Unlocking the Value of Precious Metals: Markets, Uses, and Sustainable Practices in 2024

In an ever-evolving global economy, the significance of precious metals such as gold, silver, platinum, and palladium continues to capture the attention of investors, industries, and enthusiasts alike. These metals, often regarded as cornerstones of wealth and stability, play a pivotal role not only in jewelry and investment portfolios but also in various industrial applications. From aerospace to automotive sectors, these precious metals are essential in innovative technologies and manufacturing processes. As the world shifts towards sustainable metal production, understanding the dynamics of precious metals becomes crucial for navigating today's complex market landscape. In this article, we’ll explore the markets for these valuable metals, delve into their diverse industrial applications, and examine the future of metal recycling and production, shedding light on their role in a sustainable future. Join us as we uncover the intricacies of precious metals and their impact on the modern economy, from metal alloys to metal fabrication and beyond.

- 1. **"Exploring the Markets: Understanding Precious Metals like Gold, Silver, Platinum, and Palladium"**

- 2. **"Industrial Applications of Precious Metals: From Aerospace to Automotive and Beyond"**

- 3. **"Sustainable Metal Production: The Future of Metal Recycling and Rare Earth Metals in Modern Industry"**

1. **"Exploring the Markets: Understanding Precious Metals like Gold, Silver, Platinum, and Palladium"**

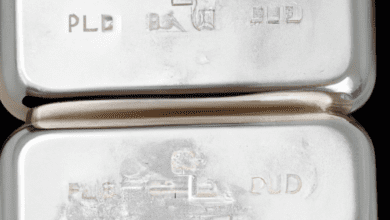

The precious metals market has long been a cornerstone of both investment strategies and industrial applications, encompassing a diverse range of uses that extend beyond mere financial assets. Gold, silver, platinum, and palladium each play unique roles in various sectors, making them invaluable commodities in today’s economy.

Gold, often regarded as a safe haven for investors, has a storied history in gold investing. Its intrinsic value and resistance to corrosion make it a preferred choice not just in jewelry fabrication but also in electronics and aerospace applications. Silver, on the other hand, is celebrated for its conductivity and versatility, finding its niche in jewelry metals, metal alloys, and even as a critical component in energy metals for solar panels.

Platinum and palladium are particularly noteworthy in the automotive industry, where they are essential for catalytic converters, helping to reduce harmful emissions. This demand underscores the importance of understanding how precious metals relate to industrial metals and their role in sustainable metal production. As industries evolve towards greener technologies, the need for these metals will only increase, driving up both their market value and their significance in metal recycling initiatives.

Additionally, the rise of 3D printing metals has opened new avenues for utilizing precious metals. Techniques in metallurgy are advancing rapidly, allowing for innovative applications in construction metals and battery metals. The intricate balance between supply and demand, especially in the context of metal mining and the availability of rare earth metals, significantly influences market trends for these precious metals.

In summary, exploring the markets for gold, silver, platinum, and palladium reveals a complex interplay between investment and industrial use. Understanding these dynamics is crucial for anyone looking to engage with metal commodities, whether through direct investment or as part of broader manufacturing and fabrication processes. Keeping an eye on metal trends is vital for investors and companies alike, as the future of precious metals continues to evolve in response to technological advancements and shifting economic landscapes.

2. **"Industrial Applications of Precious Metals: From Aerospace to Automotive and Beyond"**

Precious metals, including gold, silver, platinum, and palladium, play pivotal roles beyond their traditional uses in jewelry and investment. Their unique properties make them essential in various industrial applications, spanning multiple sectors such as aerospace, automotive, and energy.

In the aerospace industry, precious metals are utilized for their corrosion resistance and ability to withstand extreme temperatures. Platinum and palladium are particularly valuable in manufacturing catalytic converters and sensors, which are crucial for reducing emissions and enhancing fuel efficiency. The combination of these metals with base metals such as steel and aluminum leads to the creation of durable metal alloys that can endure the rigors of flight.

The automotive sector also heavily relies on precious metals. Palladium, for instance, is a key component in catalytic converters, which help convert harmful exhaust gases into less toxic emissions. As the industry shifts towards electric vehicles, the demand for battery metals, including lithium and nickel, is increasing. However, precious metals still find their place in hybrid vehicles, where they are used in various electrical components and sensors.

Beyond aerospace and automotive applications, the rise of advanced manufacturing techniques, such as 3D printing, is transforming how precious metals are utilized. The ability to create intricate designs using metals like platinum and palladium opens new avenues in various fields, including jewelry fabrication and medical device manufacturing. Moreover, metal recycling initiatives are gaining momentum, ensuring sustainable metal production and reducing the environmental impact associated with metal mining.

As industries evolve, the trends in precious metals will continue to shift. With the growing emphasis on sustainable practices, the focus is on integrating precious metals into eco-friendly applications. The development of energy-efficient technologies and the rise of renewable energy sources also highlight the importance of precious metals in the quest for cleaner energy solutions.

In summary, the industrial applications of precious metals extend far beyond their investment and decorative uses. They are vital components in aerospace, automotive, and energy sectors, contributing to innovative solutions in metal fabrication and sustainable production. Understanding these applications can help investors make informed decisions in gold investing, silver investing, and other metal commodities as they navigate the ever-evolving landscape of industrial metals.

3. **"Sustainable Metal Production: The Future of Metal Recycling and Rare Earth Metals in Modern Industry"**

Sustainable metal production is rapidly becoming a crucial focus in the modern industry, particularly as the demand for both precious and industrial metals continues to rise. With metals like gold, silver, platinum, and palladium playing significant roles in various sectors, from jewelry to aerospace and automotive applications, the need for environmentally responsible mining and recycling practices has never been more pressing.

Metal recycling offers a sustainable solution to the challenges posed by traditional metal mining. By repurposing existing metal commodities, we can significantly reduce the energy consumption and environmental impact associated with extracting new metals from the earth. For instance, recycled aluminum requires 95% less energy to produce than its primary form, making it an ideal choice for construction metals and packaging. Similarly, recycling precious metals not only preserves valuable resources but also minimizes metal corrosion and waste.

Moreover, the rise of rare earth metals, essential for modern technologies such as batteries and electronics, has sparked interest in sustainable sourcing. As industries look to innovate, integrating metal alloys that incorporate recycled materials can enhance performance while reducing reliance on newly mined resources. This trend is evident in the burgeoning fields of 3D printing metals and battery metals, where sustainability is at the forefront of development.

As we move forward, the intersection of metallurgy and sustainable practices will shape the future of metal production. By embracing metal recycling and developing new technologies for extracting and processing ferrous and non-ferrous metals, the industry can contribute to a circular economy. This shift not only supports gold investing and silver investing but also encourages responsible stewardship of our planet’s resources, ensuring that essential metals like copper, zinc, and lithium remain available for generations to come.

In summary, sustainable metal production through recycling and innovation in metallurgy presents a promising pathway for the future of both precious and industrial metals. By focusing on sustainable practices, industries can meet the growing demand while minimizing their environmental footprint and fostering a more responsible approach to metal fabrication and use.

**Conclusion**

In summary, the dynamic landscape of precious metals—including gold, silver, platinum, and palladium—plays a crucial role not only in the investment world but also across various industries. Understanding these metals and their markets is essential for anyone looking to engage in gold investing or silver investing, as well as for industries reliant on industrial metals for construction, automotive, and aerospace applications.

As we look to the future, sustainable metal production will be key in addressing the challenges posed by traditional metal mining practices. Metal recycling initiatives and the incorporation of rare earth metals into modern metallurgy will help pave the way for a more sustainable approach to resource management. Furthermore, the integration of new technologies such as 3D printing metals and advancements in battery metals will reshape how we think about metal fabrication and its impact on sectors ranging from energy to automotive.

By staying informed about metal trends and the evolving uses of both ferrous and non-ferrous metals, stakeholders can make more strategic decisions that align with sustainability goals and market demands. As we continue to explore the vast potential of precious and industrial metals, it’s clear that these materials will remain vital to innovation and economic growth in the years to come.

Whether you’re interested in the investment opportunities presented by metal commodities or the industrial applications that support modern infrastructure, the journey into the world of precious metals is one filled with promise and potential.

**References**

(Include relevant sources and citations here as per the article requirements).