Debt Dynamics: Strategies for Personal and Economic Resilience

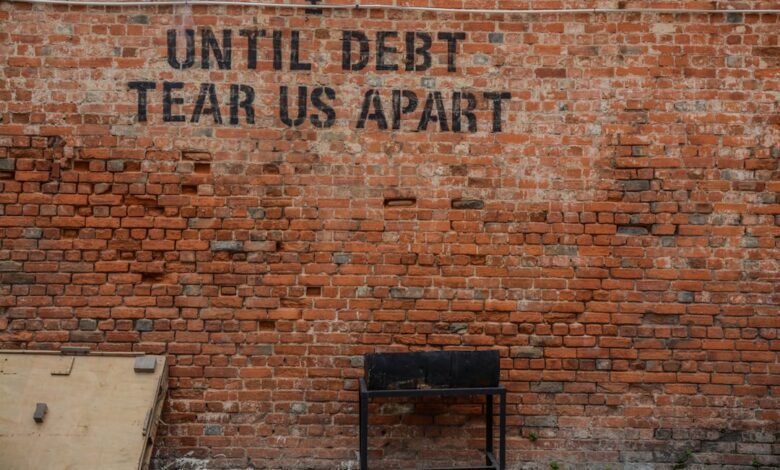

In today's fast-paced financial landscape, managing personal debt has become a critical concern for individuals and families alike. With rising living costs, stagnant wages, and the growing burden of student loans, many find themselves grappling with overwhelming debt that can hinder their financial stability and overall well-being. This article explores effective strategies for managing and reducing personal debt, emphasizing the importance of financial literacy and proactive planning. We will delve into the broader implications of high debt levels on economic growth, highlighting how individuals' financial choices can influence not only their futures but also the economy at large.

Additionally, we will examine the delicate balance between leveraging debt for investment opportunities and the risks that come with it. Negotiating with creditors for better repayment terms and seeking assistance through credit counseling are powerful tools that can pave the way toward financial freedom. Furthermore, we will analyze the impact of corporate debt on stock performance and how governments manage national debt, shedding light on its economic implications. Whether you’re looking to regain control over your finances or understand the complexities of debt on a macroeconomic scale, this article offers insights and strategies to guide you on your journey to financial health.

- 1. **Navigating Personal Debt: Strategies for Financial Freedom**

- 2. **Debt's Double-Edged Sword: Economic Growth and Investment Opportunities**

- 3. **From Negotiation to Counseling: Tools for Effective Debt Management**

1. **Navigating Personal Debt: Strategies for Financial Freedom**

Managing personal debt effectively is crucial for achieving financial freedom and stability. Here are several strategies that can help individuals navigate their debt and work toward a healthier financial future.

First, creating a comprehensive budget is essential. By tracking income and expenses, individuals can identify areas where they can cut back and allocate more funds toward debt repayment. This process not only promotes awareness of spending habits but also enables better financial planning.

Second, prioritizing debts can significantly impact repayment success. One common method is the debt snowball approach, where individuals focus on paying off the smallest debts first to build momentum and confidence. Alternatively, the debt avalanche method targets the highest-interest debts first, which can save money in interest payments over time. Choosing the right strategy depends on personal preferences and financial situations.

Additionally, individuals should explore options for consolidating their debts. This might involve taking out a personal loan with a lower interest rate to pay off multiple high-interest debts, thus simplifying payments and potentially reducing overall interest costs. Balance transfer credit cards can also be useful for consolidating credit card debt, provided they are used wisely and the balance is paid off before the promotional rate expires.

Negotiating with creditors for better repayment terms can also be beneficial. Many creditors are willing to work with borrowers who demonstrate a genuine effort to repay their debts. This could involve requesting lower interest rates, extended payment terms, or even settling for a lesser amount. Open communication and a clear understanding of one’s financial situation are key in these negotiations.

Lastly, seeking assistance from credit counseling services can provide valuable support. These organizations offer personalized advice, debt management plans, and educational resources to help individuals regain control of their finances. While there may be fees involved, the potential for reduced interest rates and structured repayment plans can make it a worthwhile investment.

In conclusion, navigating personal debt requires a proactive approach that combines budgeting, prioritization, negotiation, and potential professional assistance. Implementing these strategies can pave the way toward financial freedom and a more secure future.

2. **Debt's Double-Edged Sword: Economic Growth and Investment Opportunities**

Debt can serve as both a catalyst for economic growth and a potential hindrance, highlighting its dual nature as a financial tool. On one hand, leveraging debt allows individuals and businesses to access capital that can be used for investment in productive ventures, such as starting a new business, purchasing real estate, or funding education. When used wisely, this borrowed capital can lead to increased productivity, job creation, and ultimately, economic expansion. For instance, companies often take on debt to invest in new technologies or to expand operations, which can enhance their competitive edge and contribute to overall economic growth.

However, excessive debt levels can create vulnerabilities that may stall economic progress. High debt burdens can lead to increased interest payments, which divert funds away from investment in growth-oriented activities. Furthermore, when individuals or businesses are overwhelmed by debt, their spending decreases, leading to reduced demand for goods and services, which can negatively impact the broader economy. Additionally, if debt levels become unsustainable, it can result in defaults and financial crises, further stunting economic growth.

Investing with debt, often referred to as leveraging, presents its own set of challenges and opportunities. While it can amplify returns in favorable market conditions, it also increases risk exposure. Investors must carefully weigh the potential rewards against the possibility of significant losses, particularly in volatile markets. Thus, while debt can be an essential driver of economic growth and investment opportunities, it requires prudent management to avoid the pitfalls associated with over-leverage and financial instability.

3. **From Negotiation to Counseling: Tools for Effective Debt Management**

Effective debt management is crucial for individuals seeking to regain control of their finances. Two key tools in this process are negotiation with creditors and credit counseling services.

Negotiating with creditors can be an empowering step for borrowers. By opening a dialogue, individuals can potentially secure better repayment terms, such as lower interest rates, extended payment periods, or even debt forgiveness. Effective negotiation requires preparation—borrowers should gather relevant financial information, understand their current obligations, and be clear about their financial situation. Approaching creditors with a genuine willingness to repay, while also articulating any hardships, can foster goodwill and lead to more favorable outcomes.

In addition to negotiation, credit counseling plays a vital role in debt management. Credit counseling agencies provide invaluable resources for individuals struggling with debt. These agencies offer financial education, budgeting advice, and personalized debt management plans. Through counseling, individuals can gain a clearer understanding of their financial situation and develop actionable strategies to reduce debt. Counselors can also mediate discussions with creditors, helping to establish a structured repayment plan that is manageable for the debtor.

Ultimately, both negotiation and credit counseling serve as essential tools for individuals in debt. By utilizing these strategies, borrowers can work towards reducing their debt burden, improving their financial literacy, and fostering a more stable financial future.

In conclusion, effectively managing and reducing personal debt is a multifaceted endeavor that requires a strategic approach tailored to individual circumstances. By implementing practical strategies for financial freedom, individuals can not only alleviate their personal debt burdens but also contribute to broader economic stability. Understanding the dual nature of debt as both a potential catalyst for investment and a risk to economic growth underscores the importance of thoughtful financial planning.

Negotiation with creditors and engaging in credit counseling can provide essential support in navigating the complexities of repayment terms, empowering individuals to regain control over their financial situations. Furthermore, the implications of student loan debt on financial planning highlight the need for careful consideration when pursuing education as an investment.

On a larger scale, the management of corporate and national debt plays a pivotal role in stock performance and overall economic health. As governments strive to balance their fiscal responsibilities, the lessons learned from personal debt management resonate clearly: proactive measures, informed decision-making, and seeking professional guidance are crucial in achieving financial resilience. Ultimately, through a combination of personal accountability and informed strategies, individuals can pave their path toward financial freedom while contributing to a more robust economic landscape.