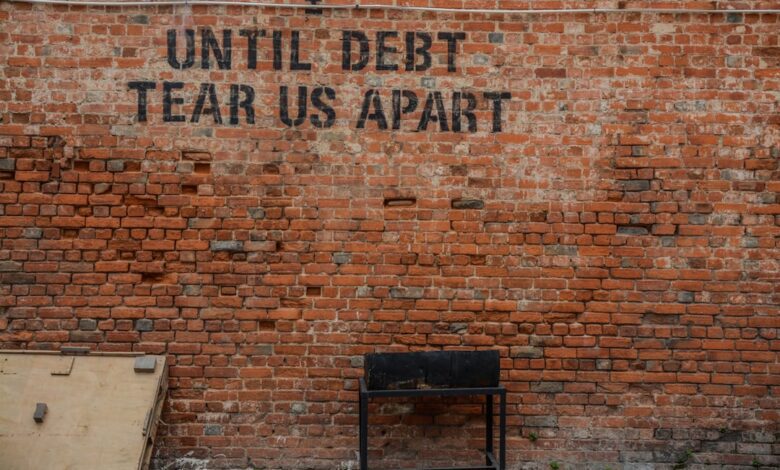

Debt Dynamics: Strategies for Personal Management and Economic Impact

In today’s fast-paced financial landscape, managing debt has become a critical concern for individuals, businesses, and governments alike. As personal debt levels reach unprecedented heights, understanding effective strategies for debt reduction is not just a matter of personal finance but a vital component of overall economic health. This article delves into the multifaceted aspects of debt management, exploring practical strategies for individuals to navigate personal debt, while also examining the broader implications of high debt levels on economic growth. We will discuss the importance of negotiating with creditors for better repayment terms and the vital role of credit counseling in helping individuals regain control of their financial futures. Additionally, we will explore the risks and rewards associated with using debt as a tool for investment, the impact of student loan debt on long-term financial planning, and how corporate debt influences stock performance. Finally, we will consider how governments manage national debt and its economic implications, highlighting the interconnectedness of personal, corporate, and governmental debt in shaping our financial landscape. Join us as we unravel these critical topics and equip ourselves with the knowledge needed to navigate the complexities of debt in today’s economy.

- 1. **Navigating Personal Debt: Strategies for Effective Management and Reduction**

- 2. **The Economic Ripple Effect: Understanding High Debt Levels and Growth**

- 3. **Negotiating with Creditors: Tips for Securing Better Repayment Terms**

1. **Navigating Personal Debt: Strategies for Effective Management and Reduction**

Managing and reducing personal debt requires a strategic approach that combines budgeting, prioritization, and proactive communication. One effective strategy is to create a detailed budget that accounts for all income and expenses. By tracking spending habits, individuals can identify areas where they can cut back, thus freeing up more money to allocate toward debt repayment.

Another crucial step is to prioritize debts based on interest rates and balances. The debt avalanche method, which focuses on paying off high-interest debts first, can save money in the long run. Alternatively, the debt snowball method emphasizes paying off smaller debts first to build momentum and motivation. Whichever method is chosen, consistency is key; setting up automatic payments can help ensure debts are managed effectively.

Additionally, individuals should consider negotiating with creditors for better repayment terms. This could involve requesting lower interest rates or extending the repayment period, which can ease the financial burden. Credit counseling services can also provide valuable support, offering guidance on budgeting and debt management strategies, and sometimes negotiating on behalf of clients.

It's important to remember that while some debt can be leveraged for investments—such as student loans for education or mortgages for homes—unmanaged debt can lead to financial instability. Regularly reviewing one’s financial situation and adjusting strategies as needed is essential for maintaining control over personal debt and ultimately achieving financial stability.

2. **The Economic Ripple Effect: Understanding High Debt Levels and Growth**

High levels of personal and corporate debt can significantly hinder economic growth, creating a ripple effect that extends beyond individual borrowers and businesses to the broader economy. When households are burdened with excessive debt, their disposable income decreases, leading to reduced consumer spending. This decline in consumption can slow down economic activity, as consumer spending is a primary driver of GDP growth.

Moreover, high debt levels can limit individuals’ ability to save, invest, or engage in entrepreneurial activities. As families and individuals prioritize debt repayment, they are less likely to invest in education, home purchases, or retirement savings, which can have long-term consequences for economic stability and growth.

On the corporate side, companies with high debt levels may face increased financial pressure, leading to reduced capital investment and innovation. Corporations burdened by debt often prioritize servicing that debt over expanding operations or hiring new employees, which can stifle productivity and competitiveness. In cases of corporate default, the consequences can reverberate through the economy, affecting suppliers, employees, and investors.

Furthermore, the government’s handling of national debt plays a crucial role in shaping economic growth. High national debt levels can lead to increased interest rates, as investors demand higher returns for perceived risk. Elevated interest rates can slow down borrowing and investment, ultimately impacting economic growth.

In summary, the interconnectedness of personal, corporate, and national debt creates a complex landscape where high debt levels can lead to reduced growth, increased financial instability, and a diminished capacity for both individuals and businesses to contribute positively to the economy. Addressing these debt issues through effective management and strategic planning is vital for fostering a sustainable economic environment.

3. **Negotiating with Creditors: Tips for Securing Better Repayment Terms**

Negotiating with creditors can be a vital step in managing personal debt and securing better repayment terms. Here are some effective strategies to enhance your chances of a successful negotiation:

1. **Assess Your Financial Situation**: Before approaching your creditors, take a comprehensive look at your financial situation. Understand your income, expenses, and the total amount owed. This knowledge will help you present a realistic proposal and demonstrate your commitment to repaying the debt.

2. **Communicate Openly and Honestly**: When you contact your creditors, be transparent about your financial difficulties. Explain your situation clearly, whether it’s due to job loss, medical emergencies, or other unforeseen circumstances. Creditor empathy can often lead to more favorable terms if they see you are genuinely trying to manage your obligations.

3. **Be Prepared with a Proposal**: Come to the negotiation with a specific proposal in mind. This could include requests for lower interest rates, extended repayment periods, or reduced monthly payments. Having a well-thought-out plan shows creditors that you are proactive and serious about wanting to resolve your debt.

4. **Know Your Rights**: Familiarize yourself with consumer protection laws and the Fair Debt Collection Practices Act (FDCPA). Understanding your rights can empower you during negotiations and help you identify any unfair practices employed by creditors.

5. **Stay Calm and Professional**: Approach the negotiation with a calm demeanor. Being respectful and professional can go a long way in fostering a cooperative relationship with your creditor. Avoid confrontational language and focus on finding a mutually agreeable solution.

6. **Follow Up in Writing**: After reaching any agreement verbally, make sure to request written confirmation of the new terms. This protects you and ensures that both you and the creditor are on the same page.

7. **Consider Seeking Help**: If negotiations become overwhelming, consider enlisting the help of a credit counselor or financial advisor. These professionals can provide valuable insights and may even negotiate on your behalf.

By employing these strategies, individuals can improve their chances of securing better repayment terms, ultimately leading to a more manageable path out of debt.

In conclusion, effectively managing and reducing personal debt is a multifaceted endeavor that requires strategic planning and informed decision-making. As this article has illustrated, high levels of personal and corporate debt can have significant implications not only for individual financial health but also for broader economic growth. By negotiating with creditors for better repayment terms and considering the role of credit counseling, individuals can take proactive steps toward financial stability.

Moreover, while leveraging debt for investment can offer potential rewards, it also carries inherent risks that must be carefully weighed. The burden of student loan debt further complicates financial planning for many, making it essential to approach debt management with a clear strategy. On a larger scale, governments’ handling of national debt plays a critical role in shaping economic policies and can have lasting effects on stock performance and economic stability.

Ultimately, understanding the interconnectedness of these factors empowers individuals and policymakers alike to make informed choices about debt, fostering a healthier financial future for all. By adopting sound debt management practices and being aware of the economic implications, we can pave the way for sustainable growth and improved financial resilience.