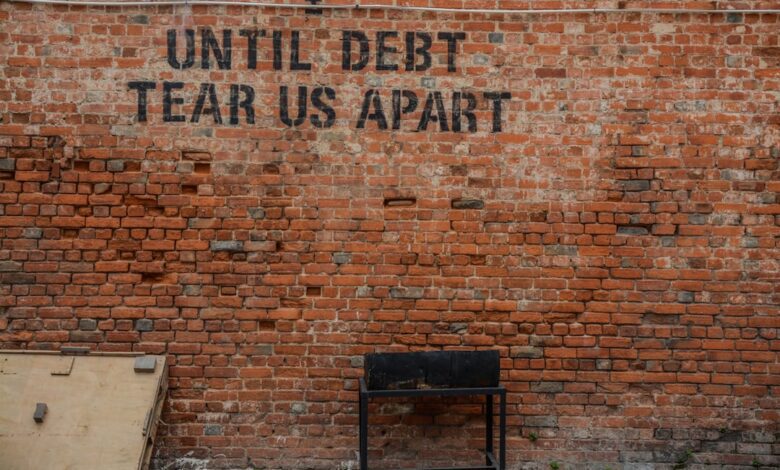

Debt Dynamics: Strategies for Personal Management and Economic Impact

In an increasingly complex financial landscape, managing personal debt has become a critical concern for individuals and families alike. The burden of debt not only affects personal finances but also has far-reaching implications for economic growth and stability. As households grapple with rising costs, understanding effective strategies for debt management and reduction is more important than ever. This article delves into various facets of debt, from practical approaches to negotiating better repayment terms with creditors to the role of credit counseling in fostering financial health. Additionally, we will explore how personal and corporate debt influences broader economic factors, such as stock performance and national debt management. By examining these interconnected issues, we aim to provide valuable insights for navigating the challenges of debt while highlighting its potential risks and rewards in the context of investment. Join us as we navigate the intricacies of debt management and its significant impact on both personal and economic well-being.

- 1. **Navigating Personal Debt: Effective Strategies for Management and Reduction**

- 2. **The Ripple Effect: How High Debt Levels Stifle Economic Growth**

- 3. **Negotiating with Creditors: Tactics for Securing Better Repayment Terms**

1. **Navigating Personal Debt: Effective Strategies for Management and Reduction**

Managing and reducing personal debt is crucial for achieving financial stability and well-being. Effective strategies can help individuals regain control over their finances and work towards a debt-free future.

One of the first steps in managing personal debt is to assess the total debt load. This involves listing all debts, including credit cards, loans, and any other obligations, alongside their interest rates and minimum monthly payments. Understanding the full scope of debt can help prioritize which debts to tackle first, often focusing on those with the highest interest rates, a method known as the avalanche approach. Alternatively, the snowball method encourages paying off smaller debts first to build momentum and motivation.

Creating a budget is another essential strategy. A well-structured budget allows individuals to track income and expenses, identify areas where spending can be cut, and allocate more funds towards debt repayment. It’s important to differentiate between needs and wants, ensuring that essential expenses are covered while minimizing discretionary spending.

Negotiating with creditors can also be a powerful tool in debt management. Many creditors are willing to discuss repayment options, lower interest rates, or even settle for a reduced amount if approached proactively. Being honest about financial difficulties and demonstrating a commitment to repayment can lead to more favorable terms.

Additionally, utilizing credit counseling services can provide valuable guidance. Credit counselors can offer personalized financial plans, help negotiate with creditors, and educate individuals about managing their finances effectively. This professional support can be particularly beneficial for those feeling overwhelmed by their debt.

Lastly, individuals should consider establishing an emergency fund, even while repaying debt. This fund can help avoid additional debt from unexpected expenses, creating a more sustainable financial situation. By implementing these strategies, individuals can navigate their personal debt more effectively, reduce their financial burden, and work towards achieving long-term financial health.

2. **The Ripple Effect: How High Debt Levels Stifle Economic Growth**

High debt levels can create a ripple effect that stifles economic growth at both individual and macroeconomic levels. When consumers and businesses are burdened by excessive debt, their ability to spend and invest diminishes significantly. Households may prioritize debt repayment over consumption, leading to a decline in demand for goods and services. This reduction in consumer spending can negatively impact businesses, resulting in lower revenues, reduced hiring, and potentially leading to layoffs. Consequently, this cycle can contribute to a slowdown in economic growth.

At the corporate level, high debt can limit a company's capacity to invest in expansion or innovation. Firms burdened by substantial liabilities may face higher interest payments, which can divert funds away from productive investments. This stagnation can inhibit competitiveness and ultimately slow down overall economic progress. Additionally, when companies struggle with high levels of debt, it may lead to increased volatility in the stock market, as investor confidence wanes in the face of potential defaults or bankruptcies.

On a national scale, high levels of debt can also stifle economic growth. Governments that allocate a significant portion of their budgets to servicing debt may have limited resources for public investment in infrastructure, education, and healthcare. This can hinder long-term growth prospects and reduce the overall quality of life for citizens. Furthermore, if investors perceive that a government is over-leveraged, it may lead to higher borrowing costs or diminished trust in the economy, further exacerbating the problem.

In summary, the impact of high debt levels extends beyond individual borrowers to influence broader economic health. By constraining consumer spending, limiting corporate investment, and affecting government capabilities, high debt can create a challenging environment for sustained economic growth.

3. **Negotiating with Creditors: Tactics for Securing Better Repayment Terms**

Negotiating with creditors can be a crucial step in managing personal debt and securing better repayment terms. Effective negotiation requires preparation, clear communication, and a willingness to explore various options. Here are several tactics to consider:

1. **Assess Your Financial Situation:** Before approaching creditors, take a comprehensive look at your financial status. Understand your income, expenses, and the total amount of debt you owe. This knowledge will enable you to present a realistic repayment plan to your creditors.

2. **Establish Open Communication:** Reach out to your creditors as soon as you anticipate difficulty in making payments. Being proactive demonstrates responsibility and can foster goodwill. Use clear and respectful communication to explain your situation, whether it’s job loss, medical expenses, or other financial challenges.

3. **Request Specific Changes:** When negotiating, be clear about what you need. This could include lower interest rates, extended payment terms, or a temporary payment reduction. Providing a specific request can help creditors understand how they can assist you while still ensuring their interests are met.

4. **Offer a Reasonable Proposal:** Creditors are often more willing to negotiate if you come prepared with a feasible proposal. For example, if you propose a lower monthly payment, ensure it aligns with your budget and can be sustained over time. This shows creditors that you have thought through your plan and are committed to repayment.

5. **Be Persistent but Patient:** Negotiating can take time, and it may require multiple conversations. If your initial request is denied, don’t hesitate to ask for alternative options or escalate the matter to a higher-level representative.

6. **Consider Professional Assistance:** If negotiations become overwhelming, consider seeking help from a credit counselor or debt management professional. These experts can provide guidance, help you communicate effectively, and negotiate on your behalf, often leading to better outcomes.

7. **Document Everything:** Keep a written record of all communications with creditors, including dates, times, and details of discussions. This documentation can be crucial if disputes arise and serves as a reference for future negotiations.

By employing these strategies, individuals can enhance their chances of securing favorable repayment terms, ultimately reducing their financial burden and improving their overall financial health.

In conclusion, managing and reducing personal debt is a multifaceted challenge that requires a strategic and informed approach. By implementing effective debt management strategies, individuals can regain control over their finances, which not only benefits their personal economic stability but also contributes to broader economic growth. Understanding the ripple effects of high debt levels highlights the importance of fostering a healthy financial ecosystem, where both consumers and businesses can thrive.

Negotiating with creditors can lead to more favorable repayment terms, providing relief for those struggling with overwhelming obligations. Furthermore, credit counseling plays a crucial role in guiding individuals toward sustainable debt management practices, empowering them to make informed decisions about their financial futures.

While the allure of using debt to invest can present opportunities, it is essential to weigh the associated risks and rewards carefully. Additionally, the impact of student loan debt on financial planning underscores the importance of addressing educational financing in the context of long-term financial health.

At a macroeconomic level, the relationship between corporate debt and stock performance, alongside the management of national debt by governments, paints a complex picture of how debt influences both individual and collective prosperity. Ultimately, by fostering awareness and adopting proactive measures, individuals and policymakers alike can work towards a more balanced and equitable financial landscape, ensuring that debt serves as a tool for growth rather than a barrier to success.