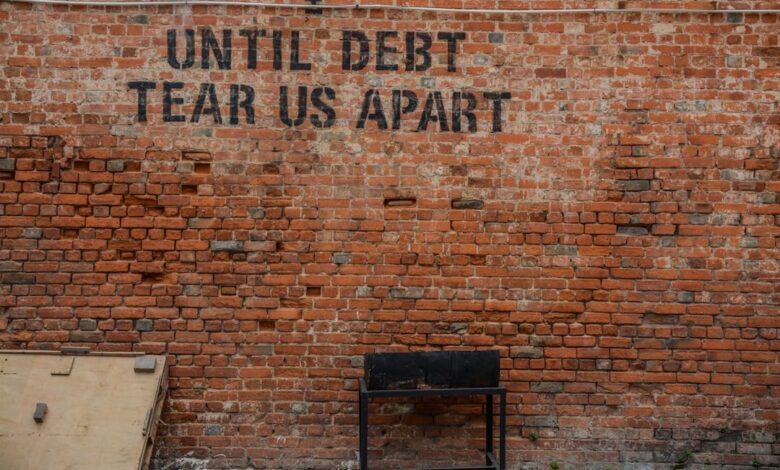

Debt Dilemmas: Strategies for Personal Management and Economic Implications

In today’s fast-paced financial landscape, personal debt has become a common burden that affects individuals and families across various demographics. As the pressures of student loans, credit card balances, and other liabilities mount, managing and reducing personal debt has never been more critical. This article will explore effective strategies for debt reduction and management, highlighting the importance of understanding how high debt levels can stifle economic growth. Additionally, we will delve into practical negotiation tactics for engaging with creditors to secure better repayment terms, emphasizing the pivotal role of credit counseling in facilitating financial recovery.

Beyond personal finance, the implications of debt extend to broader economic considerations, including the influence of corporate debt on stock performance and how government debt management affects national economic health. We will also examine the delicate balance between leveraging debt for investment opportunities and the risks associated with such strategies. By addressing these multifaceted issues, this article aims to equip readers with valuable insights and actionable steps toward achieving financial stability and understanding the intricate relationship between personal and national debt dynamics.

- 1. **Navigating Personal Debt: Effective Strategies for Reduction and Management**

- 2. **Debt Dynamics: Understanding the Economic Impact of High Debt Levels**

- 3. **Negotiation Tactics: Engaging Creditors for Improved Repayment Solutions**

1. **Navigating Personal Debt: Effective Strategies for Reduction and Management**

Managing and reducing personal debt requires a strategic approach that combines effective budgeting, prioritization, and communication with creditors. One of the first steps in this process is to create a detailed budget that outlines all income sources and monthly expenses. This clarity allows individuals to identify areas where they can cut back and allocate more funds toward debt repayment.

Setting clear financial goals is essential. Prioritizing debts based on interest rates can help in deciding which debts to tackle first—often referred to as the avalanche method. Alternatively, some may prefer the snowball method, which focuses on paying off the smallest debts first to gain momentum and motivation.

Establishing an emergency fund, even a small one, can prevent individuals from relying on credit cards or loans in times of unexpected expenses, thereby reducing the risk of accumulating more debt. Additionally, individuals should explore ways to increase their income, such as taking on part-time work or freelancing, to accelerate debt repayment.

Communication with creditors is crucial. Many creditors are willing to negotiate better repayment terms, such as lower interest rates or extended payment plans, especially if they believe it will increase the likelihood of repayment. Proactively reaching out to creditors can demonstrate a commitment to managing debt responsibly.

Credit counseling services can also play a vital role in debt management. These organizations provide resources and guidance, helping individuals create budgets, understand their financial situations, and negotiate with creditors.

Finally, it’s important to maintain a long-term perspective. Building good financial habits, such as saving regularly and avoiding unnecessary debt, can lead to sustainable financial health beyond just reducing current debt levels. By implementing these strategies, individuals can effectively navigate personal debt, leading to improved financial stability and peace of mind.

2. **Debt Dynamics: Understanding the Economic Impact of High Debt Levels**

High levels of debt can significantly influence economic growth, affecting both individual financial health and broader economic stability. When consumers and businesses are heavily indebted, their ability to spend and invest diminishes. This reduced spending power can lead to lower demand for goods and services, ultimately stunting economic growth.

Moreover, high personal and corporate debt levels can increase the vulnerability of economies to financial crises. As interest rates rise, the cost of servicing debt becomes burdensome, leading to higher default rates and increased financial strain. This scenario can create a ripple effect, impacting credit markets, reducing access to loans, and constraining economic expansion.

In addition, government debt levels can also play a crucial role in shaping economic performance. While some level of national debt can be beneficial for funding infrastructure and public services, excessive debt may lead to higher taxes and reduced public spending in the long term. This can stifle growth and limit the government's ability to respond effectively to economic downturns.

The interplay between high debt levels and economic growth is complex, as it can vary depending on factors such as interest rates, inflation, and consumer confidence. Policymakers must carefully monitor debt levels to ensure that they do not reach a point where they become detrimental to economic stability and growth. Understanding these dynamics is essential for developing strategies that promote sustainable economic health while managing the risks associated with high debt levels.

3. **Negotiation Tactics: Engaging Creditors for Improved Repayment Solutions**

When facing personal debt, negotiating with creditors can be a crucial step toward achieving better repayment terms. Effective negotiation tactics can lead to reduced interest rates, extended payment timelines, or even settlements for less than the total owed. Here are some strategies to consider:

First, prepare thoroughly before initiating any discussions. Understand your financial situation, including your income, expenses, and the total debt owed. Gathering documentation such as pay stubs, bank statements, and a budget can help demonstrate your ability to repay or your need for adjustments. This preparation not only shows creditors that you are serious but also provides a solid foundation for your negotiation.

Second, establish a rapport with your creditor. Approach the conversation with a positive attitude and express your willingness to settle the debt responsibly. A calm and respectful tone can go a long way in persuading creditors to consider your requests. Remember, creditors often prefer to negotiate rather than risk default, so presenting yourself as a cooperative borrower can create a more collaborative atmosphere.

Third, be clear about what you want. Whether you are seeking a lower interest rate, a different payment plan, or a temporary forbearance, articulating your needs clearly can help guide the discussion. It’s beneficial to propose specific terms that you believe are reasonable based on your financial situation. Additionally, having a backup plan, such as alternative repayment strategies, can provide flexibility during negotiations.

Lastly, don’t hesitate to follow up. If you reach an agreement, make sure to get it in writing and confirm the details. If your initial request is denied, ask for the reasons and be prepared to counter any objections. Persistence can be key, as creditors may be willing to reconsider their stance with additional information or after some time has passed.

By employing these negotiation tactics, individuals can potentially alleviate their debt burden and create a more manageable repayment plan, ultimately contributing to their overall financial health.

In conclusion, managing and reducing personal debt is a multifaceted challenge that requires a strategic approach and a deep understanding of the broader economic implications. As we have explored, high levels of personal and corporate debt can stifle economic growth and influence stock performance, underscoring the interconnectedness of individual financial health and the larger economy. Effective negotiation with creditors can lead to better repayment terms, while credit counseling serves as a valuable resource for those seeking guidance in navigating their debt.

Moreover, the risks and rewards of leveraging debt for investment must be carefully weighed, particularly in light of the long-term implications of student loan debt on financial planning. As individuals and governments alike grapple with debt management, it is crucial to adopt informed strategies that promote sustainability and economic stability. By prioritizing debt reduction and seeking professional advice when necessary, individuals can not only improve their financial well-being but also contribute to a healthier economic landscape. Ultimately, responsible debt management is not just a personal endeavor; it is a collective effort that can foster resilience and growth within our communities and economies.