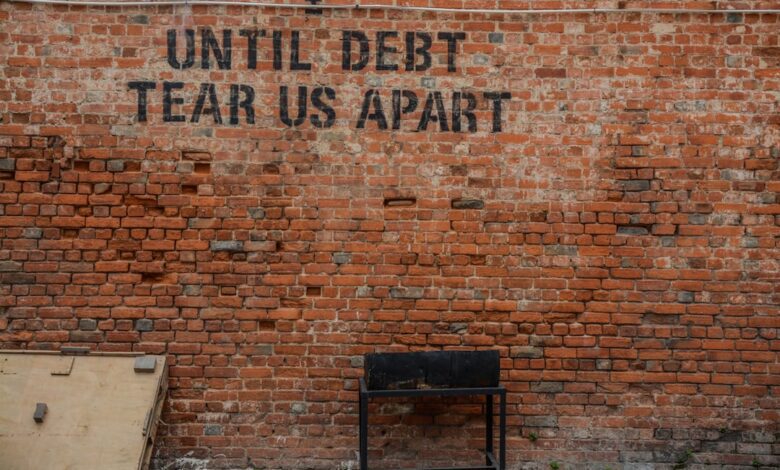

Debt Dynamics: Strategies for Personal Management and Economic Impact

In today's fast-paced financial landscape, managing personal debt has emerged as a critical concern for individuals and families alike. As rising debt levels affect not only personal finances but also broader economic stability, understanding effective strategies for debt management is essential. This article delves into various aspects of debt, from practical methods for reducing personal liabilities to the intricate relationship between high debt levels and economic growth. We will explore how negotiation skills can empower individuals to secure better repayment terms with creditors and the pivotal role of credit counseling in fostering financial resilience. Additionally, we will examine the complex dynamics of using debt as an investment tool, the implications of student loan debt on financial planning, and the impact of corporate debt on stock performance. Finally, we will discuss how governments navigate national debt and its far-reaching economic consequences. By equipping readers with valuable insights and actionable strategies, this article aims to promote sound financial practices and enhance overall economic well-being.

- 1. "Navigating Personal Debt: Effective Strategies for Management and Reduction"

- 2. "The Ripple Effect: How High Debt Levels Influence Economic Growth"

- 3. "Mastering Negotiation: Securing Better Terms with Creditors for Debt Relief"

1. "Navigating Personal Debt: Effective Strategies for Management and Reduction"

Managing and reducing personal debt can be a daunting task, but with effective strategies, individuals can regain financial stability and peace of mind. The first step in navigating personal debt is to create a comprehensive budget that outlines income, expenses, and debt obligations. This enables borrowers to see their financial picture clearly and identify areas where they can cut back on spending to allocate more funds towards debt repayment.

One effective method for managing debt is the debt snowball approach, where individuals focus on paying off the smallest debts first while making minimum payments on larger debts. This strategy provides quick wins, boosting motivation and confidence as debts are eliminated. Alternatively, the debt avalanche method prioritizes debts with the highest interest rates, which can save money on interest payments over time.

Another key strategy is to negotiate with creditors for better repayment terms. Many lenders are willing to work with borrowers facing financial difficulties, offering options such as lower interest rates, extended payment plans, or debt settlements. Open communication with creditors can lead to more manageable payment arrangements and reduce the overall debt burden.

Additionally, seeking the assistance of credit counseling services can provide valuable support. These organizations offer guidance on budgeting, debt management plans, and financial education, helping individuals develop skills to avoid future debt issues. Credit counselors can also act as intermediaries between borrowers and creditors, assisting in negotiations and creating a more organized approach to repayment.

Finally, individuals should consider consolidating their debts through options like personal loans or balance transfer credit cards. While this can simplify payments and potentially lower interest rates, it is essential to assess the terms carefully to avoid falling into a cycle of new debt. By employing these strategies, individuals can take control of their personal debt, paving the way for a more secure financial future.

2. "The Ripple Effect: How High Debt Levels Influence Economic Growth"

High debt levels can significantly influence economic growth through various interconnected channels. When individuals, businesses, or governments are burdened by excessive debt, their financial flexibility diminishes, leading to a range of economic consequences.

Firstly, high personal debt often constrains consumer spending, which is a critical driver of economic growth. Individuals with substantial debt obligations may prioritize debt repayment over discretionary spending, resulting in reduced consumption. This decline in consumer spending can hinder business revenues, leading to slower economic growth and potentially causing a contraction in specific sectors.

Moreover, businesses facing high levels of corporate debt may experience increased financial stress. Elevated debt levels can result in higher interest payments, which divert funds away from investment in innovation, expansion, and workforce development. Consequently, this can stifle productivity and competitiveness, further slowing economic growth.

At the government level, high national debt can lead to increased borrowing costs and reduced fiscal space. Governments may find themselves allocating a larger portion of their budgets to service debt rather than investing in infrastructure, education, or healthcare—essential components for long-term economic growth. Additionally, if investors perceive a nation’s debt levels as unsustainable, it could lead to a loss of confidence, driving up interest rates and stifling growth.

The ripple effect of high debt levels can also lead to greater economic inequality. Those with lower debt levels may find themselves at a disadvantage in a sluggish economy, while those with substantial debts may face financial distress, potentially resulting in higher rates of bankruptcy and foreclosures. This can exacerbate social tensions and hinder overall economic stability.

Ultimately, high debt levels create a complex web of interactions that can dampen economic growth, create barriers to investment, and foster an environment of uncertainty. Addressing these debt issues is crucial for promoting a healthier economic landscape and fostering sustainable growth.

3. "Mastering Negotiation: Securing Better Terms with Creditors for Debt Relief"

Negotiating with creditors can be a crucial strategy in managing personal debt, providing individuals with the opportunity to secure better repayment terms that can alleviate financial pressure. The first step in this process is to prepare thoroughly. Gather all relevant financial documents, including account statements, income details, and a clear understanding of your debts. This preparation allows you to present a comprehensive picture of your financial situation, which can help creditors understand your need for more favorable terms.

When approaching creditors, it's important to communicate openly and honestly. Explain your circumstances—such as job loss, medical expenses, or other financial hardships—that have made it challenging to keep up with payments. Many creditors are willing to work with customers who demonstrate a genuine commitment to repayment but need assistance due to temporary setbacks.

Proposing specific changes can also facilitate the negotiation process. Options might include requesting a lower interest rate, extending the repayment period, or even negotiating a settlement amount that is less than the total owed. Be ready to suggest realistic terms that you can manage while ensuring they are appealing to the creditor.

Additionally, timing can play a significant role in negotiations. Creditors may be more amenable to discussions at certain times, such as after a missed payment or during a promotional period when they aim to retain customers. Being proactive and reaching out before falling significantly behind can also demonstrate your intent to maintain a good relationship.

Finally, consider leveraging the help of a credit counselor or financial advisor if negotiations become overwhelming. These professionals can provide valuable insights and support, helping you navigate complex discussions with creditors and devise a personalized repayment strategy. Ultimately, mastering negotiation skills can lead to significant improvements in your financial situation, making it easier to manage and reduce personal debt.

In conclusion, effectively managing and reducing personal debt is crucial not only for individual financial well-being but also for the broader economic landscape. The strategies outlined—ranging from proactive debt management techniques and negotiation with creditors to the support offered through credit counseling—empower individuals to take control of their financial futures. Understanding the implications of high debt levels on economic growth highlights the importance of maintaining healthy financial practices, as excessive debt can stymie progress at both personal and national levels.

Moreover, the discussion on the risks and rewards of leveraging debt for investment underscores the need for careful consideration in financial planning, particularly in light of student loan obligations that often shape long-term financial decisions. The interplay between corporate debt and stock performance further illustrates how interconnected these financial dynamics are, reminding us that debt, while sometimes necessary, must be approached with caution.

Finally, the insights into how governments manage national debt reinforce the idea that effective debt management strategies are vital not only for individuals but also for maintaining economic stability. By prioritizing responsible borrowing and focusing on debt reduction, we can contribute to a healthier economy, paving the way for sustainable growth and financial security for ourselves and future generations.