Debt Dynamics: Strategies for Personal Management and Economic Impact

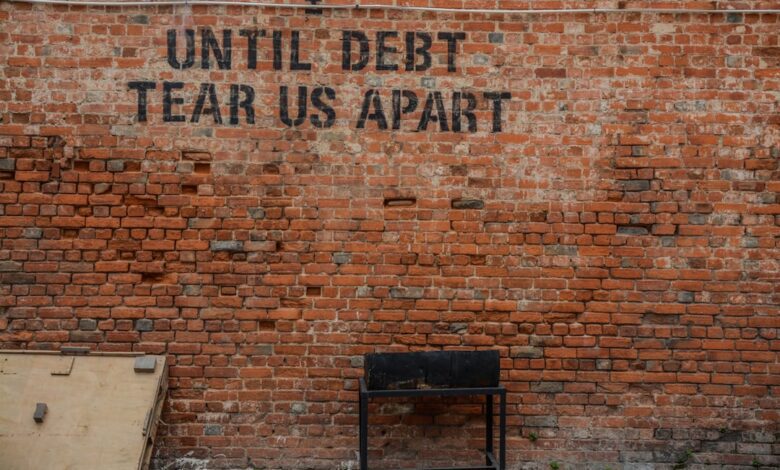

In today's fast-paced financial landscape, personal debt has become a significant concern for individuals and families alike. As the burden of debt weighs heavily on many, understanding effective strategies for managing and reducing personal debt is crucial for achieving financial stability and freedom. This article delves into a range of topics related to debt, including its profound impact on economic growth, and offers insights into negotiating with creditors for better repayment terms. Additionally, we explore the vital role of credit counseling in effective debt management and examine the complexities of using debt as a tool for investment. The implications of student loan debt on financial planning, the effects of corporate debt on stock performance, and how governments manage national debt will also be discussed, illustrating the multifaceted nature of debt in our economy. Join us as we navigate these critical issues and empower you with the knowledge to take control of your financial future.

- Here are three possible headlines for sections of the article covering the specified topics:

- 1. **Navigating Personal Debt: Effective Strategies for Financial Freedom**

Here are three possible headlines for sections of the article covering the specified topics:

Managing and reducing personal debt is a crucial aspect of financial health that can significantly influence overall economic stability. High levels of personal debt can hinder consumer spending, which is a key driver of economic growth. When individuals are burdened by debt, they often cut back on expenditures, impacting businesses and, consequently, the broader economy.

Negotiating with creditors can be an effective strategy for those struggling with repayment. Open communication can lead to more favorable repayment terms, such as lower interest rates or extended payment periods, alleviating some financial pressure. Additionally, credit counseling can play a vital role in debt management. These services provide individuals with guidance on budgeting, debt repayment strategies, and financial literacy, empowering them to take control of their finances.

While debt can be risky, it can also serve as a tool for investment. Used wisely, borrowing can enhance returns on investments, but it carries the potential for significant losses if the market turns. This duality is especially relevant for student loans, which can impact financial planning for years to come. Graduates often face the challenge of balancing their loan repayments with other financial goals, such as homeownership or retirement savings.

Corporate debt also warrants attention, as it can influence stock performance. Companies with high debt levels may face increased interest payments, potentially affecting their profitability and stock prices. Similarly, governments grapple with national debt, which can have profound economic implications. Effective management of this debt is essential to maintain economic stability and promote growth, impacting everything from interest rates to public spending.

1. **Navigating Personal Debt: Effective Strategies for Financial Freedom**

Navigating personal debt can be daunting, but with effective strategies, individuals can work towards achieving financial freedom. The first step is to assess the total amount of debt and categorize it by type, interest rate, and repayment terms. This comprehensive overview allows for prioritization, focusing first on high-interest debts, such as credit cards, which can accumulate quickly if not addressed.

Creating a realistic budget is essential for managing monthly expenses and identifying areas where spending can be reduced. Allocating extra funds toward debt repayment can significantly decrease the overall interest paid and shorten the repayment timeline. Additionally, establishing an emergency fund can prevent the accumulation of new debt in case of unexpected expenses.

Another effective strategy is the debt snowball method, where individuals pay off the smallest debts first while maintaining minimum payments on larger debts. This approach can provide psychological motivation as small victories build momentum towards larger goals. Alternatively, the debt avalanche method focuses on paying off debts with the highest interest rates first, which can save money in the long run.

Communication with creditors is also crucial. Many creditors are willing to negotiate better repayment terms, such as lower interest rates or extended payment plans, especially if the debtor demonstrates a commitment to repayment. Seeking professional help from credit counseling services can provide valuable guidance and support in navigating these negotiations.

Lastly, it’s important to re-evaluate financial habits and consider lifestyle changes that promote long-term financial health. By implementing these strategies, individuals can take proactive steps toward reducing personal debt and achieving greater financial stability.

Managing and reducing personal debt is crucial for maintaining financial health and stability. One effective strategy is to create a detailed budget that outlines all income sources and expenses. This allows individuals to identify areas where they can cut back and allocate more funds toward debt repayment. Additionally, the snowball method—paying off the smallest debts first—can provide psychological benefits by offering quick wins, while the avalanche method focuses on paying off debts with the highest interest rates first, ultimately saving money on interest.

High levels of personal debt can significantly impact economic growth. When consumers are burdened with debt, they tend to reduce their spending, which can lead to decreased demand for goods and services. This reduction in consumption can hinder business growth and limit job creation, creating a cycle that stifles economic expansion.

Negotiating with creditors is another vital tool for debt management. Borrowers can reach out to their creditors to discuss their financial situation and seek better repayment terms, such as reduced interest rates, extended payment plans, or even settlement options for a lower total payment. Effective negotiation often involves preparing a clear case for hardship and demonstrating a willingness to make payments.

Credit counseling services can also play a significant role in debt management. These organizations provide professional guidance and can assist individuals in creating a sustainable debt management plan. They often negotiate with creditors on behalf of clients, helping to secure more favorable terms and providing education on budgeting and financial literacy.

Using debt to invest carries inherent risks and rewards. While leveraging debt can amplify investment returns, it can also lead to significant losses if investments do not perform as expected. Individuals should carefully evaluate their risk tolerance and have a solid understanding of the investment landscape before taking on debt for investment purposes.

Student loan debt is a growing concern that profoundly impacts financial planning for graduates. High levels of student debt can delay major life milestones, such as buying a home or saving for retirement, as borrowers allocate a significant portion of their income to repayment. This burden can hinder long-term financial goals and necessitate strategic planning to manage other financial responsibilities.

Corporate debt also affects stock performance. High levels of corporate debt can increase the risk for investors, particularly in volatile economic climates. Companies with manageable debt levels may be better positioned to weather economic downturns, while those with excessive debt might struggle to maintain profitability, impacting their stock prices.

Lastly, governments manage national debt through various strategies, including issuing bonds and controlling fiscal policy. The implications of national debt on economic stability are profound; excessive debt can lead to higher interest rates and reduced public investment, while manageable debt levels can stimulate growth and investment in critical infrastructure. As such, the balance between stimulating economic growth and maintaining sustainable debt levels remains a key focus for policymakers.

In conclusion, effectively managing and reducing personal debt is a multifaceted endeavor that requires a strategic approach and an understanding of the broader economic implications. High levels of personal and corporate debt can stifle economic growth and affect stock performance, highlighting the importance of sound financial practices both at the individual and national levels. By employing negotiation tactics with creditors, individuals can secure more favorable repayment terms, while credit counseling offers valuable guidance for those struggling to regain control over their finances.

Moreover, the risks and rewards associated with leveraging debt for investment must be carefully weighed, particularly in light of the ongoing challenges posed by student loan debt, which can significantly impact financial planning for many young adults. As we navigate these complex issues, it is essential to remain informed about the dynamics of debt management and its effects on one's financial well-being. Ultimately, fostering a culture of responsible borrowing and prudent financial decision-making is crucial for achieving long-term economic stability and personal financial freedom.