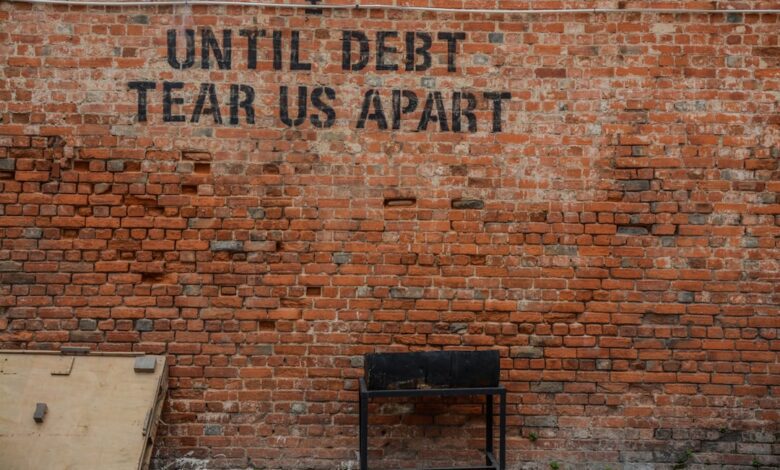

Debt Dynamics: Strategies for Personal Management and Economic Impact

In an era where financial stability is increasingly challenged by rising living costs and unpredictable economic conditions, managing and reducing personal debt has become a pressing concern for many individuals and families. High levels of personal and corporate debt not only strain household budgets but also pose significant risks to broader economic growth. Understanding the interplay between personal financial decisions and macroeconomic factors is essential for navigating today’s financial landscape. This article delves into effective strategies for managing personal debt, the critical impact of debt on economic performance, and the importance of negotiation with creditors. We will explore the role of credit counseling, examine the complex relationship between student loan debt and financial planning, and analyze how corporate debt influences stock performance. Additionally, we will consider how governments manage national debt and its implications for the economy. By equipping readers with practical insights and strategies, this article aims to empower individuals to take control of their financial futures while recognizing the broader economic context in which they operate.

- Here are three possible headlines for sections of an article covering the specified topics:

- 1. **Effective Strategies for Personal Debt Management: Navigating Your Financial Landscape**

Here are three possible headlines for sections of an article covering the specified topics:

Managing personal debt is a critical issue that affects individuals and families across various demographics. One effective strategy is to create a comprehensive budget that tracks income and expenses, allowing individuals to identify areas where they can cut back and allocate more funds toward debt repayment. Additionally, utilizing the debt snowball or avalanche method can provide a structured approach to paying off debts, either by focusing on the smallest debts first or prioritizing those with the highest interest rates.

High levels of personal debt not only strain individual finances but can also have broader implications for economic growth. When consumers are burdened with debt, their spending power is diminished, leading to reduced consumption and potentially stunted economic expansion. This cyclical effect can hinder job creation and investment, ultimately affecting the overall economic landscape.

Negotiating with creditors is another vital strategy for managing debt. Individuals should approach creditors to discuss potential alternatives, such as lower interest rates, extended repayment terms, or even debt settlement options. Open communication can often lead to more favorable terms, easing the repayment process and helping to avoid default.

Credit counseling services play a crucial role in debt management, offering professional guidance to those struggling with financial issues. These services provide personalized plans and educational resources, empowering individuals to make informed decisions about their finances and develop a sustainable path to debt reduction.

The decision to use debt as a tool for investment can be both risky and rewarding. While leveraging debt can amplify returns, it also increases exposure to financial loss if investments do not perform as expected. Careful consideration and risk assessment are essential before pursuing this strategy.

For many, student loan debt significantly impacts financial planning. The burden of student loans can delay major life milestones, such as homeownership or retirement savings, necessitating a strategic approach to budgeting and long-term financial goals.

Corporate debt also plays a critical role in stock performance. High levels of corporate borrowing can affect investor confidence and company valuation, influencing stock prices. Investors must assess a company's debt levels in relation to its earnings and growth prospects to make informed investment decisions.

Lastly, government management of national debt is a complex issue with significant economic implications. Effective debt management strategies, such as maintaining sustainable debt-to-GDP ratios and implementing sound fiscal policies, are crucial for ensuring long-term economic stability and growth. Understanding the balance between borrowing for public investment and the risks of increasing national debt is essential for policymakers navigating these challenges.

1. **Effective Strategies for Personal Debt Management: Navigating Your Financial Landscape**

Effective personal debt management is crucial for maintaining financial health and achieving long-term stability. Here are several strategies individuals can employ to navigate their financial landscape:

1. **Create a Comprehensive Budget**: Establishing a detailed budget allows individuals to track income and expenses, identify unnecessary expenditures, and allocate funds towards debt repayment. Utilizing budgeting tools or apps can simplify this process and provide a clear overview of financial standing.

2. **Prioritize Debt Payments**: Adopt a systematic approach to debt repayment. The snowball method, which involves paying off the smallest debts first to build momentum, can be motivating. Alternatively, the avalanche method focuses on paying off debts with the highest interest rates first, minimizing overall interest paid.

3. **Consolidate Debts**: Consider debt consolidation options, such as personal loans or balance transfer credit cards, which can simplify payments and potentially lower interest rates. However, it’s essential to assess the terms and ensure that consolidation doesn’t lead to increased debt.

4. **Negotiate with Creditors**: Engaging directly with creditors can lead to better repayment terms. Many creditors are willing to offer lower interest rates, extended payment plans, or even settlements for less than the owed amount, particularly if they believe it increases the likelihood of repayment.

5. **Increase Income**: Exploring additional income sources, such as part-time jobs, freelancing, or selling unused items, can provide extra funds for debt repayment. Even small increases in income can have a significant impact when directed toward reducing debt.

6. **Seek Professional Help**: Credit counseling services can provide valuable guidance in managing personal debt. These organizations can help individuals develop a personalized debt management plan, negotiate with creditors, and offer financial education to prevent future debt accumulation.

7. **Stay Informed about Financial Products**: Being aware of the terms and conditions of loans and credit cards can help individuals make informed decisions. Understanding variable versus fixed interest rates, fees, and repayment terms can prevent individuals from falling into unfavorable debt situations.

By implementing these strategies, individuals can take control of their personal debt, reduce financial stress, and pave the way for a more secure financial future.

Managing and reducing personal debt is a critical concern for many individuals, as high debt levels can significantly affect financial stability and overall well-being. Strategies for managing personal debt often begin with creating a comprehensive budget that outlines income, expenses, and existing debts. This transparency allows individuals to identify areas where spending can be reduced and helps prioritize debt repayment.

One effective approach is the debt snowball method, which involves focusing on paying off the smallest debts first while making minimum payments on larger debts. This strategy can provide psychological motivation as individuals experience quick wins, leading to increased confidence and commitment to debt reduction. Alternatively, the debt avalanche method prioritizes paying off debts with the highest interest rates first, minimizing the total interest paid over time.

When dealing with creditors, negotiation can also play a crucial role in improving repayment terms. Borrowers should be prepared to communicate openly about their financial situation and propose realistic payment plans. Creditors may be willing to lower interest rates, extend repayment terms, or even settle for a reduced total amount due, especially if they believe it increases the likelihood of receiving payments.

In addition to personal strategies, credit counseling services can provide valuable resources for individuals struggling with debt. Certified credit counselors can offer tailored advice, assist with budgeting, and create a debt management plan that consolidates payments into a single monthly installment, often at a reduced interest rate.

While managing debt is essential, it's also important to consider the risks and rewards of using debt to invest. Leveraging debt can potentially amplify returns, but it also increases financial risk, particularly if investments do not perform as expected. Careful evaluation and risk assessment are crucial before using debt as an investment tool.

Another significant factor is the impact of student loan debt on financial planning. Graduates often face substantial loan repayments that can delay milestones such as homeownership and retirement savings. This debt burden necessitates strategic financial planning to balance loan repayment with other financial goals.

Understanding corporate debt is also vital, as high levels of corporate borrowing can affect stock performance. Investors should consider a company's debt-to-equity ratio and overall financial health when evaluating investment opportunities.

At a broader level, governments manage national debt through various fiscal policies, which can have profound economic implications. High national debt levels can influence interest rates, inflation, and economic growth, making it essential for policymakers to strike a balance between stimulating growth and maintaining fiscal responsibility. Overall, addressing both personal and national debt requires a thoughtful approach that considers both immediate needs and long-term financial health.

In conclusion, effectively managing and reducing personal debt is essential not only for individual financial health but also for broader economic stability. By employing strategies such as budgeting, negotiating with creditors, and seeking credit counseling, individuals can take proactive steps to regain control over their finances. Understanding the implications of high debt levels—both personal and corporate—on economic growth underscores the importance of responsible borrowing and investment practices. While leveraging debt can present opportunities for growth, particularly in the context of student loans and investments, it also carries inherent risks that must be carefully considered. Ultimately, a comprehensive approach to debt management, informed by both personal circumstances and broader economic factors, can lead to improved financial outcomes and contribute positively to the economy as a whole. As individuals navigate their financial journeys, staying informed and seeking professional guidance when necessary will empower them to make sound decisions that promote long-term financial well-being.