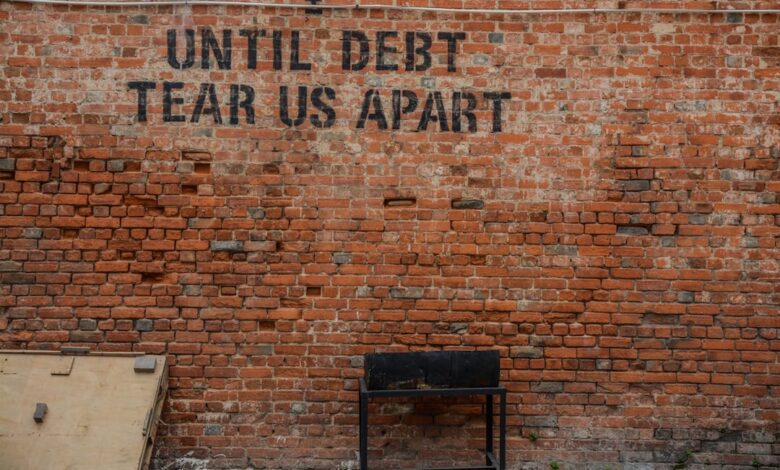

Debt Dynamics: Strategies for Personal Management and Economic Impact

In today's fast-paced financial landscape, managing and reducing personal debt has become a crucial skill for individuals seeking to achieve long-term financial stability. With rising living costs and increasing reliance on credit, many people find themselves grappling with overwhelming debt levels. This article explores a range of strategies for personal debt management, examining effective methods to alleviate financial burdens while also addressing the broader implications of high debt levels on economic growth.

As we delve into the intricacies of negotiating with creditors for more favorable repayment terms, we will also highlight the invaluable role of credit counseling in helping individuals regain control over their finances. Additionally, we will explore the complex relationship between debt and investment, shedding light on the risks and rewards that come with leveraging debt for financial growth.

Furthermore, we will discuss the specific challenges posed by student loan debt and its significant impact on financial planning for young adults. On a larger scale, the article will also consider how corporate debt influences stock performance and how governments manage national debt, including its potential economic implications. By navigating these multifaceted issues, we aim to equip readers with the knowledge and tools necessary to make informed decisions in their personal and financial lives.

- 1. **Navigating the Debt Landscape: Effective Strategies for Personal Debt Management**

- 2. **The Economic Ripple Effect: How High Debt Levels Influence Growth**

- 3. **Negotiating with Creditors: Tools for Better Repayment Terms and Financial Stability**

1. **Navigating the Debt Landscape: Effective Strategies for Personal Debt Management**

Managing personal debt requires a structured approach that combines effective strategies, discipline, and awareness of one’s financial situation. Here are several key strategies to navigate the debt landscape effectively:

1. **Create a Comprehensive Budget**: The first step in managing debt is understanding your income and expenses. A detailed budget helps identify areas where spending can be reduced, allowing for more funds to be allocated toward debt repayment. This includes tracking discretionary spending and prioritizing essential costs.

2. **Prioritize Debt Repayment**: Not all debts are created equal. Consider using the avalanche or snowball method for repayment. The avalanche method focuses on paying off high-interest debts first, which saves money in the long run. Conversely, the snowball method involves paying off the smallest debts first to build momentum and motivation.

3. **Negotiate with Creditors**: Many creditors are willing to negotiate repayment terms. Contacting them to discuss lower interest rates, extended repayment periods, or settlement options can lead to more manageable payment plans. It’s important to approach these conversations prepared with your financial information and a clear proposal.

4. **Consider Debt Consolidation**: Consolidating multiple debts into a single loan can simplify repayments and potentially lower interest rates. However, it’s essential to evaluate the terms carefully and ensure that consolidation does not lead to more debt.

5. **Seek Professional Help**: Credit counseling services can provide valuable guidance and support. These organizations help individuals create personalized debt management plans and may negotiate with creditors on behalf of clients. It’s crucial to choose a reputable agency that offers transparent services.

6. **Build an Emergency Fund**: While it may seem counterintuitive to save while in debt, having an emergency fund can prevent reliance on credit for unexpected expenses. Aim to save a small amount each month, gradually building a cushion that protects against further debt accumulation.

7. **Educate Yourself on Financial Literacy**: Understanding the fundamentals of personal finance, including interest rates, credit scores, and the impact of debt on financial health, empowers individuals to make informed decisions. Engaging in financial literacy programs or workshops can enhance your ability to manage debt effectively.

8. **Set Realistic Goals**: Establish short-term and long-term financial goals that include debt reduction targets. Celebrate small victories to stay motivated and focused on the overall objective of achieving financial freedom.

By implementing these strategies, individuals can take control of their personal debt, reduce financial stress, and work toward a more secure financial future.

2. **The Economic Ripple Effect: How High Debt Levels Influence Growth**

High levels of personal and corporate debt can have significant implications for economic growth. When individuals carry substantial debt, their disposable income is often tied up in repayments, limiting their ability to spend on goods and services. This reduction in consumer spending can lead to decreased demand for products, which in turn affects businesses' revenues and profitability. As companies experience lower sales, they may be forced to cut costs, leading to layoffs or reduced hiring, further exacerbating the economic slowdown.

Additionally, high debt levels can create uncertainty in the financial markets. Investors may perceive high debt-to-income ratios as a sign of risk, potentially leading to increased interest rates as creditors seek to mitigate their exposure. Higher borrowing costs can deter both consumers and businesses from taking on new loans, stifling investment and innovation.

Moreover, the interconnectedness of personal and corporate debt means that when consumers struggle with debt, it can impact corporations, as consumer spending accounts for a significant portion of economic activity. This cycle can create a feedback loop where high debt levels lead to reduced economic growth, which in turn makes it more difficult for individuals and businesses to manage their debts effectively.

In summary, the ripple effect of high debt levels can hinder economic growth through reduced consumer spending, increased borrowing costs, and a cautious investment climate. Addressing these debt issues is crucial for fostering a healthier economic environment that encourages sustainable growth and development.

3. **Negotiating with Creditors: Tools for Better Repayment Terms and Financial Stability**

Negotiating with creditors can be a crucial step toward achieving better repayment terms and enhancing financial stability. Effective communication and preparation are key components in this process.

First, it's important to gather all relevant financial information, including income, expenses, and outstanding debts. This will provide a clear picture of one’s financial situation and help in articulating a reasonable proposal to creditors. Understanding the terms of the existing debt, such as interest rates and payment schedules, is also essential, as it allows for informed discussions.

When approaching creditors, it is advisable to be honest and transparent about financial difficulties. Many creditors are willing to negotiate, especially if they believe that working with the borrower is more beneficial than pursuing collections or legal action. Proposing specific adjustments, such as lower interest rates, extended payment terms, or a temporary reduction in monthly payments, can be effective strategies.

Additionally, demonstrating a commitment to repayment can strengthen the negotiation position. This can involve offering to make a lump-sum payment to settle the debt for less than the full amount owed, which some creditors may find appealing.

Using a credit counseling service can also provide valuable support during negotiations. These professionals are experienced in dealing with creditors and can help craft a repayment plan that meets both the borrower’s needs and the creditors’ requirements.

Overall, effective negotiation with creditors not only aids in reducing immediate financial burdens but also contributes to long-term financial stability by establishing more manageable debt repayment plans.

In conclusion, effectively managing and reducing personal debt is crucial not only for individual financial health but also for broader economic stability. As we've explored, high levels of personal debt can stifle economic growth, making it essential for individuals to adopt proactive strategies to navigate their financial landscape. Engaging in negotiations with creditors can lead to more favorable repayment terms, offering a pathway to financial relief. Additionally, credit counseling serves as a valuable resource, equipping individuals with the knowledge and tools needed to manage their debt effectively.

While leveraging debt for investment can yield rewards, it also carries significant risks that must be carefully weighed. Furthermore, the implications of student loan debt on financial planning highlight the need for informed decision-making during the pursuit of education. On a larger scale, corporate debt impacts stock performance, and government management of national debt plays a pivotal role in shaping economic policies.

By understanding these interconnected dynamics, individuals can make informed choices regarding their debt, contributing not only to their financial well-being but also to the overall economic health of their communities. Ultimately, a balanced approach to debt management, characterized by negotiation, education, and strategic planning, can empower individuals to achieve financial stability and foster economic resilience.