concerns about sustainability and risk, particularly during economic downturns. Investors often scrutinize corporate debt levels when evaluating a company's financial health and potential for future growth.

Governments, too, face the challenge of managing national debt, which has profound economic implications. A nation's ability to service its debt can affect its credit rating, interest rates, and overall economic stability. Effective management of national debt is crucial for fostering a healthy economic environment, encouraging investment, and ensuring that public services are maintained without excessive taxation or deficit spending.

In summary, strategies for managing debt, whether personal or corporate, have significant implications for individuals and the economy alike. By employing effective negotiation techniques, seeking credit counseling, and understanding the risks associated with debt, individuals can navigate their financial obligations more successfully, ultimately contributing to a more robust economic landscape.

2. **The Economic Ripple Effect: Understanding High Debt Levels and Their Impact on Growth**

High debt levels can significantly impede economic growth, creating a ripple effect that extends beyond individual borrowers to the broader economy. When households and businesses carry excessive debt, their financial flexibility is constrained. This often leads to reduced consumer spending and investment, which are critical drivers of economic expansion.

For households, high levels of debt can result in diminished disposable income, as a larger portion of earnings is directed toward servicing debt rather than being spent on goods and services. This decline in consumer spending can stifle demand, leading to slower economic growth and potentially triggering a cycle of job losses and reduced business revenues.

On the corporate side, companies burdened by excessive debt may prioritize debt repayment over capital investment and innovation. This reluctance to invest in growth can hinder productivity improvements and the development of new products or services, further limiting the economy's potential for growth.

Moreover, high aggregate debt levels can lead to increased vulnerability during economic downturns. When economic conditions worsen, heavily indebted entities are often the first to feel the pinch, leading to defaults and bankruptcies that can destabilize financial markets. This instability can lead to tighter credit conditions, making it more difficult for businesses and consumers to borrow, which further exacerbates the economic slowdown.

In summary, while some level of debt can be beneficial for stimulating growth, excessive debt can create significant barriers to economic progress, affecting everything from individual financial health to national economic stability. Addressing these challenges requires a multifaceted approach, including financial education, responsible lending practices, and robust economic policies that promote sustainable debt levels.

In conclusion, effectively managing and reducing personal debt is not only crucial for individual financial health but also plays a significant role in the broader economic landscape. By implementing strategic approaches to debt management, individuals can gain control over their finances, paving the way for improved economic growth. The discussion of high debt levels highlights the ripple effects that personal and corporate debt can have on the economy, underscoring the importance of responsible borrowing and repayment practices.

Negotiating with creditors and seeking credit counseling are vital steps that can lead to better repayment terms and financial stability, providing individuals with the tools needed to navigate their debt challenges. While the allure of leveraging debt for investment can offer potential rewards, it is essential to weigh these against the inherent risks, particularly in the context of student loans, which significantly influence long-term financial planning.

Moreover, understanding the dynamics of corporate debt and national debt management equips individuals and policymakers alike with insights into the economic implications of debt on stock performance and overall economic health. As we strive for a more sustainable financial future, embracing effective debt management strategies and fostering open communication with creditors will be key in reducing personal debt and promoting economic resilience. By taking proactive steps today, individuals can not only enhance their financial well-being but also contribute to a healthier economy for all.